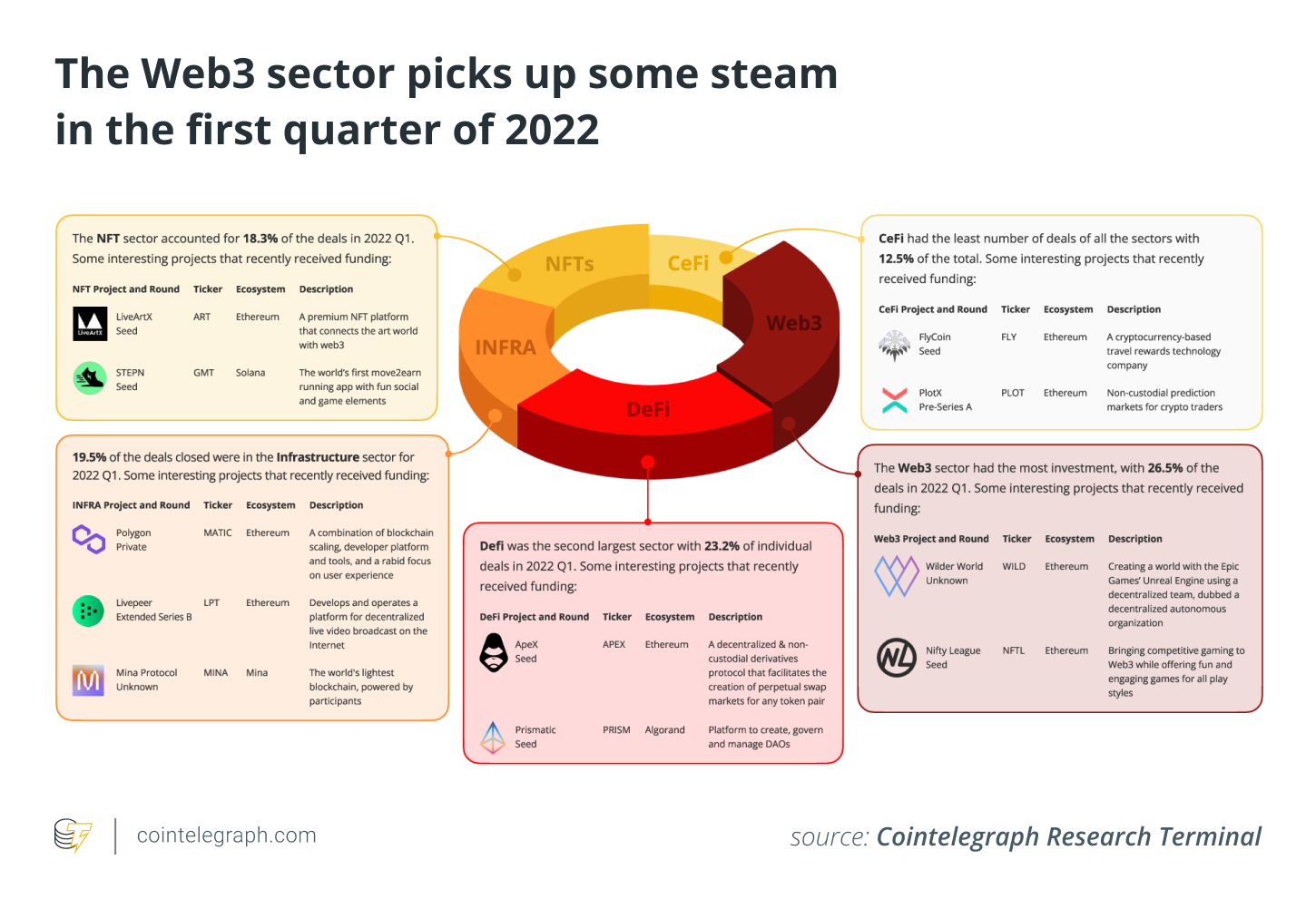

Undoubtedly, the innovation most abundant in impact within the Web3 world this season may be the sidechain. The greatest-volume blockchain providers on the planet — Binance, Polygon, Ankr and Avalanche — have lately released sidechain functionality. They’re investing vast sums in to these new implementations — with valid reason.

Sidechains would be the probably multichain means to fix crypto’s scalability problem. Multiple projects have unsuccessful or stalled after they hit a particular degree of traffic. Ethereum gas charges are notoriously costly, while Solana is constantly congested enough where it must be switched off. Pointless to state, Web3 cannot grow unless of course transactions are fast, low-cost and secure.

Layer-2 (L2) solutions didn’t solve the issue despite much expectation and implementation. Sidechains will vary and may end up being the very best answer as crypto enters mainstream adoption.

What exactly is a sidechain?

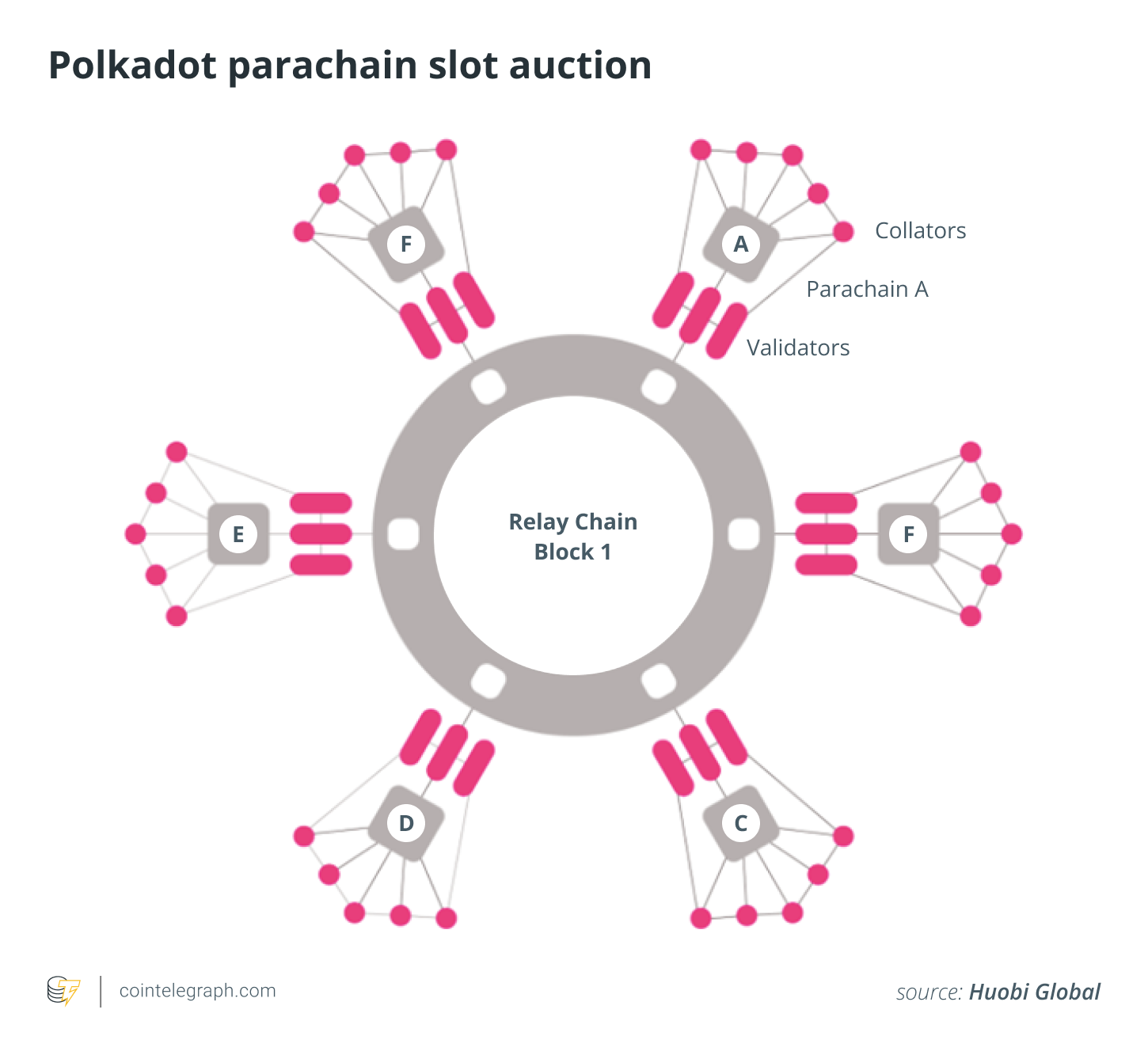

A sidechain passes a variety of names from various providers. Ankr calls them Application Chains Avalanche calls them a SubNet Polygon describes them like a SuperNet. You could also hear the terms parachains, nested blockchains, or application-specific blockchains, which Binance describes as application sidechains. Like all things the program development world, there are various features and implementations. For example, some sidechains may be equal and interdependent, others inside a parent-child relationship in which the child takes attributes in the parent.

Related: What exactly are parachains: Helpful tips for Polkadot & Kusama parachains

However, sidechains offer elevated scalability because developers can launch a brand new blockchain or sidechain to focus on a particular function. For example, Avalanche has dedicated chains (X-Chain, C-Chain, P-Chain) for particular purposes. So, blockchains could be designed particularly to cope with certain kinds of transactions or high-frequency applications. If a person transaction type causes all of the issues, it will not block in the entire blockchain, only a dedicated sidechain.

The truth is layer-1 blockchains (Ethereum, Bitcoin, Avalanche, Binance) are not shipped for games. This is actually the single area in which the scalability concerns are highlighted, with gaming being resource-intensive and requiring high daily transaction volumes. The Crabada game on Avalanche lately elevated the price to $11 per transaction. And altering the first layer-1 blockchain to focus on Web3 games isn’t achievable.

Sidechain shortcomings

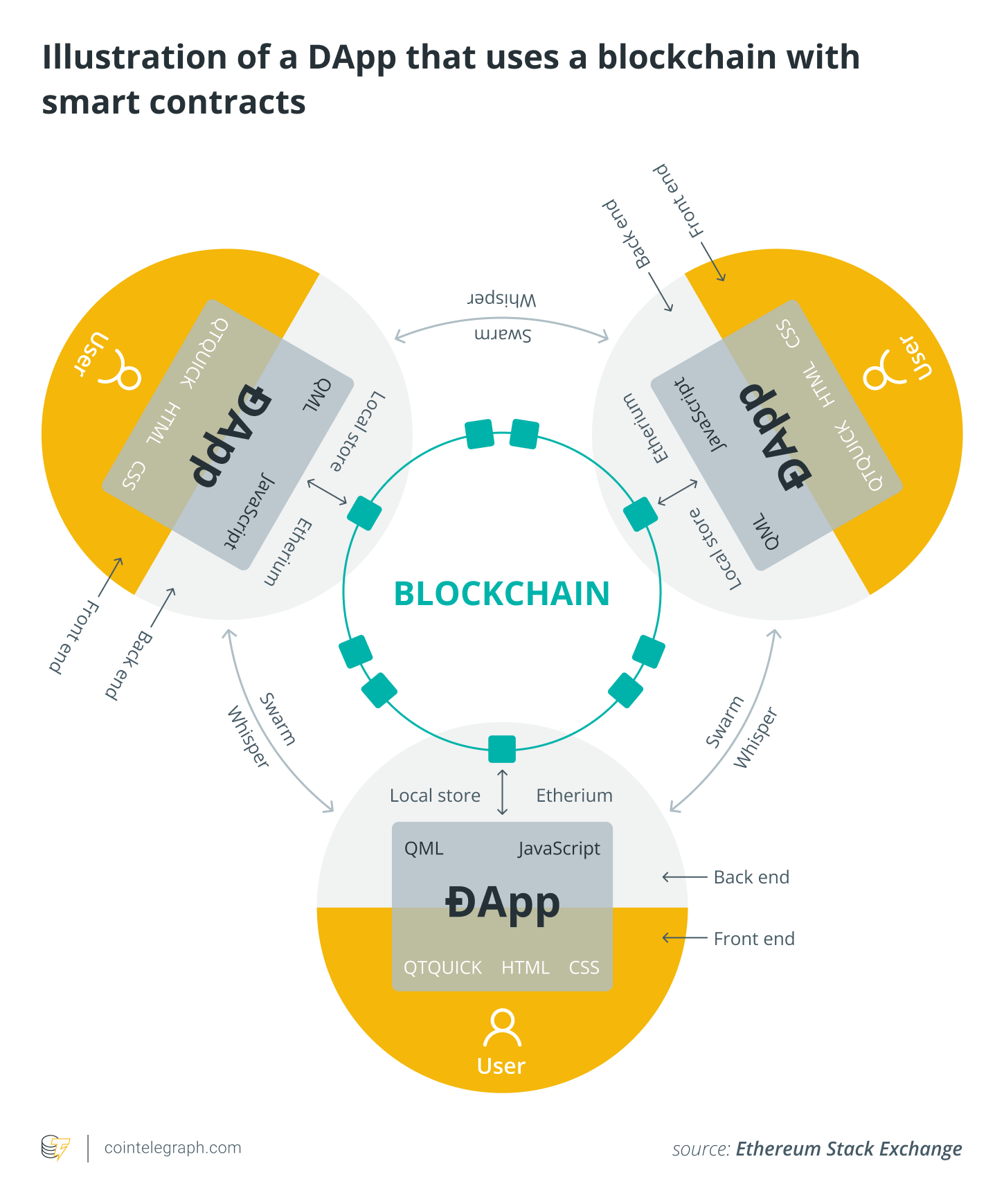

Sidechains have infinite applications and therefore are likely the best choice to proceed with Web3. But sidechains are controlled by their very own algorithm, which aren’t infallible to bad architecture. Most decentralized applications (DApp) aren’t familiar enough with the intricacies of running their very own Web3 infrastructure, node and validator systems. These are required to process transactions and be sure speed, security and reliability.

Because each sidechain needs to run its very own infrastructure, sidechains are often less secure because the initial chain (a typical misconception). The safety options that come with a powerful blockchain aren’t inherited on the given sidechain. The sidechain features its own consensus mechanism, its very own validator charges and it is own vulnerabilities according to each developer’s configuration.

Ronin, an Axie Infinity sidechain, was hacked for $620 million in Ether (ETH) and USD Gold coin (USDC). Although this is a obvious and apparent failure when it comes to network security, the sidechain processed 560% more transactions than Ethereum, meaning it did stand out when it comes to Web3 scalability despite its security vulnerabilities. Axie made a decision to have only nine validators, four which ran everything. It was a obvious attack vector the Sky Mavis team overlooked.

Related: The way forward for the web: Within the race for Web3’s infrastructure

Which is the greatest pitfall connected using the sidechain: They depend around the DApp developers’ proficiency in running their very own infrastructure. Companies for example Ankr have started solving this by providing Application-Chain-in-a-Box solutions. Other infrastructure companies surely follow. The benefits of sidechains far over-shadow the safety vulnerabilities when the industry makes good standards.

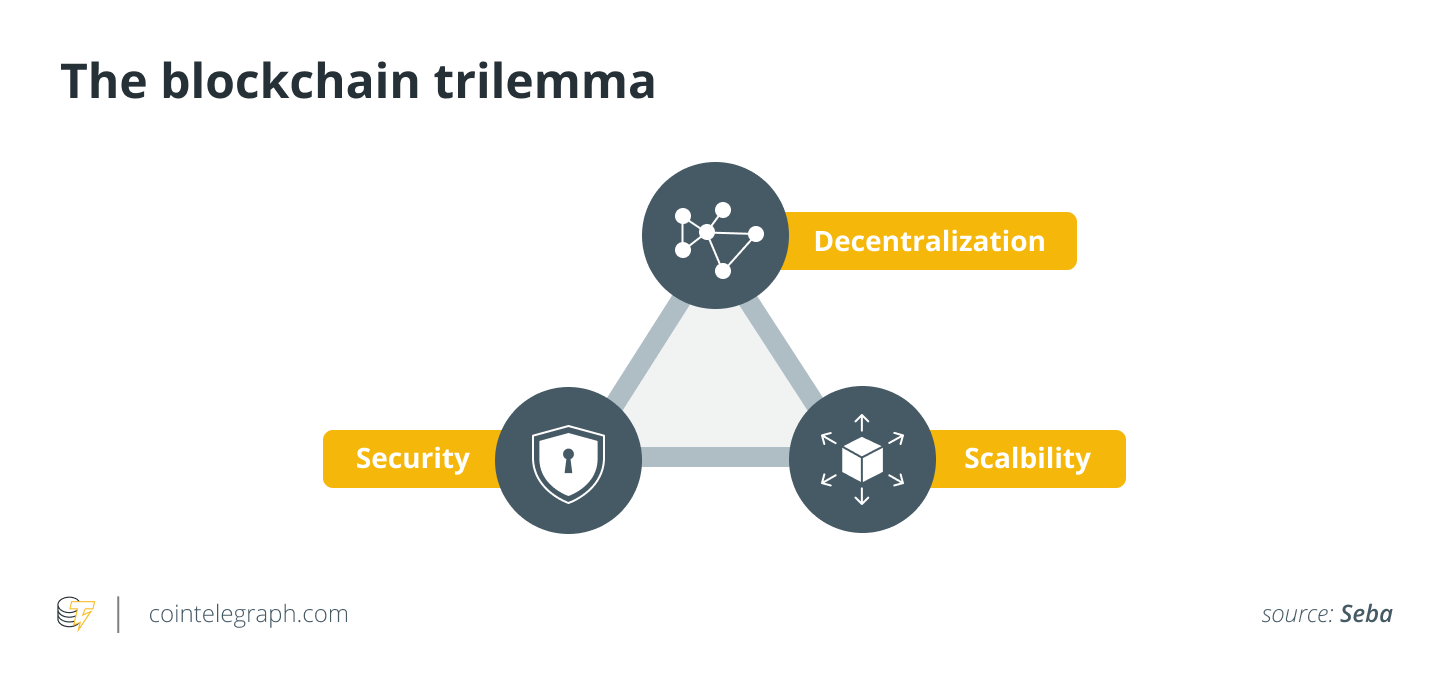

Those are the smartest choice for what is known the blockchain trilemma whenever you attempt to increase performance around the primary chain, you need to do so at the fee for either security or decentralization (the triangular being performance, decentralization and security).

How are sidechains not the same as layer-2 solutions?

They are technology, and lots of people don’t fully agree with the terms. Many people state that sidechains are a kind of L2 solution. But this isn’t strictly true. An L2 is the one other “layer” on the top from the layer 1. A sidechain is really a near-identical implementation of the blockchain however with its very own consensus protocols and node infrastructure. It’s also tweaked for particular functions. With this definition, Ethereum’s Plasma Network isn’t a sidechain, but an L2 (it inherits its security in the root chain and posts it).

Popular L2 solutions include Bitcoin’s Lightning Network and Ethereum’s Raiden Network. They are best referred to as condition channels, a subcategory of L2s. They permit two network participants to conduct transactions from the blockchain without requiring permission from miners or validator nodes. They are simpler to apply and also have a place when it comes to growing transaction speed. But they’re less flexible, customizable or fast when compared with sidechains.

For instance, a sidechain makes it possible for developers to rapidly and simply deploy their very own chain for any specific purpose. Multiple test blockchains could be developed to determine what ones work the very best. Or different systems could be implemented based on user feedback. This isn’t the situation with L2s, that are basically a bandaid to handle a scalability problem.

Related: What is the secure future for mix-chain bridges?

A sidechain is really a new dedicated chain for any specific purpose. An L2 is frequently an area put on a failing layer 1, which doesn’t have the bandwidth to aid existing traffic.

Scalability: The primary subject in Web3

Many might think that scalability, security and decentralization are simply developer issues that don’t matter. However they visit the core of worldwide finance and also have significant effects for everyone. Sidechains and L2s are not only meaningless terminology, however the architecture where Web3 is going to be built and also the perfect vehicles for unlimited scalability. And Web3 may be the answer to global economic freedom with deep implications for growth across industries and geographical locations.

Bitcoin and Ethereum were initially produced having a concentrate on security and decentralization, not scalability. In connection with this, they’ve been a millionaire, but both of them are ultra slow at 7 transactions per second (TPS) and 15 TPS, correspondingly. Visa, meanwhile, handles around 24,000 TPS. To ensure that global crypto adoption as well as for Web3 arrive at fruition, sidechains are essential. They’ll ultimately help make 24,000 TPS seem like a snail around the pavement, and that’s why a few of the world’s greatest providers are positively working and promoting them. They could be the very best Web3 innovation since smart contracts.

Sidechains would be the future

The way forward for Web3 scalability lies with sidechains. For this reason Ankr is positively promoting fraxel treatments and additional supplying the node infrastructure that supports it.

Developers could possibly get a passionate sidechain for his or her specific application, potentially resolving the blockchain trilemma for good. Through ready-made frameworks, launching a passionate blockchain for any specific application is going to be easy to achieve.

Blockchain easily defeats centralized legacy institutions when it comes to security and decentralization. The final remaining pillar is scalability, which may be potentially resolved by sidechains.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Gregory Gopman is really a tech entrepreneur employed in the blockchain space where he can serve as the main marketing officer of Ankr and runs a blockchain consultancy known as Mewn that can help launch projects and also be their valuation. Greg has labored in startups for fifteen years — ten years with Plastic Valley tech companies and 5 years building crypto projects. He’s most widely known for co-founding the Akash Network and AngelHack and helping Kadena grow from $80 million to in excess of $4 billion in 100 days.