Ethereum’s native token Ether (ETH) fell around the final buying and selling day’s Q2/2022, buying and selling synchronized with riskier assets among persistent fears of greater inflation and rising rates of interest. Also it could cause further declines heading into Q3.

ETH cost breakdown going ahead

ETH’s cost stepped nearly 5% this June 30 to $1,044 carrying out a four-day losing streak. The ETH/USD pair has additionally broke below its interim rising trendline support, which in conjugation having a horizontal trendline potential to deal with the upside, constitutes an “climbing triangular” pattern.

Climbing triangles are bearish continuation patterns once they occur following a sharp downtrend. Therefore, a failure from an climbing triangular typically leads to the cost falling further lower, typically up to the structure’s maximum height.

Ether have been trending in a climbing triangular since June 13, breaking underneath the triangle’s lower trendline on June 29 — moving that supported an increase in buying and selling volumes, confirming traders’ conviction in regards to a further downtrend.

Consequently, ETH’s downside target in Q3, brought through the climbing triangular setup, involves be near $835, almost 20% less than today’s cost.

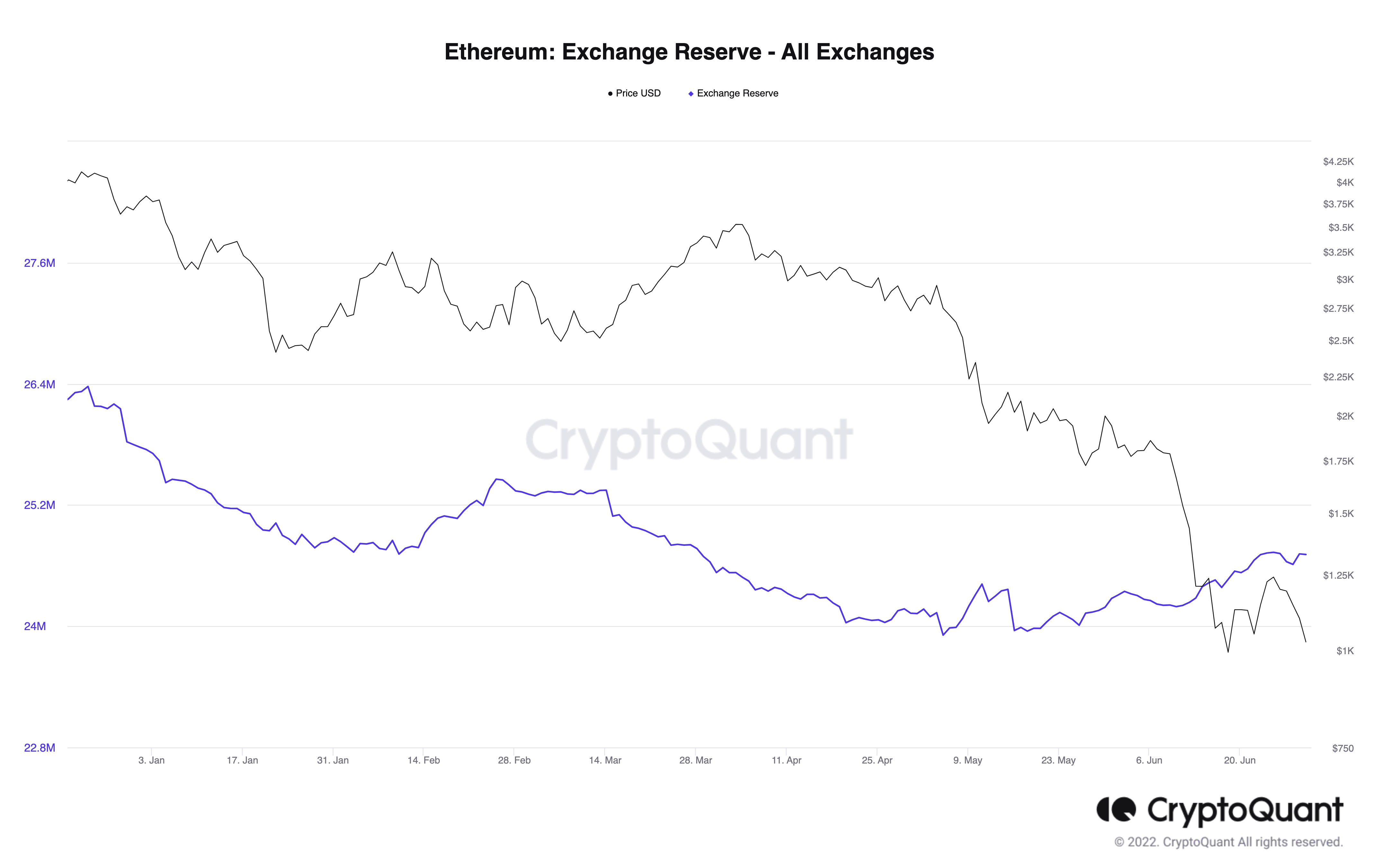

Exchange reserves are rising

The bearish technical outlook can also be boosted by an upward trend in the amount of ETH on exchanges.

Particularly, investors have deposited around a million Ether tokens across all crypto buying and selling platforms since May 2022, based on data from CryptoQuant. As the quantity of ETH increases in exchanges’ wallets, it signifies an increasing selling pressure within the Ether market.

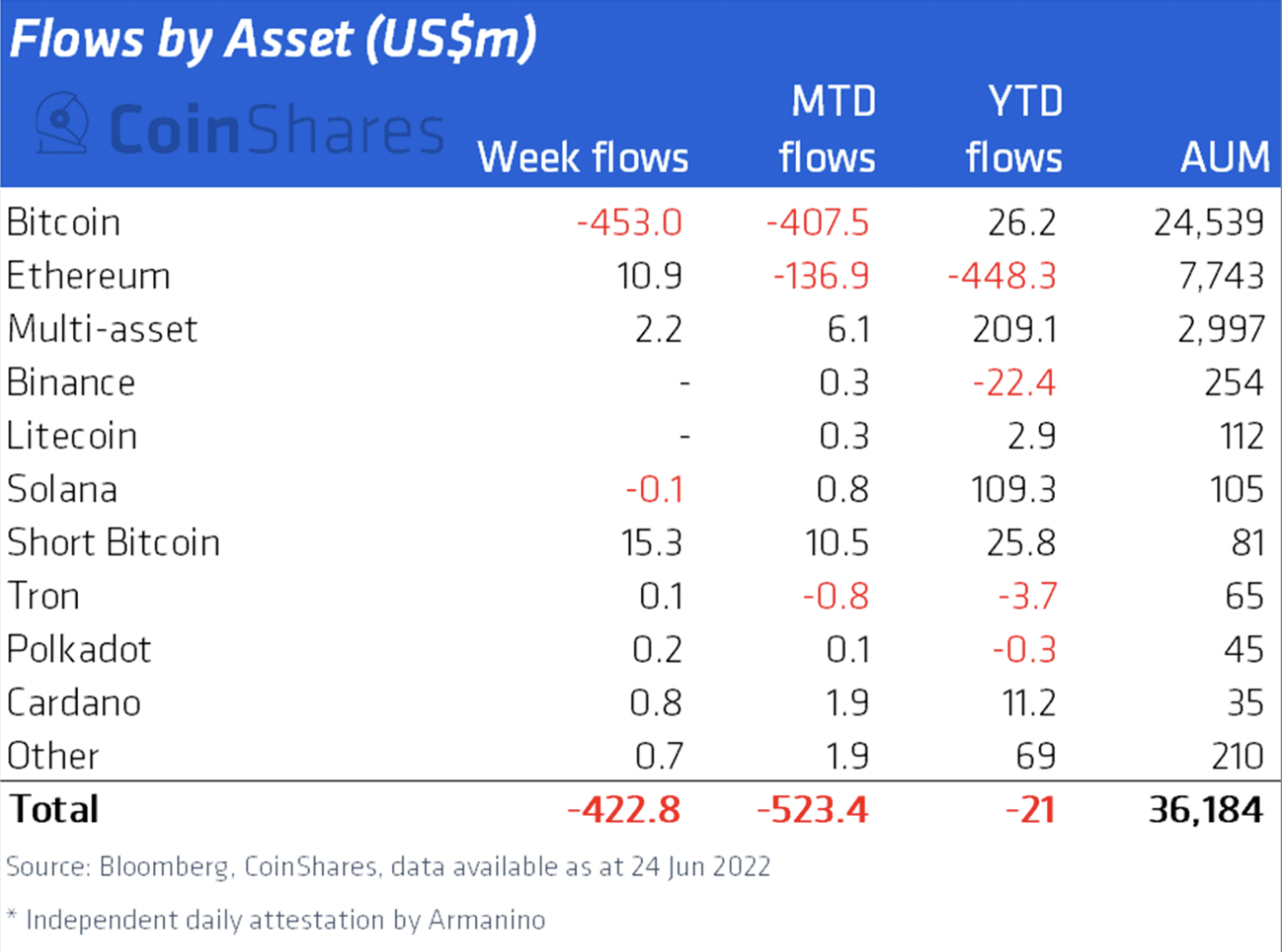

Institutional investors are also restricting their exposure in Ether by withdrawing capital in the dedicated investment funds, CoinShares noted in its weekly report.

Ether-focused investment products have observed $136.9 million price of outflows in June. In 2022 to date, they’ve processed circa $450 million in withdrawals, confirming that traditional investors are extremely bearish on ETH.

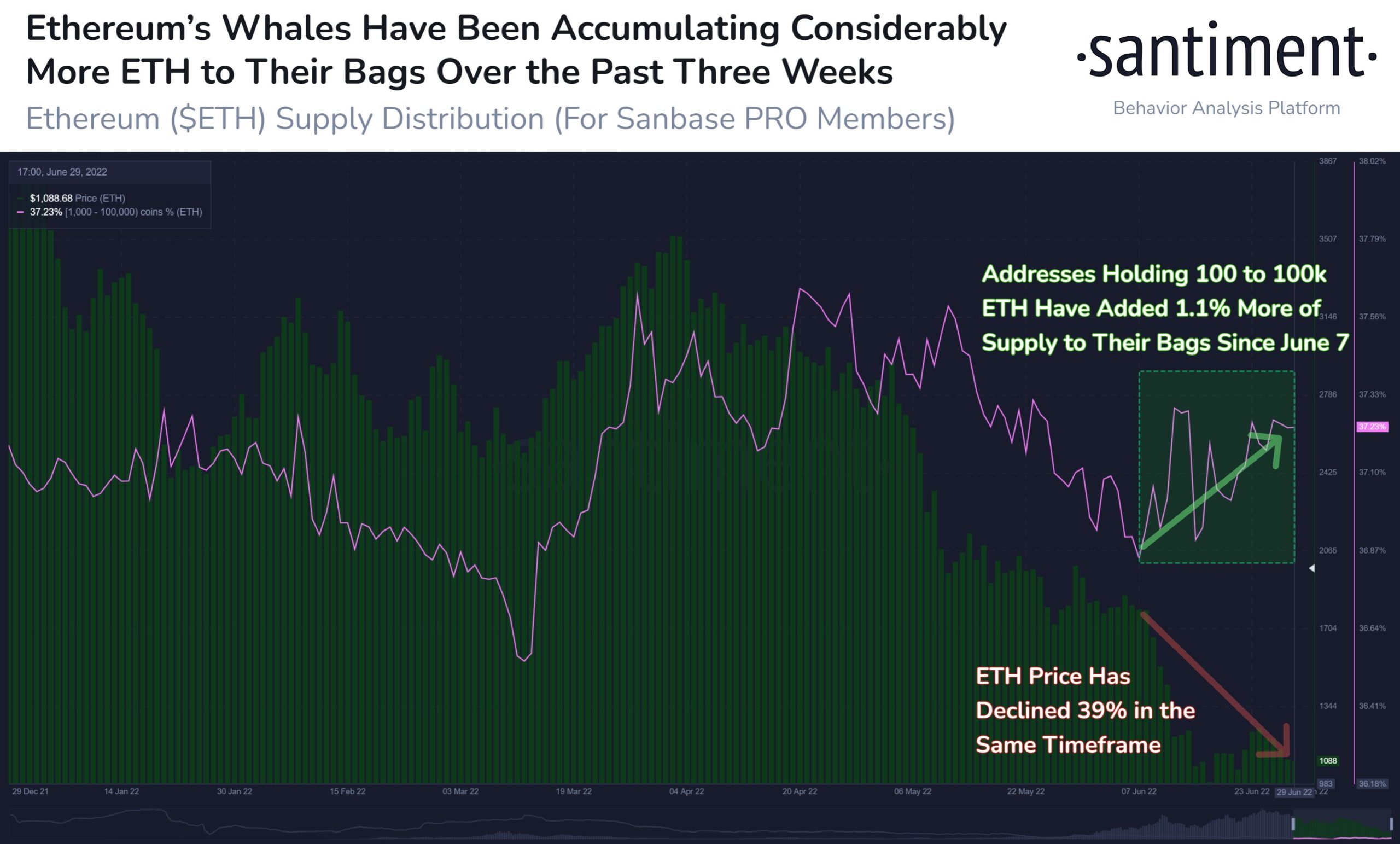

ETH sharks and whales purchase the dip

Around the vibrant side, the loss of Ether’s prices across June provides a number of its wealthiest investors the chance to “purchase the dip.”

Related: ‘Can’t stop, will not stop’ — Bitcoin hodlers purchase the dip at $20K BTC

“Ethereum shark and whale addresses (holding between 100 to 100K $ETH) have with each other added 1.1% a lot of coin’s supply for their bags about this -39% dip [since June 7],” noted Santiment, a crypto-focused data analytics platform, adding:

“Historic evidence suggests this tier group getting alpha on future cost movement.”

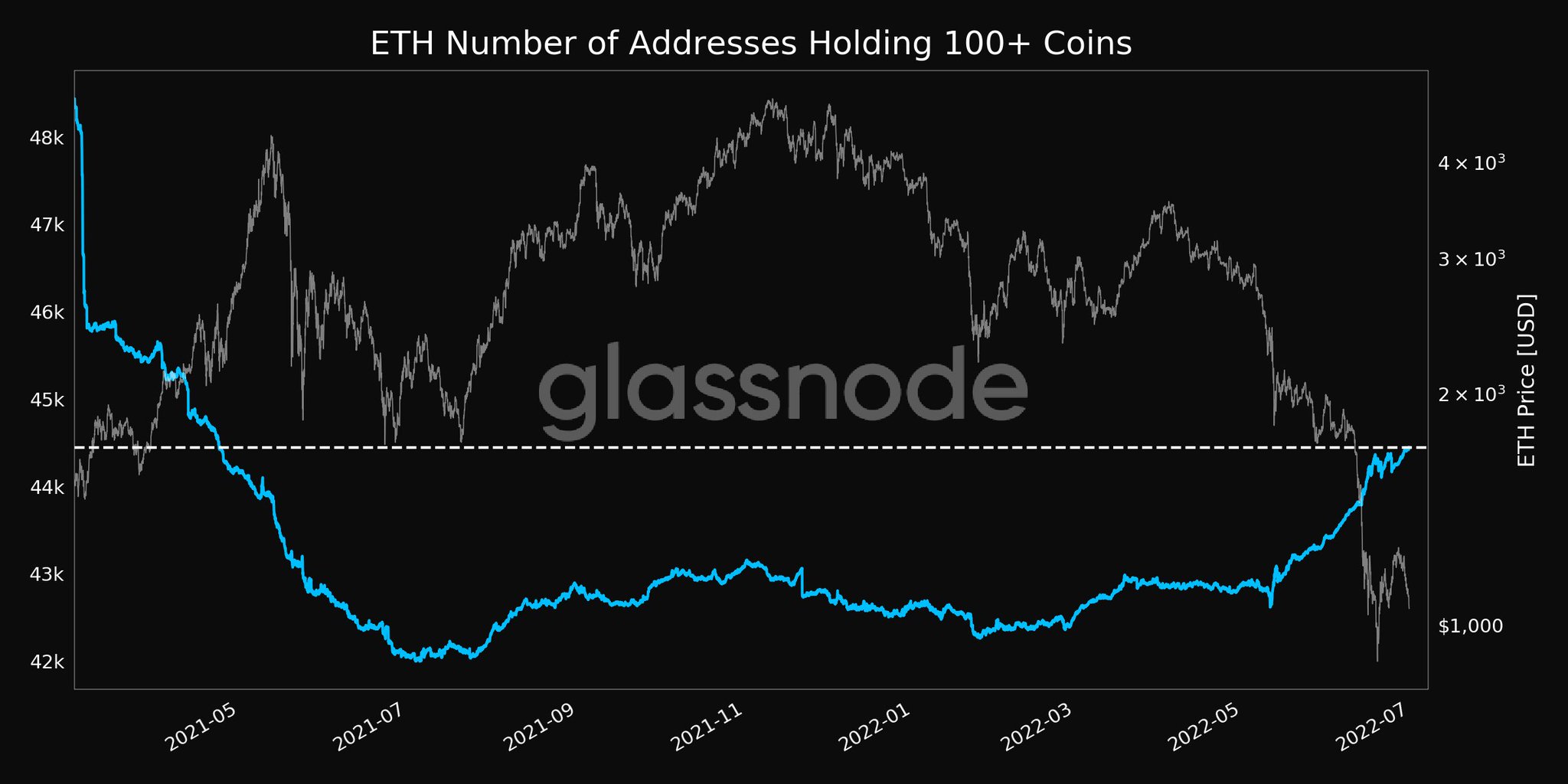

Furthermore, smaller sized investors are also showing an identical dip-buying sentiment, having a consistent rise in addresses holding a minimum of .1, 1, and 10 ETH because the finish of this past year, data from Coinglass shows.

Ether’s cost is presently lower nearly 75% year-to-date.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.