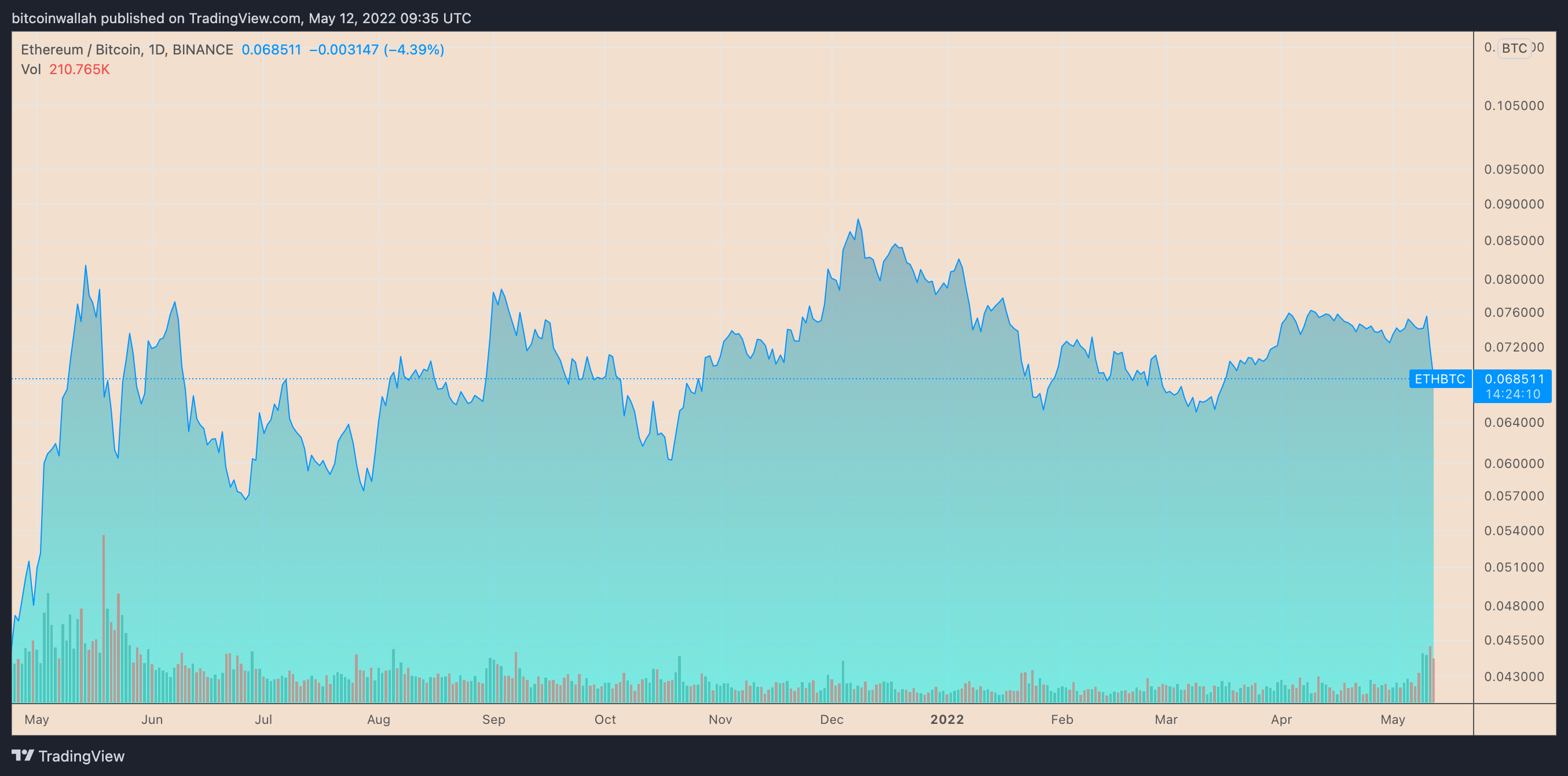

Ethereum’s native token, Ether (ETH), stepped to the cheapest level in almost two several weeks against Bitcoin (BTC) like a crypto market sell-off intensified on May 12.

Macro headwinds get caught up to ETH/BTC finally

The ETH/BTC buying and selling pair fell by 7.5% to .0663 previously 24 hrs. The down-side move came as part of a correction that started May 11 once the pair traded in the local a lot of .0768. That pressed Ether lower against BTC by as much as 13.75%.

Cryptocurrencies came under stress in recent days alongside stock markets. Particularly, money managers, traders and investors show indications of “de-risking” their portfolios among growing concerns over an more and more hawkish U . s . States Fed.

Ether, the 2nd-largest cryptocurrency by market capital, has additionally been hit through the same macro headwinds, now buying and selling 65% less than its record a lot of around $4,870 in November 2021. Similarly, Bitcoin is lower 63% from the all-time a lot of $69,000 within the same period.

Because of Ether’s slightly limited decline when compared with Bitcoin’s, ETH/BTC has proven resilience regardless of the market downturn in 2022. Nevertheless, the happy couple now shows indications of catching to the bearish trend, suggesting more discomfort ahead.

Rising wedge breakdown in play

ETH/BTC’s latest decline has already established it break below its prevailing rising wedge pattern, suggesting the pair’s technical downside target might be reduced than May 12’s local lows.

That’s because rising wedges are bearish reversal patterns that typically send the cost lower up to their maximum height when measured in the breakdown point.

Hence, the ETH/BTC rising wedge’s breakdown target involves be near .064 after adding the structure’s maximum height, usually around -.009 BTC, towards the breakdown reason for .073 BTC.

On the other hand, ETH/BTC continues to be testing an upward sloping trendline, marked as “LTF support” within the chart above, as support since June 2021. The pair’s make an effort to break underneath the cost floor of May 12 fell short as traders collected to purchase the dip. That motivated Ether to rebound by 3.5% from the intraday low of .066 BTC.

Related: DOGE will get more love on Twitter and Ether will get more hate: Data analysis

But ETH faces a string of resistance levels because it pursues an upward continuation trend within the future. They have an interim cost ceiling of .069 BTC — based on the .236 Fib type of the Fibonacci retracement graph attracted in the .087 BTC-swing high towards the .064 BTC-swing low adopted through the 200-day exponential moving average (200-day EMA nowhere wave) near .073 BTC.

Bitcoin’s market dominance hits six-month high

The ETH/BTC plunge coincided using the Bitcoin dominance index — a metric that measures Bitcoin’s share of the market against altcoins — climbing to almost 45% on May 12, its greatest level since November 2021. It can possibly claim that traders are viewing Bitcoin because the safer bet — the “digital gold” — among the present market turmoil.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.