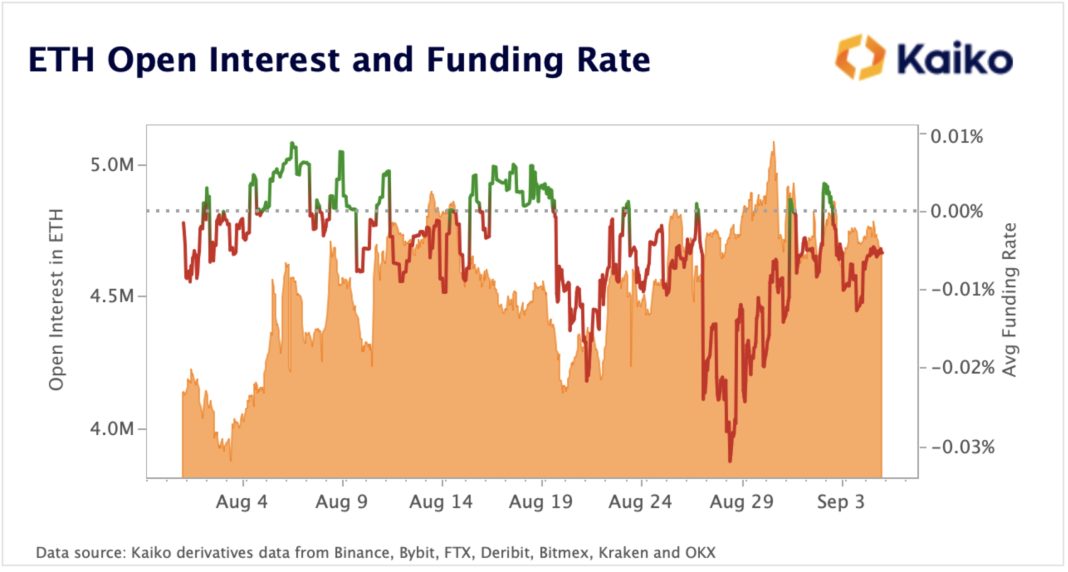

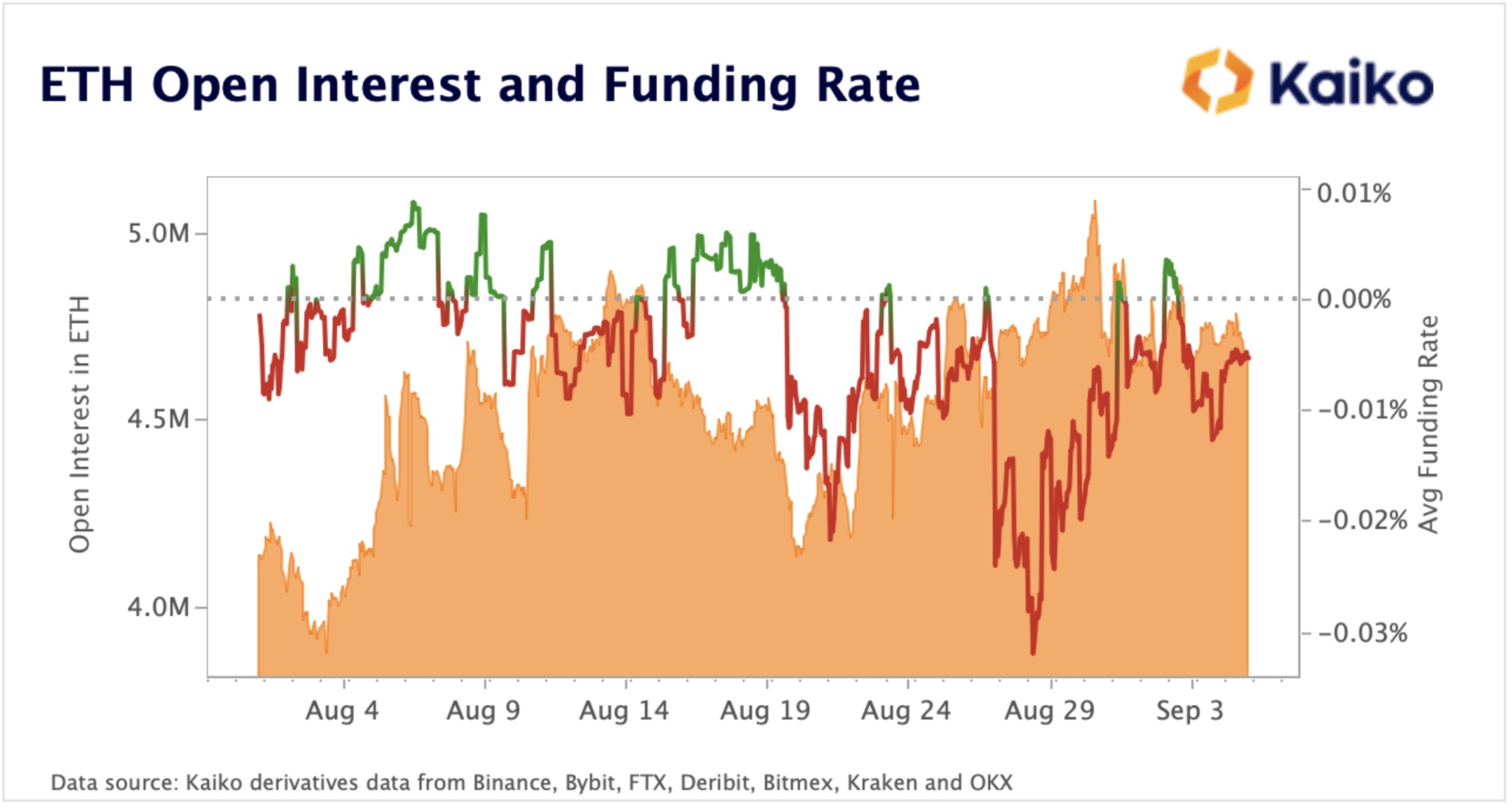

Open interest (OI) in ethereum (ETH) futures has retraced in the all-time highs in ETH terms arrived at at the end of August, despite Ethereum’s long awaited transition to proof-of-stake moving closer each day.

Per a brand new report from crypto investigator Kaiko, a pullback in ETH OI continues to be observed to date in September, retracing from 5.1m ETH within the finish of August to 4.7m ETH by September 5. And even though the present open interest rates are a decline in the highs, still it marks among the largest buildups of OI within the ETH futures market.

The uptick in interest from futures traders may come as the Ethereum network is preparing for that network’s transition from proof-of-work (Bang) to proof-of-stake (PoS), a celebration referred to as Merge that’s likely to occur between September 10 and 20.

The notable alterations in OI originates because the place cost of ETH has ongoing to increase because the finish of August, moving from the closing cost on August 31 of USD 1,554 to USD 1,668 by Tuesday at 11:30 UTC.

Ethereum cost expires 6.8% today on Merge optimism

During the time of writing, the place cost of ETH was up 6.8% within the last 24 hrs or more 7.4% within the last seven days. The daily gain was enough to really make it today’s best artist one of the top ten cryptoassets by market capital, per CoinGecko data.

Based on the Kaiko report, the loss of OI originates as funding rates within the ETH futures market briefly entered into positive territory, before later falling back underneath the zero-line.

“This could indicate that sentiment regarding ETH in front of the Merge is improving among futures investors in mind changes from risk hedging pre-Merge to some more positive outlook publish-Merge,” the Kaiko report stated.

An optimistic funding rate implies that traders who’re lengthy have to pay a funding fee to individuals who’re short, while an adverse funding rate leads to the alternative situation.

Funding rates on perpetual futures are usually positive during bullish market conditions and negative during bearish conditions.