Following a boost in Ether (ETH) prices a week ago, the cryptocurrency may certainly be treading inside a consolidation phase, states asset management firm IDEG’s chief investment officer.

Inside a report distributed to Cointelegraph on Monday, the writer from the report, Markus Thielen, stated he as they continues to be bullish on ETH prices six days ago, he’s now switched “cautious.”

The thesis continues to be according to macro factors and cost research into the cryptocurrency, noting the Given is proven to “ramp up its Quantitative Tightening (QT) program which drains liquidity,” while noting that ETH’s prices had arrived at technical resistance around $1,800.

The asset management firm also noted this originates as Ethereum has witnessed a 47% stop by network revenue, home loan business total volume locked (TVL) there seemed to be home loan business the stablecoin market cap with USDC experiencing $1.1 billion of output during the last week.

Talking with Cointelegraph on Tuesday, IDEG chief investment officer Markus Thielen noted the recent cost rally is not based on a general change in fundamentals.

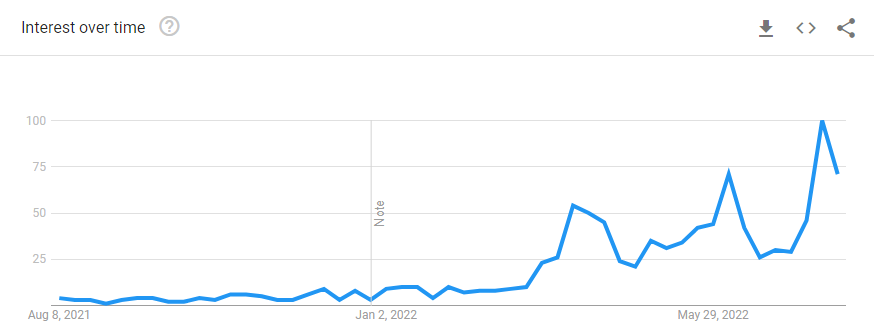

Thielen also believes that hype round the Ethereum Merge has become experiencing a downward trend, highlighted by recent Search data.

Source: “Ethereum Merge” Google trends results: Google, IDEG Research.

Thielen recommended this “Merge fatigue” signifies that ETH is placed for any consolidation period before the approaching Merge on September 19. But, Thielen also added this may open doorways for additional buying possibilities:

“Ideally, a drop in to the finish of August would set us up for an additional great entry-level.”

Related: Pro traders could use this ‘risk averse’ Ethereum options technique to take part in the Merge

Thielen also commented around the interesting correlation between ETH cost and Ethereum Merge Search results which are presently playing:

“It is a great indicator for sentiment and interest, but it’ll eventually break lower and be irrelevant. Nonetheless, it could offer some insights into timing current Ethereum’s cost become the big event.”

Following a Merge, Thielen is from the view that ETH cost is going to be mostly affected by how quickly adoption rates increase:

“While gas charges might stay, the adoption curve may not rise initially as quickly as many hope, this might make ETH slightly valued, when measured in pure cashflow terms”.

ETH is presently costing $1,587 during the time of writing, lower 6.24% during the last 24 hrs.