Ethereum blockchain is slated for among the greatest updates since its beginning, because it will transition to some proof-of-stake (PoS) mining consensus from the current proof-of-work (Bang) one.

The Merge date is scheduled for Sept. 15, following the effective Goerli test internet integration — the ultimate test internet merger prior to the actual transition. Ether (ETH), the native token, was on the bullish surge following the announcement from the Merge date in This summer using the ETH cost rising to a different six-month a lot of over $2,000 but unsuccessful to consolidate the critical resistance.

The bullish enthusiasm when it comes to token cost and market sentiment appears to be a decline once we close to the Merge. A substantial slice of ETH whales has witnessed a clear, crisp loss of their holdings.

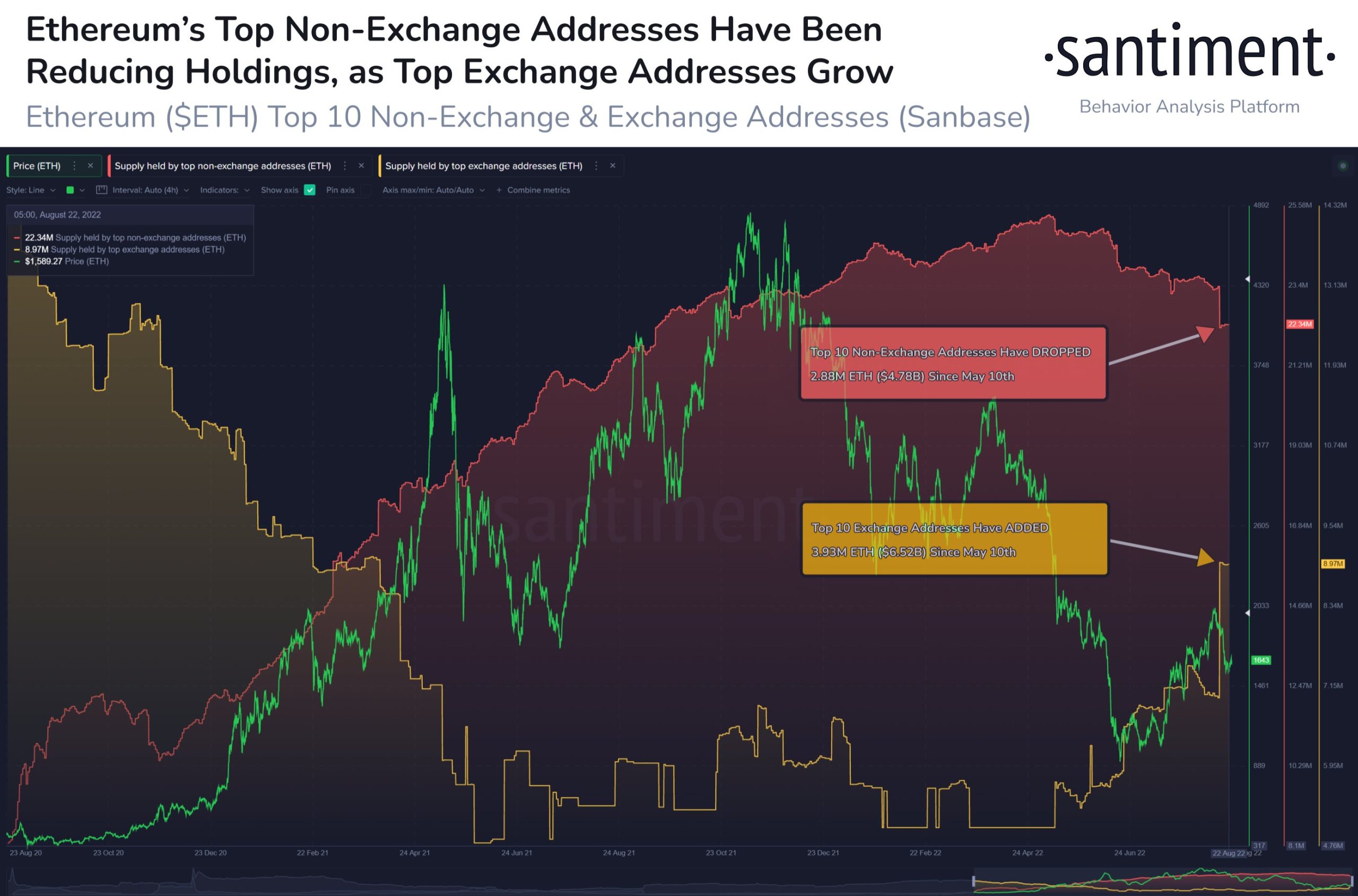

Data from crypto analytic firm Santiment signifies the gap between Ethereum’s top-10 largest non-exchange addresses and exchange addresses is closing. In the last three several weeks, top whale addresses have sent a lot of ETH onto exchanges as non-exchange addresses saw a decline of 11% while exchange-based addresses have experienced a 78% surge.

The flow of crypto onto exchanges is recognized as a bearish sentiment and it is frequently made by traders to consider an income by selling their tokens. The rise in the quantity of ETH by whale addresses on exchanges suggests these whales expect the cost to visit lower soon.

Many market analysts also think that the Merge will be a “purchase the rumor, sell this news” kind of event. In which the market rallied as a direct consequence from the Merge date confirmation, but tend to eventually visit a cost decline following the key event. The old saying implies that if great news is anticipated sometime later on, the cost will frequently move greater awaiting that date, although not always after.

I believe #Ethereum will drop so difficult around the Merge day.

The entire anticipation gets not bought on the place market but around the futures market.

Be cautioned.

— Crypto Rover (@rovercrc) August 23, 2022

The Merge would mark the conclusion from the second of three phases in Ethereum’s transition towards the PoS consensus. The PoS transition process started in December 2020 using the launch from the Beacon chain.

Related: Monthly Ethereum options data suggests $2K will stay an elusive target

The present phase was scheduled to become performed by mid-2021, however, because of several delays, it’s now slated for that third quarter of 2022. The 3rd phase will be the most important because it would introduce several scalability features for example sharding and reducing blockchain’s energy consumption considerably.

The Sept. 15 event is really a significant milestone for Ethereum, however, simultaneously, the Merge would only mean a big change of mining consensus. Key benefits for example high transaction capacity, lower gas charges and decrease in energy consumption would really come following the completing the 3rd phase.