Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

The FTX contagion that began within the second week of November continues to be haunting various crypto protocols within the DeFi ecosystem. The most recent to be taken in by the contagion includes the Solana-based decentralized exchange (DEX) Serum, which Alameda and FTX were backers. Another DeFi crypto buying and selling firm Auros Global missed its principal repayment on the 2,400 Wrapped Ether (wETH) DeFi loan.

Searching at another key news within the DeFi ecosystem, popular DEX protocol Uniswap launched its nonfungible token (NFT) marketplace aggregator, allowing users around the platform to trade NFTs.

Ankr grew to become the most recent victim of the exploit, with reported losses of nearly $5 million. The decentralized-finance protocol stated it’s dealing with exchanges to instantly halt buying and selling of their BNB staking rewards token, aBNBc.

The interest in liquid Ethereum staking has hit new records, seeing the greatest surge publish Merge.

The very best 100 DeFi tokens saw some respite rally after nearly three days of bearish dominance. A lot of the DeFi tokens traded in eco-friendly, with lots of hitting double-digit gains.

Serum exchange made ‘defunct’ following a collapse of Alameda and FTX

Solana-based DEX Project Serum has notified its community the collapse of their backers — Alameda and FTX — has made it “defunct.” They behind the work shared that “there is hope” regardless of its ongoing challenges due to the option open to “fork” Serum.

Based on the announcement, “A community-wide effort to fork Serum goes strong.” OpenBook, the city-brought fork from the Serum v3 program, has already been survive Solana with more than $a million daily volume, based on continuous efforts to grow it and also be its liquidity.

Crypto buying and selling firm Auros Global misses DeFi payment because of FTX contagion

Crypto buying and selling firm Auros Global seems to become struggling with FTX contagion after missing a principal repayment on the 2,400 wETH DeFi loan.

Institutional credit underwriter M11 Credit, which manages liquidity pools on Walnut Finance, told its supporters inside a November. 30 Twitter thread the Auros missed a principal payment around the 2,400 wETH loan, that is worth as a whole around $3 million.

Ankr confirms exploit, requests immediate buying and selling halt

BNB Chain-based DeFi protocol Ankr has confirmed it’s been hit with a multi-billion dollar exploit on 12 ,. 1. The attack made an appearance to become first discovered by on-chain security analyst PeckShield at roughly 12:35 am UTC on 12 ,. 2.

Inside an hour from the attack, Ankr confirmed on Twitter the aBNB token continues to be exploited which they’re dealing with exchanges to instantly halt buying and selling from the compromised token.

Uniswap launches NFT marketplace aggregator

According to a different publish on November 30, DEX Uniswap announced that users are now able to trade NFTs on its native protocol. As relayed through Uniswap, the part will initially feature NFT collections for purchase on platforms including OpenSea, X2Y2, LooksRare, Sudoswap, Larva Labs, X2Y2, Foundation, NFT20 and NFTX.

Uniswap developers declare that users can help to save as much as 15% on gas costs when compared with other NFT aggregators when utilizing Uniswap NFT, which unifies ERC-20 and NFT swapping right into a single swap router. Integrated with Permit2, users can swap multiple tokens and NFTs in a single swap while conserving gas charges.

Interest in liquid Ethereum staking options keeps growing publish-Merge

Blockchain data analytics transported out by Nansen highlights the ever-growing quantity of Ether (ETH) being staked across various staking solutions within the several weeks following Ethereum’s shift to proof-of-stake (PoS) consensus.

The long awaited Merge is a boon for DeFi generally, and staking solutions will be in popular since Ethereum’s shift to PoS. This really is based on blockchain data from a number of staking solutions over the Ethereum ecosystem.

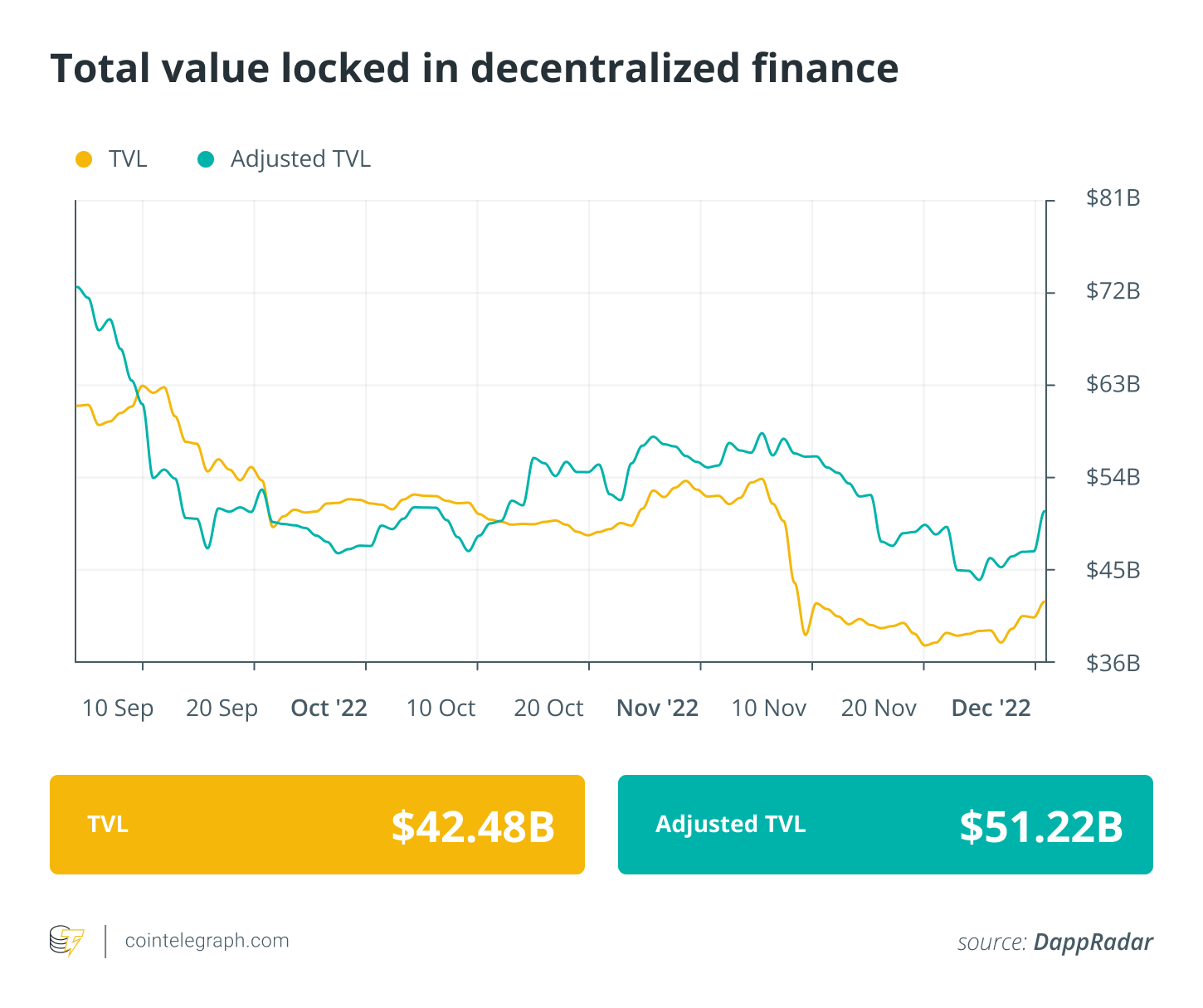

DeFi market overview

Analytical data reveals that DeFi’s total value locked rose above $40 billion. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital had its first bullish week after FTX contagion.

Fantom (FTM) was the greatest gainer one of the best players DeFi tokens, registering an outburst of 36.8% in the last week, adopted by Chainlink (LINK) having a 12.47% surge. Uniswap (UNI) also saw weekly gains of 11%.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.