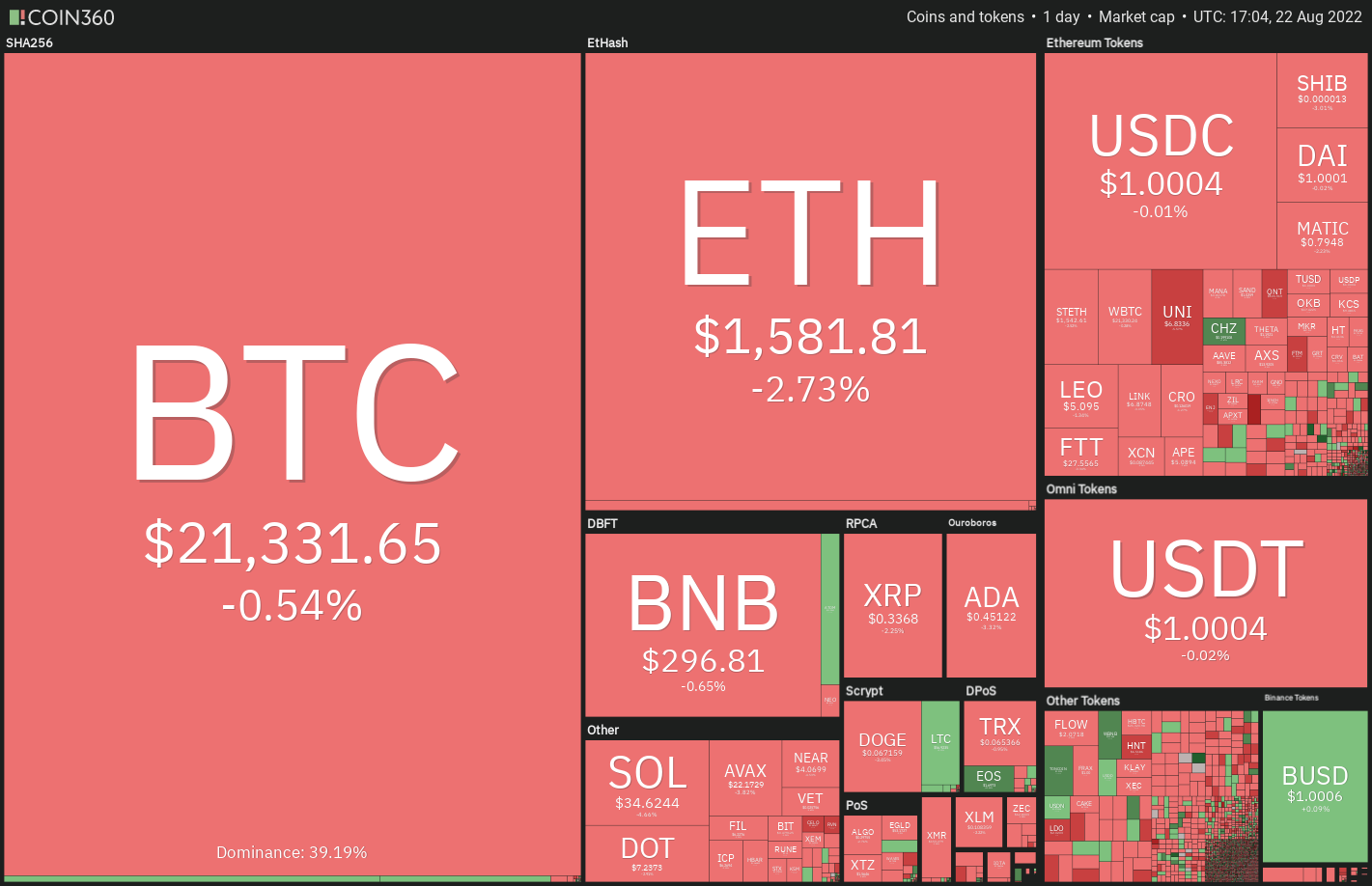

The Ecu stock markets and also the U . s . States equities financial markets are both deep at a negative balance on August. 22 as investors fear that aggressive rate hikes might not be from the table.

Another factor keeping investors nervous may be the upcoming Jackson Hole economic symposium, that is scheduled to start on August. 25. Investors are worried that Fed chairman Jerome Powell could further talk about the Fed’s hawkish stance and plans for future rate of interest hikes.

This macro uncertainty has stored the institutional investors from the crypto markets. CoinShares data demonstrated that crypto investment products recorded weekly volumes of $1 billion, that is 55% less than the yearly average.

On-chain analytics resource Material Indicators stated that Bitcoin (BTC) hasn’t damaged underneath the This summer lows. This means the bear market rally isn’t yet over. However, buyers will need to push the cost over the 200-week moving average of near $23,000 to achieve top of the hands.

Could Bitcoin and many major altcoins create a strong comeback within the next couple of days and do you know the critical levels to take into consideration? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The buyers defended the support type of the climbing funnel on August. 19 and began a bounce however the recovery stalled at $21,800. This means that bears are posing a powerful challenge close to the moving averages.

A small positive would be that the lengthy tail around the August. 22 candlepower unit implies that bulls are trying to defend the support line with vigor. If bulls push the cost above $21,800, the BTC/USDT pair could rise towards the 20-day exponential moving average (EMA) ($22,725).

When the cost turns lower out of this resistance, it’ll claim that the sentiment has switched negative and traders can sell on rallies. That may increase the potential of a rest underneath the funnel. In the event that happens, the selling momentum could get and also the pair could plummet toward the June 18 low at $17,622.

On the other hand, if buyers thrust the cost over the 20-day EMA, it’ll claim that the happy couple may extend its stay within the funnel for any couple of more days. The bulls will attempt to push the cost toward the resistance type of the funnel.

ETH/USDT

Ether (ETH) stepped underneath the 20-day EMA ($1,718) and also the breakout degree of $1,700 on August. 19, which implies that traders who’d bought at ‘abnormal’ amounts were exiting their positions.

The bulls tried to stall the decline in the 50-day simple moving average (SMA)($1,549) however the weak bounce off it suggests too little aggressive buying in the level. This increases the probability of a rest underneath the support.

In the event that happens and also the ETH/USDT pair breaks below $1,500, the selling could intensify because the bulls may wait for a cost to achieve the following strong support before choosing again. The happy couple could therefore decline to $1,280.

On the other hand, when the cost bounces from the current level and increases over the 20-day EMA, traders who didn’t buy in the 50-day SMA may buy strongly lest they lose out on the up-move. That may push the cost toward $2,000.

BNB/USDT

Binance Coin’s (BNB) bounce from the strong support at $275 is facing stiff resistance in the 20-day EMA ($301) however a minor positive would be that the bulls haven’t ceded ground towards the sellers. This signifies that buyers expect the recovery to carry on further.

When the cost increases over the 20-day EMA, the BNB/USDT pair could rally towards the overhead resistance at $338. It is really an important level to keep close track of just because a break and shut above it’ll complete the bullish inverse mind and shoulders pattern. This setup includes a pattern target of $493.

It might not be an upright dash towards the target objective as bears may make an effort to stall the rally at $420 and on the other hand at $460.

On the other hand, when the cost turns lower in the current level and breaks below $275, the happy couple will develop a short-term mind and shoulders pattern. That may begin a decline toward the pattern target of $212.

It is best to hold back for either pattern to accomplish before creating a situation since the setups have a tendency to break lower generally.

XRP/USDT

Ripple (XRP) remains stuck within the range from $.30 and $.39. The bulls are trying to defend the support at $.33 but they are facing stiff resistance at greater levels.

When the cost turns lower and breaks below $.33, the probability of a drop to $.30 increases. This level has formerly acted as strong support hence, traders may purchase the dip, expecting a rally to $.39.

Another possibility would be that the cost bounces off $.33 and breaks over the moving averages. In the event that happens, the XRP/USDT pair may rally towards the stiff overhead resistance at $.39.

It is not easy to calculate the direction from the breakout from the range. Therefore, traders may wait for a break to occur before creating fresh positions.

ADA/USDT

Cardano (ADA) tucked underneath the 50-day SMA ($.49) on August. 19, indicating that bears possess the upper hands. Buyers attempted to begin a relief rally on August. 20 however the weak bounce shows too little demand at greater levels.

The bears will attempt to sink the cost towards the strong support at $.40. It is really an important level to keep close track of since the bulls have defended the amount effectively since May 12. A rest and shut below this support could signal the beginning of the following leg from the downtrend.

On the other hand, when the cost rebounds off $.40, the buyers will endeavour to push the ADA/USDT pair over the moving averages. When they manage to achieve that, the happy couple could rally towards the downtrend line.

SOL/USDT

Solana (SOL) broke underneath the moving averages on August. 19, indicating that bears possess the upper hands soon. The sellers will attempt to sink the cost towards the immediate support at $32.

When the cost rebounds off $32, the bulls will endeavour to push the SOL/USDT pair over the moving averages. When they succeed, it’ll claim that the happy couple may rise toward the overhead resistance at $48.

Unlike this assumption, when the cost slips below $32, the happy couple could slide towards the crucial support at $26. The bulls are anticipated to protect this level with all of their might since the failure to do this may signal the resumption from the downtrend.

DOGE/USDT

Dogecoin (DOGE) bounced from the trendline on August. 20 however the bulls couldn’t obvious the overhead hurdle in the 20-day EMA ($.07). This signifies that bears don’t want to surrender their advantage and therefore are selling on minor rallies.

The DOGE/USDT pair created a Doji candlepower unit pattern on August. 21, which resolved towards the downside on August. 22 and also the cost tucked underneath the trendline. When the cost sustains underneath the trendline, the happy couple could further decline to $.06. It is really an important level for that bulls to protect just because a break below it could cause a drop towards the crucial support at $.05.

To invalidate this bearish view, the bulls will need to push and sustain the cost over the 20-day EMA. In the event that happens, it’ll claim that bulls strongly purchased the drop underneath the trendline. That may open the doorways for any possible rally towards the overhead resistance at $.08.

Related: BTC to get rid of $21K despite miners’ capitulation exit? 5 items to know in Bitcoin now

Us dot/USDT

Polkadot (Us dot) broke underneath the 50-day SMA ($7.78) on August. 19, indicating too little buying support in the bulls. The bears will make an effort to sink the cost towards the strong support at $6.

Once the cost is buying and selling inside a wide range, traders generally purchase the rebound from the support by continuing to keep a good stop-loss. This increases the risk-to-reward ratio. Therefore, the probability of a bounce from the $6 support is high. In the event that happens, the Us dot/USDT pair may remain range-bound between $6 and $10 for many additional time.

The following trending move could start away below $6 or away above $10. When the support at $6 gives way, the happy couple may begin the following leg from the downtrend.

SHIB/USDT

Shiba Inu (SHIB) is witnessing a tussle close to the 20-day EMA ($.000013) with the bulls and also the bears vying for supremacy. The buyers are trying to push the cost over the overhead resistance at $.000014 however the bears have held their ground.

The 20-day EMA has flattened out and also the relative strength index (RSI) is close to the midpoint, indicating an account balance between demand and supply. This balance could tilt in support of the bulls when the cost increases above $.000014. In the event that happens, the SHIB/USDT pair could rise towards the stiff overhead resistance at $.000018.

On the other hand, when the cost breaks below $.000012, the happy couple could tilt in support of the sellers. The happy couple could then drop to another strong support at $.000010.

MATIC/USDT

Polygon (MATIC) continues to be consolidating in a wide range between $.75 and $1 within the last couple of days. The bulls purchased the dip towards the support from the range however the rebound is facing stiff resistance in the bears at greater levels.

If bulls push the cost over the 20-day EMA ($.86), the MATIC/USDT pair could chance a rally towards the overhead resistance at $1 in which the bears will probably mount a powerful defense. When the cost turns lower out of this resistance, the happy couple could extend its stay within the range for many additional time.

Unlike this assumption, when the cost turns lower in the current level and breaks below $.75, it’ll claim that bears have returned in command. The happy couple could then decline to another support at $.63.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.