Whether one analyzes Ether’s (ETH) longer-term or weekly time period, there’s little expect bulls. Aside from the negative 69% year-to-date performance, a climbing down funnel continues to be pressuring the ETH cost and will be offering resistance at $1,200.

Regulatory uncertainty is constantly on the weigh lower the sphere. For instance, Starling, an electronic bank located in the Uk, announced on November. 22 it would no more allow people to send or get money from digital asset exchanges or retailers. The financial institution described cryptocurrencies as “high-risk and heavily employed for criminal purposes.”

Other concerning news for that Ethereum ecosystem involved the decentralized finance (DeFi) platform AAVE, which endured a brief-seller attack on November. 22 aimed to learn from under-collateralized loans.

Strangely enough, a similar exploit happened around the Mango Markets DeFi application in October. Although not really a direct attack around the Ethereum network, the attacker has proven critical flaws in certain major decentralized collateral lending applications.

In addition, the Singapore-based cryptocurrency loan provider Hodlnaut is apparently facing a police probe over allegations of cheating and fraud. The problems began on August. 8 following the finance company reported a liquidity crisis and suspended withdrawals around the platform.

Lastly, on November. 22, U . s . States senator Elizabeth Warren correlated the demise from the FTX exchange to subprime mortgages of 2008 and cent stocks employed for pump-and-dump schemes. Warren stated the FTX collapse ought to be a “wake-up call” to regulators to enforce laws and regulations around the crypto industry.

That’s the reason the $1.13 billion Ether monthly options expiry on November. 25 will put lots of cost pressure around the bulls, despite the fact that ETH published 11% gains between November. 22-24.

The majority of the bullish bets were placed above $1,400

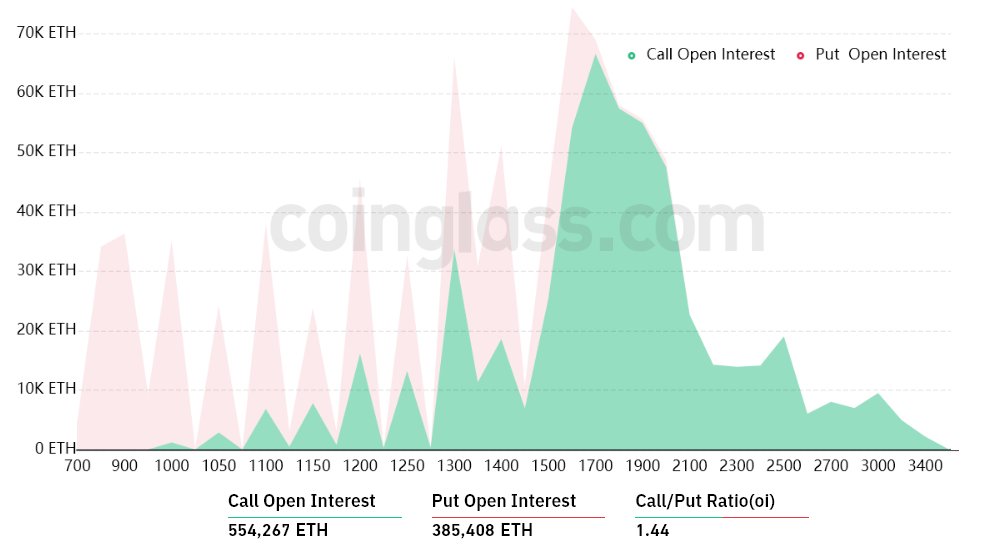

Ether’s rally toward the $1,650 resistance on November. 5 gave the bulls the signal to anticipate a continuation from the upward trend. This becomes apparent since 17% from the call (buy) choices for November. 25 happen to be placed below $1,400. Consequently, Ether bears be more effective positioned for that monthly expiry from the approaching $1.13 billion options.

A wider view while using 1.44 call-to-put ratio shows a skewed situation with bullish bets (calls) open interest at $665 million in comparison to the $460 million put (sell) options. Nonetheless, with Ether presently hovering around $1,200, bears possess a dominant position.

For example, when the Ether cost remains below $1,250 at 8:00 am UTC on November. 25, only $40 million price of these call (buy) options is going to be available. This difference is really because there’s no use within the authority to buy Ether at $1,250 or $1,500 whether it trades below that much cla on expiry.

Bears could pocket a $215 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on November. 25 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $1,050 and $1,150: 800 calls versus. 20,200 puts. The internet result favors bears by $215 million.

- Between $1,150 and $1,250: 3,300 calls versus. 15,100 puts. The internet result favors bearish bets by $140 million.

- Between $1,250 and $1,300: 4,700 calls versus. 13,200 puts. The internet result favors bears by $100 million.

- Between $1,300 and $1,400: 8,700 calls versus. 8,900 puts. The internet outcome is balanced between bulls and bears.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

A 7-year-old dormant Bitcoin wallet could complicate things for Ether bulls

Ether bulls have to push the cost above $1,300 on November. 25 to balance the scales and steer clear of a possible $215 million loss. However, Ether bulls appear at a complete loss since a Bitcoin wallet associated with the 2014 Mt. Gox hack moved 10,000 BTC on November. 23.

Ki Youthful Ju, the cofounder of blockchain analytics firm Cryptoquant, has verified the findings, noting .6% from the funds were delivered to exchanges and could represent sell-side liquidity.

If bears dominate the November ETH monthly options expiry, which will likely add firepower for more downside bets. Thus, right now, there’s no indication that bulls can change the tables and steer clear of pressure in the two-week-lengthy climbing down triangular.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.