Major decentralized exchange (DEX) Uniswap (UNI) is incorporated in the initial phases of raising significant funds to help expand its decentralized finance (DeFi) choices, according to a different report.

Uniswap Labs, a DeFi startup adding towards the Uniswap Protocol, is engaging with numerous investors to boost an equity round of $100 million to $200 million, TechCrunch reported on Sept. 30.

The startup is dealing with investors like Polychain and something of Singapore’s sovereign funds included in the approaching funding round, the report notes, citing two anonymous people acquainted with the problem. Based on the report, Uniswap could be worth $1 billion, however the the deal are susceptible to changes because the discussions round the round haven’t been finalized.

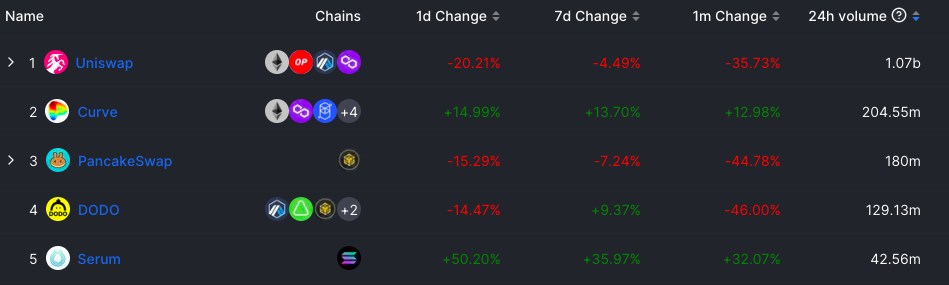

The brand new funding apparently aims to create more DeFi tools and nonfungible token (NFT) choices to Uniswap. During the time of writing, Uniswap’s daily buying and selling volumes amounted to $1.1 billion, or about 57% of buying and selling across global DEXs, based on data from DefiLlama. In comparison, Curve, the 2nd-largest DEX after Uniswap by volumes, has about $205 million in daily volumes.

“Our mission would be to unlock universal possession and exchange,” Uniswap Labs chief operating office Mary-Catherine Lader apparently stated. “If you are able to embed the opportunity to swap value and also have people join the city and exchange value together with your project, or perhaps your company or organization — that’s a effective method to allow more and more people to take part in this possession,” she added.

Uniswap Labs declined to verify or deny the set of the startup’s plans concerning the raise.

As formerly as reported by Cointelegraph, Uniswap has been around talks with multiple NFT lending protocols, targeting ambitious intends to tackle liquidity issues and also the “information asymmetry” around NFTs. The Ethereum-based DEX has possessed a growing trend regardless of the bear market this season.

Related: Pantera intends to raise $1.25B for second blockchain fund: Report

Launched in 2018, Uniswap completed its first-ever funding round in the American crypto-focused investment firm Paradigm in 2019. The organization also closed a set A funding round brought by Andreessen Horowitz in 2020, with a lot more investments from firms like Paradigm, USV, Version One, Variant, Parafi Capital yet others.