Total value locked (TVL) in decentralized finance (DeFi) platforms built on Layer-2 systems for Ethereum (ETH) rose with a massive 964% within the first quarter when compared to same quarter this past year, even while average transaction charges on Ethereum’s first layer fell by 80%.

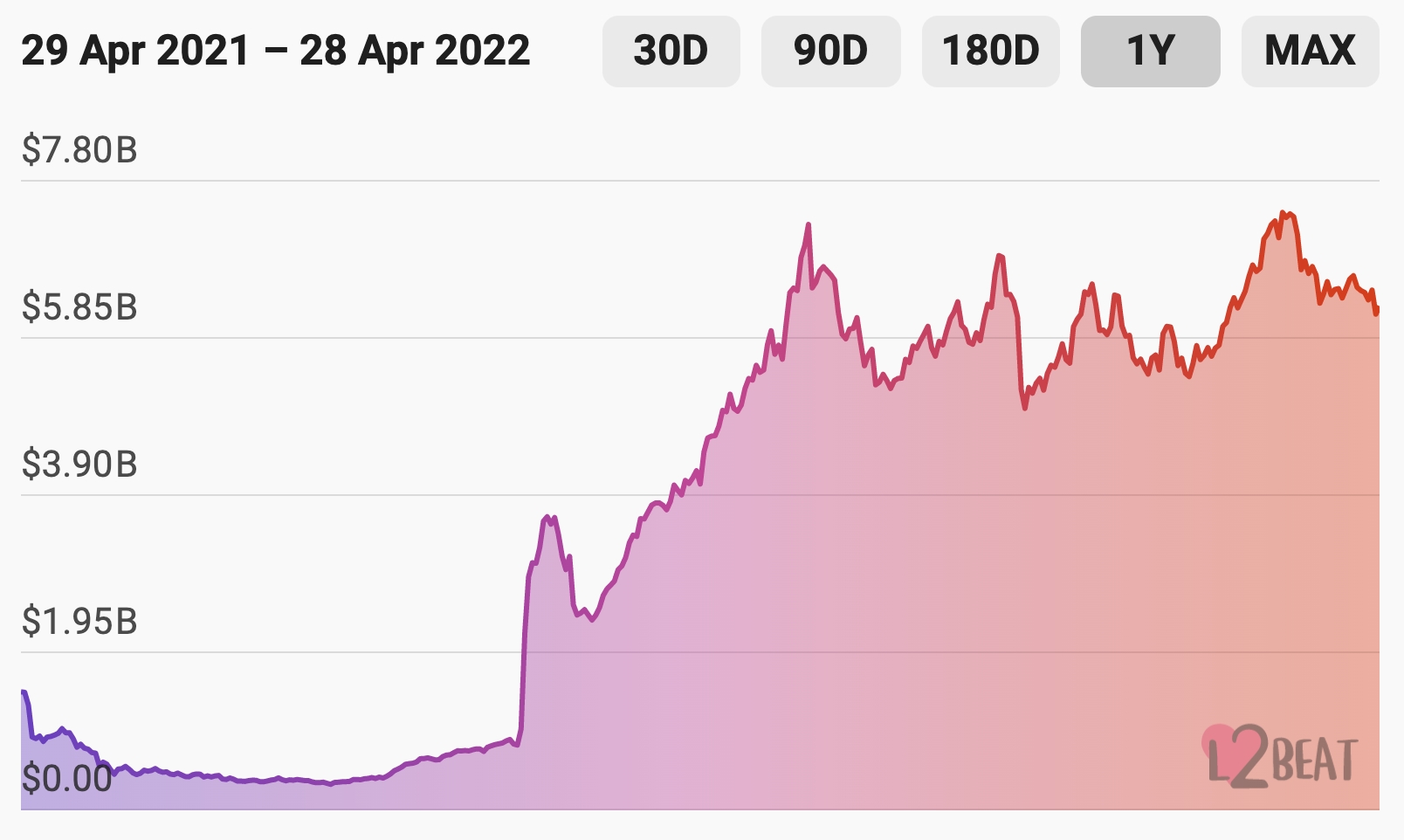

The information concerning the surprising development in TVL on Layer-2 platforms was shared inside a quarterly Condition of Ethereum report in the crypto educational resource Bankless, proclaiming that the quantity elevated by 964% from USD 686.9m by the finish of Q1 2021 to USD 7.3bn in the finish of Q1 2022.

The figure includes the entire value locked across all Ethereum Layer-2 scaling solutions, including positive rollups, zero-understanding rollups, and validiums, the report stated. It added that in most, greater than USD 23bn in digital assets, including USD 4.2bn price of ETH, happen to be bridged from Ethereum to Layer-2 systems along with other Layer-1 blockchains.

Development in TVL on Ethereum L2 systems:

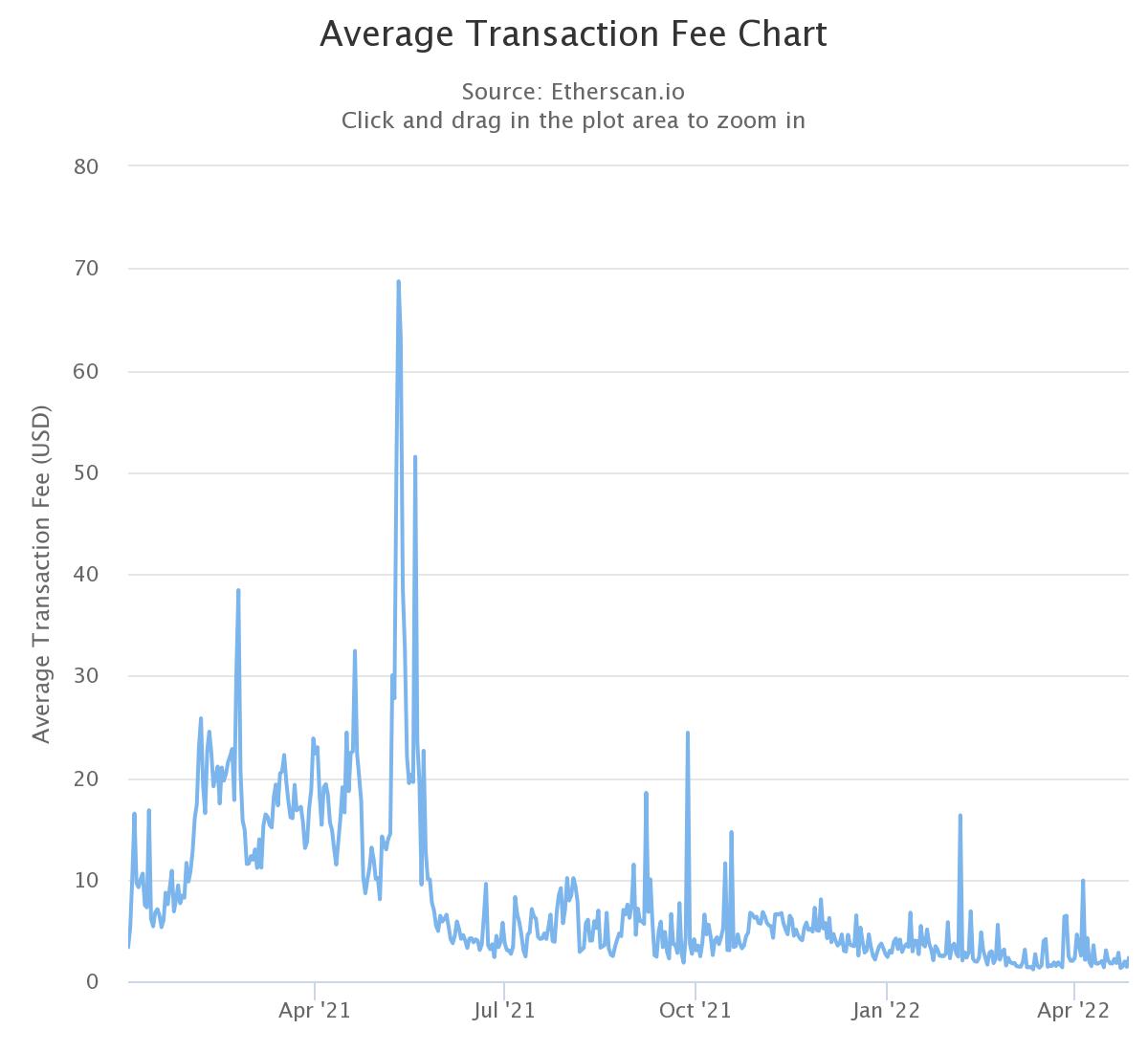

The big growth observed in using Layer-2 systems is possibly surprising because of the fall that’s been observed in transaction charges on Ethereum within the same period. Ethereum for any lengthy time completely dominated just blockchains for DeFi protocols, but has lately seen more usage shift to Layer-2 chains like Polygon (MATIC) and Arbitrum.

A Layer-2 network is really a separate blockchain built on the top of the blockchain (Layer-1), typically utilized by users who are required faster and cheaper transactions. Additionally to Ethereum-based systems, other systems for example Solana (SOL), Avalanche (AVAX), and BNB Chain (BNB) will also be more and more popular with DeFi users.

The charges, that have lengthy been high and offered as the main reason why users migrated to Layer-2 systems along with other blockchains, are actually lower at typically USD 2.98, the report stated.

That comes even close to a typical transaction fee of USD 14.93 by the finish of Q1 this past year – a discount of 80% during the period of annually.

Regardless of the stop by the typical transaction fee compensated, the quantity compensated by users for transacting around the network – referred to as network revenue – ongoing to increase year-over-year.

Based on the report, network revenue elevated 46% in the first quarter of this past year, from USD 1.6bn to USD 2.4bn. Using this, USD 2.48bn – or 87% – was taken off the circulating way to obtain ETH with the burning mechanism which was introduced with EIP-1559, the report stated.

____

Find out more:

– Layer 2 in 2022: Prepare for Rollups, Bridges, Newly Discovered Apps, Existence With Ethereum 2., and Layer 3

– Using Layer-2 Solutions to reduce Ethereum Charges: StarkWare

– Vitalik Buterin States His Influence Over Ethereum Diminishing, Harder to create Unexpected Things Happen

– Ethereum’s Merge Could Lower Interest in Bitcoin but Regulatory & Technical Challenges Persist

– Ethereum Foundation’s Crypto Holding Comprised of 99% ETH

– Bitcoin Funds See Slowing Investment Outflows, Ethereum Outflows Accelerate

– Buterin Claims Ethereum Simplicity continues to be Possible, as Developers Warn of Growing Complexity

– Ethereum Developer States Merge Delayed Until a ‘Few Several weeks After’ June