Cost action over the cryptocurrency market was largely subdued on This summer 21, as traders required each day to digest gains in the last week and book profits following a greatest relief rally since early June.

Among speculation by what drove the current rally, the Ethereum Merge has consistently rated towards the top of their email list. The marketplace rally shifted into high gear following a tentative date of Sept. 19 was looking for the mainnet Merge.

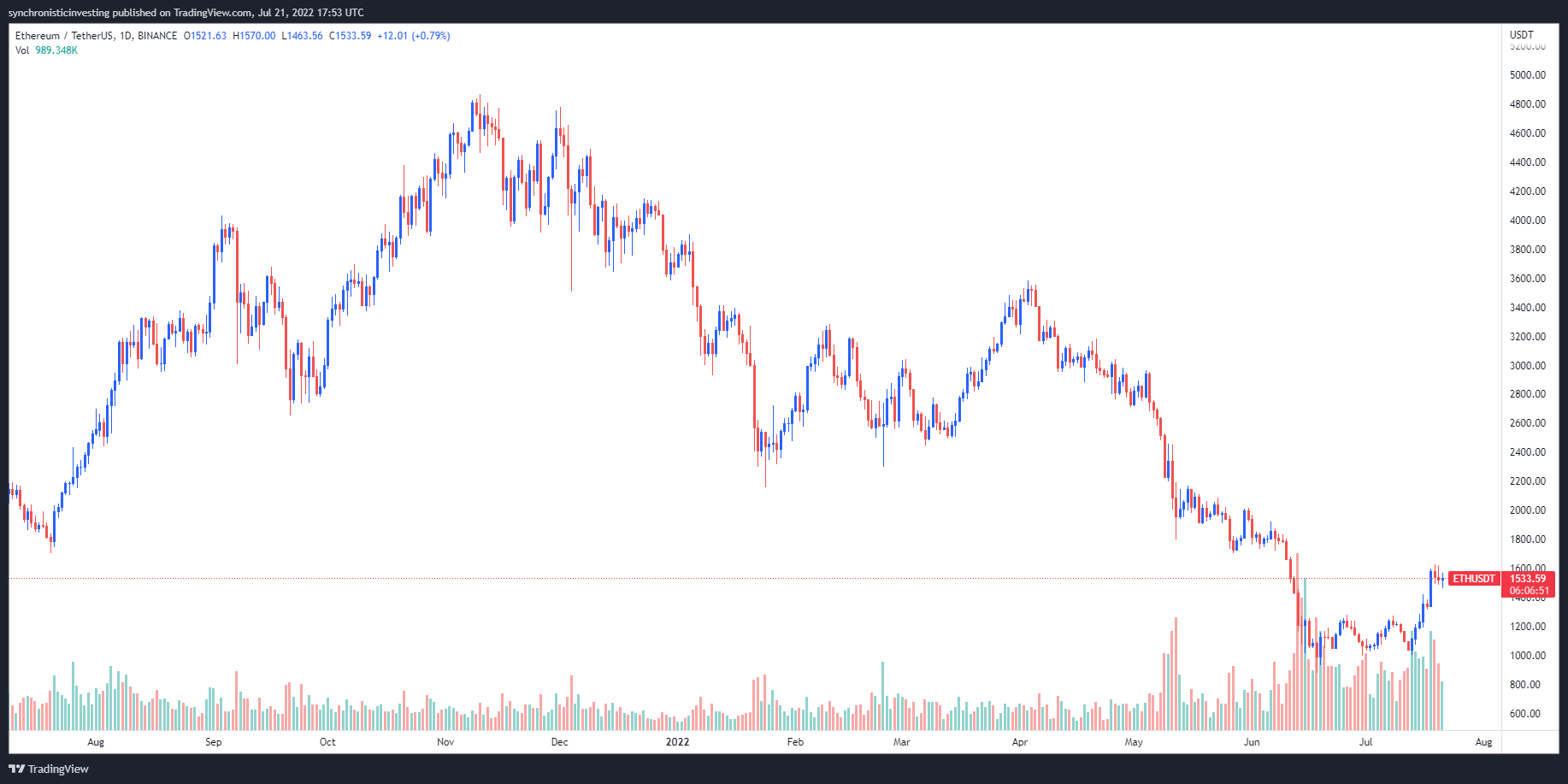

Data from Cointelegraph Markets Pro and TradingView implies that after hitting a higher of $1,620 on This summer 20, Ether’s (ETH) price retraced to some low of $1,463 in early buying and selling hrs on This summer 21 and it has since rose back above support at $1,500.

Since the first cost surge introduced on through the Merge announcement has subsided, here’s what several analysts expect to unfold as Ether’s mainnet transition to proof-of-stake approaches.

A proper pullback

Ether’s pullback on This summer 21 is really a positive development based on market analyst Rekt Capital, who published the next chart highlighting the significance of its weekly close above $1,300 and subsequent move greater.

Rekt Captial stated:

“Though #ETH could just continue greater to achieve top of the orange region, it might be healthier for ETH to dip. This type of retest from the lower orange area would only increase possibility of continuation.”

This summer 21’s pullback aligns with this particular outlook and suggests the potential of moving as much as $1,700 soon.

Look out for a clear, crisp drop to $1,200

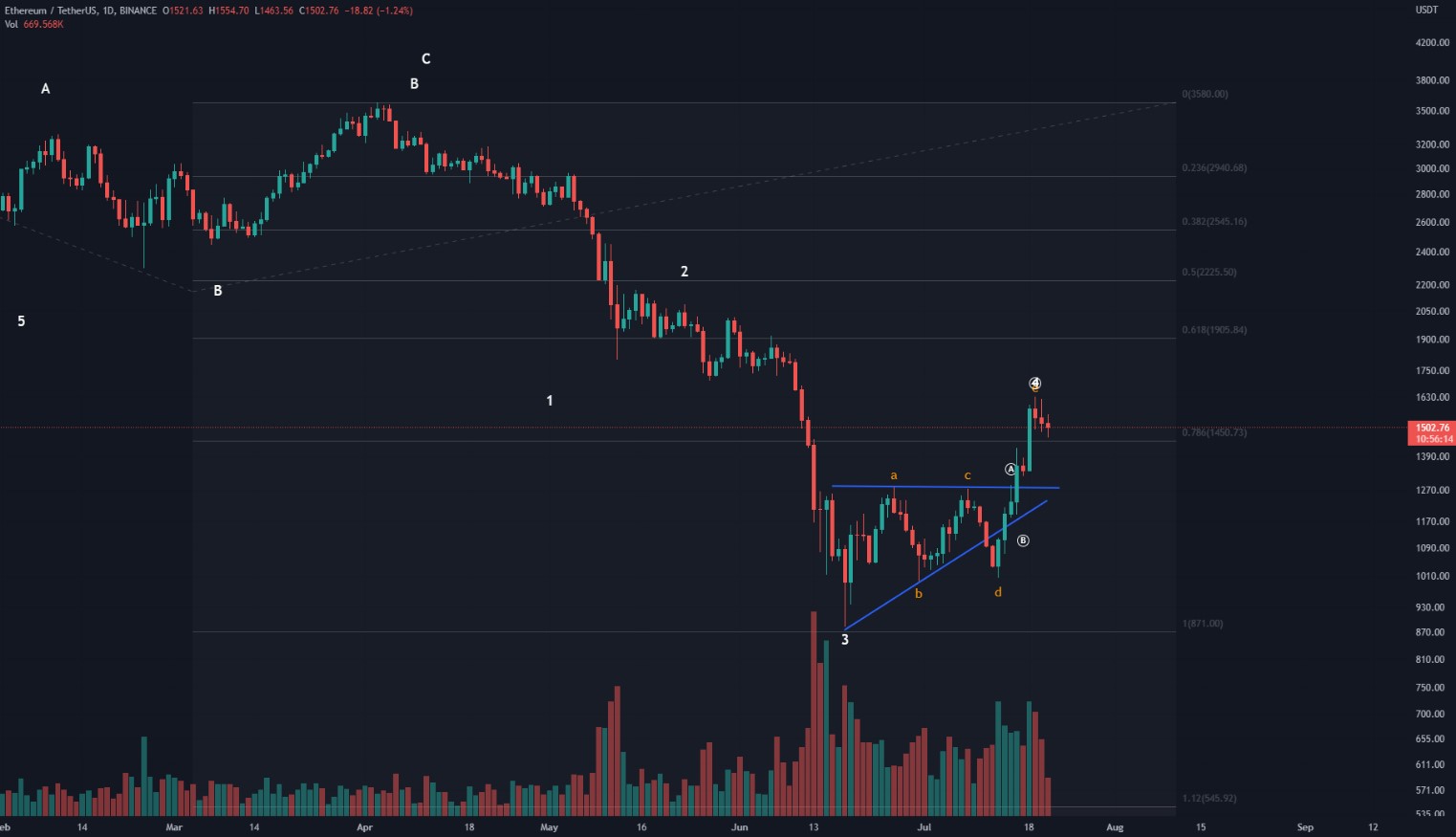

Ether’s modest retrace seemed to be an anticipated development by crypto trader and pseudonymous Twitter user Team Lambo, who provided the next chart showing the obvious rejection at $1,630 and 10% retracement.

Team Lambo described inside a Twitter publish:

“Now the larger correction can come below $1,440 and probably will discover a sharp drop towards $1,200 so continue awaiting that move for #Ethereum.

Lower highs and greater lows

A far more nuanced research into the recent cost action for Ether was provided by market analyst CryptoLinns, who published the next chart noting the move ahead This summer 20 didn’t set a brand new high as the drop on This summer 21 didn’t set up a new have less some-hour chart.

CryptoLinns stated,

“The last candle demonstrated a lengthy lower shadow line, which proves demand made an appearance. But volume isn’t enough. Be careful if the need for this candle now’s persistent.”

Based on CryptoLinns, the present support level is situated at $1,450 while overhead resistance is located at $1,630.

Your final little bit of understanding of the critical levels to look at around the Ethereum chart was supplied by crypto trader Altcoin Sherpa, who published the next chart identifying ‘abnormal’ amounts of support at $1,012 and $1,281 and overhead resistance at $1,701, $2,145 and $2,465.

The general cryptocurrency market cap now is $1.039 trillion and Ether’s dominance rates are 18%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.