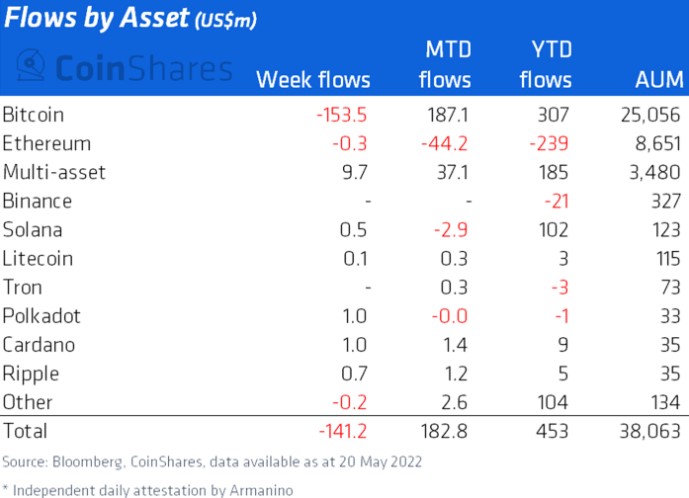

Digital asset investment products saw $141 million in outflows throughout the week ending on May 20, moving that reduced the entire assets under management (AUM) by institutional funds lower to $38 billion, the cheapest level since This summer 2021.

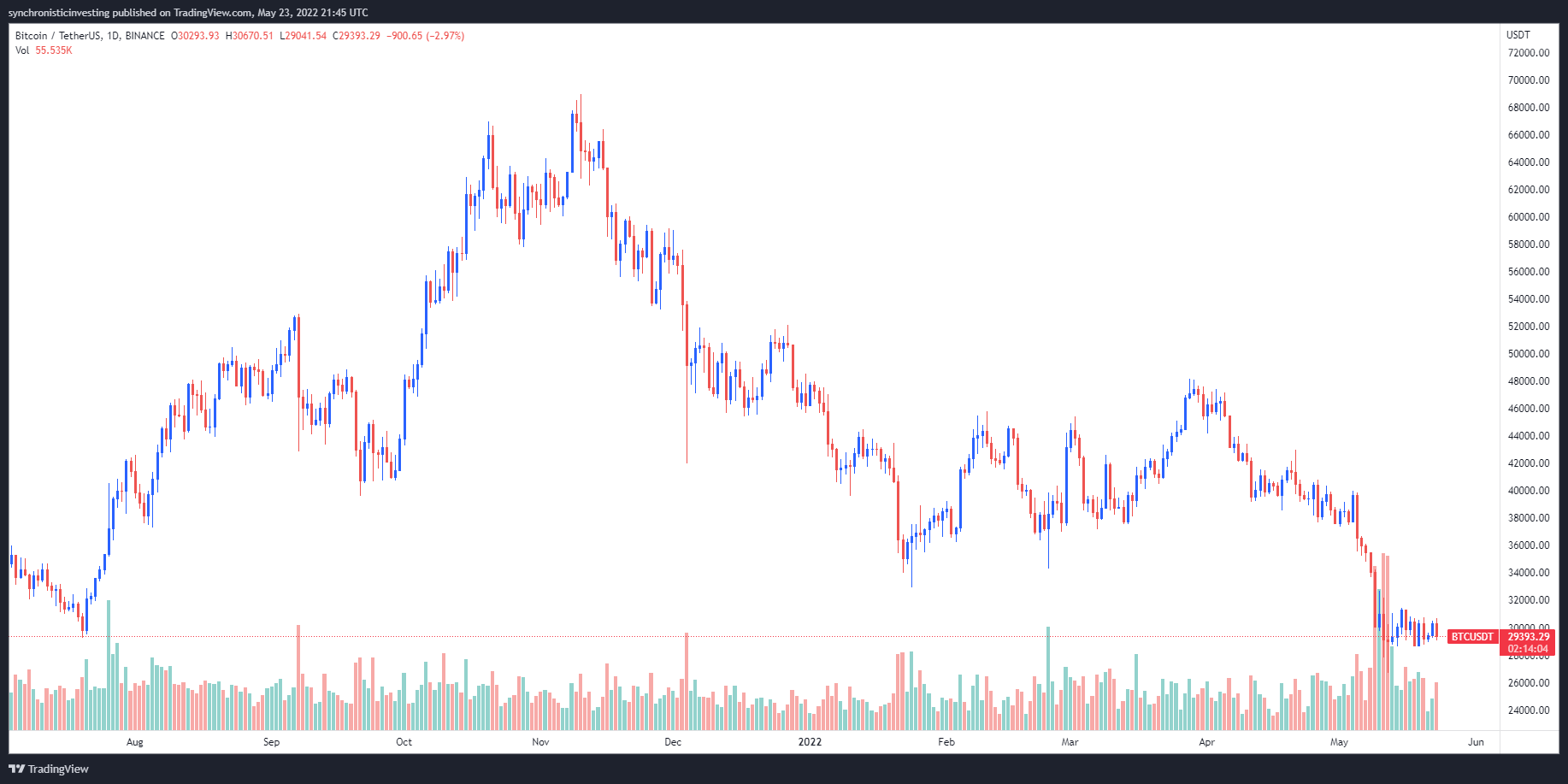

According towards the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the main focus of outflows after experiencing a decline of $154 million for that week. Removing funds coincided having a choppy week of buying and selling that saw the cost of BTC oscillate between $28,600 and $31,430.

Regardless of the sizable output, the month-to-date BTC flow for May remain positive at $187.a million, as the year-to-date figure is $307 million.

On the better note, the multi-asset group of investment products were able to record as many as $9.seven million price of inflows a week ago. This brings the yearly total inflow in to these products to $185 million, representing 5.3% from the total AUM.

CoinShares pointed towards the uptick in volatility just as one source for that elevated inflows into multi-asset investment products, which may be viewed as “safer in accordance with single line investment products during volatile periods.” To date in 2020, these investment products only have experienced two days of outflows.

Cardano (ADA) and Polkadot (Us dot) brought the altcoin inflows with increases of $a million each, adopted by $700,000 price of inflows into Ripple (XRP) and $500,000 into Solana (SOL).

Of all the assets covered, Ethereum (ETH) has witnessed the worst performance to date this season with $44 million price of outflows within the month of May getting its year-to-date figure to $239 million.

Related: Bitcoin’s current setup creates a fascinating risk-reward situation for bulls

Strengthening dollar is constantly on the impact crypto market sentiment

The declining curiosity about digital asset investment products comes among the setting of the strengthening dollar, that has been “one of the most basic macro factors driving asset prices during the last six several weeks,” based on cryptocurrency market intelligence firm Delphi Digital.

As proven around the chart above, the Dollar Index (DXY) has risen from 95 at the beginning of 2022 to 102 on May 23, annually-to-date gain of 6.8%. This marks the quickest year-over-year change for that DXY in the recent past and brought to some breakout in the range it absolutely was stuck in within the last seven-years.

Delphi Digital stated,

“This DXY strength is a consistent drag to risk asset performances over this same period of time.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.