Ethereum investment products elevated by 2.36% to $6.81 billion in assets under management (AUM) throughout August, outperforming Bitcoin items that saw a 7.16% fall off to $17.4 billion.

The figures were found in a brand new report by CryptoCompare.

It was also reflected within the Bitcoin (BTC) and Ethereum (ETH)-product buying and selling volumes, with Grayscale’s noticably Bitcoin product, GBTC experiencing a 24.4% stop by volume, while its Ethereum product, GETH really elevated 23.2%. CryptoCompare’s report suggeste the long awaited Ethereum Merge was the reason behind the modification in buying and selling volumes:

Indeed, even in a more granular level, no Bitcoin products covered within this report saw AUM or volume gains within the month of August. We’re able to be seeing interest escape from Bitcoin for the short term, as Ethereum-based products contain the attention using the much-anticipated merge coming.

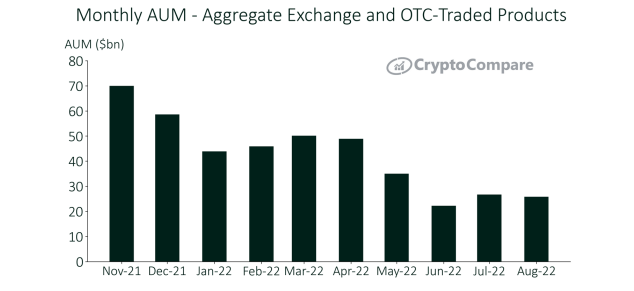

Monthly AUM figures for digital asset investment products fell 4% overall, that was largely related to 6% fall from Grayscale’s GBTC product, because it makes up about $13.4 billion from the total $25.8 billion of digital assets under management (53.4%).

The biggest inflows originated from products falling underneath the “Other” umbrella, representing non-Bitcoin and Ethereum products, which saw a 12.3% increase to $1.13 billion within the first three days, based on the report.

Regardless of the bear market, numerous highly-considered banking institutions have launched crypto investment products through the month of August. These items came by means of Eft’s (ETFs), Exchange Traded Certificates (ETC), Exchange Traded Notes (ETN) and Trust products.

One of the most notable was BlackRock’s private place Bitcoin Trust, moving which introduced in regards to a “here comes Wall Street” response from former Grayscale Chief executive officer Craig Silbert. The launch from the Bitcoin Trust in the world’s largest asset manager came following its partnership with Coinbase to supply its clients with institutional buying and selling services.

Charles Schwab was another lender to create a play this month, getting launched its very own “Schwab Crypto Thematic ETF”, tickered STCE around the New You are able to Stock Market, which supplies contact with a mixture of mining and staking companies, together with several blockchain-based applications.

Related: Institutions flocking to Ethereum for 7 straight days as Merge gets near: Report

BetaShares launched Australia’s first Metaverse-focused ETF around the Australian Stock Market (ASX), plus a new Metaverse and nonfungible token (NFT) focused ETF launched by finance firm SoFi.