Ethereum investors who staked huge amount of money price of Ether (ETH) tokens to get validators on its soon-to-launch proof-of-stake (PoS) network are actually facing heavy paper losses.

Ether place traders outshine stakers by 36.5%

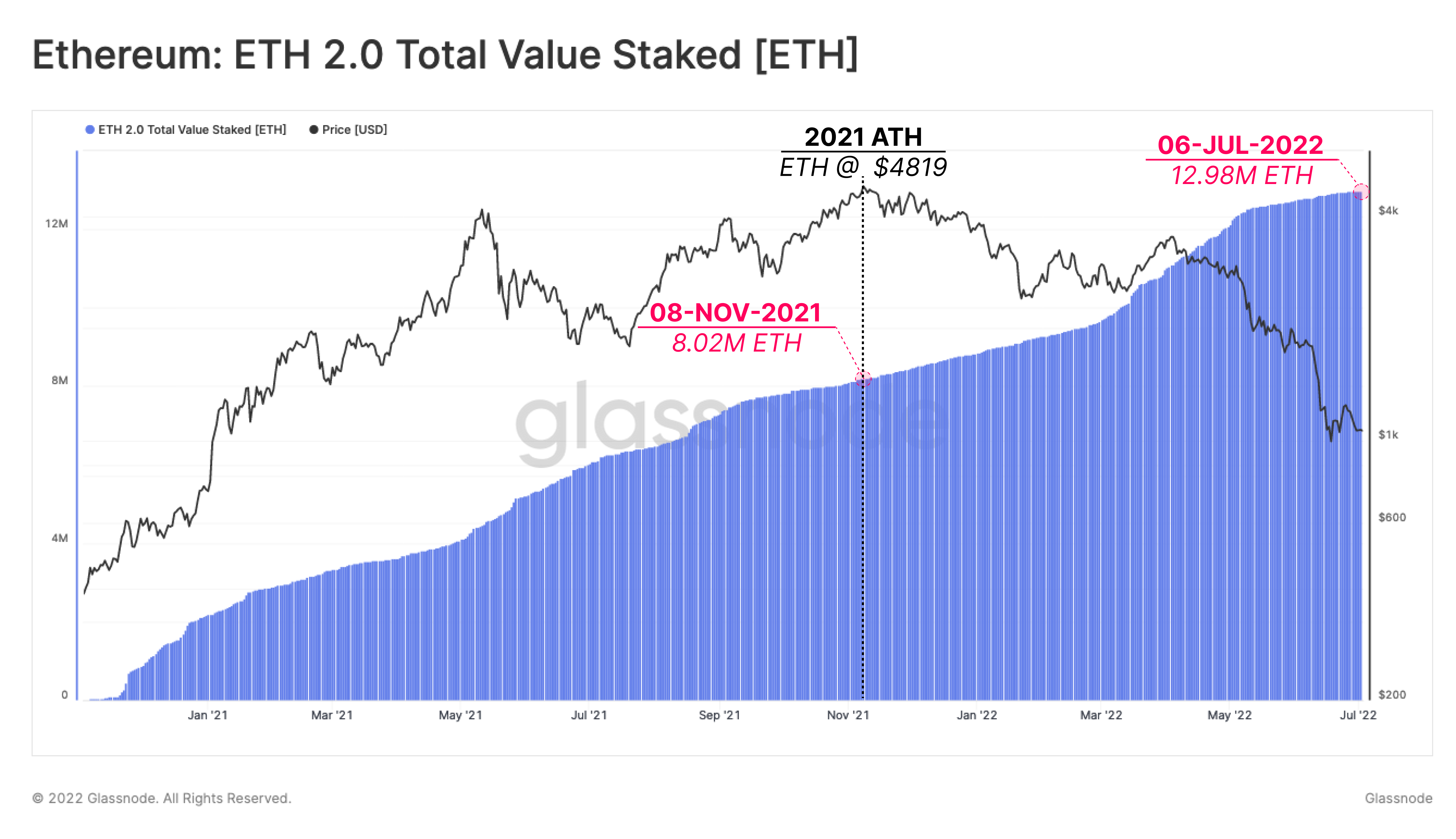

At length, investors have locked just a little over 13 million ETH in to the so-known as Ethereum 2. smart contract because it went reside in December 2020. However, there’s no date when these investors can redeem their tokens plus the 10% yield.

Interestingly, around 62% of Ether tokens were deposited prior to the cost peaked around $4,930 in November 2021. Meanwhile, another 38% were deposited following the record high, according to Glassnode’s latest report.

Consequently, the entire value locked within the Ethereum 2. smart contract peaked at $39.7 billion in November 2021, brought by 263,918 network validators. However, the worth has dropped to $14.85 billion by This summer 7, despite yet another inflow of 5 million ETH within the last eight several weeks.

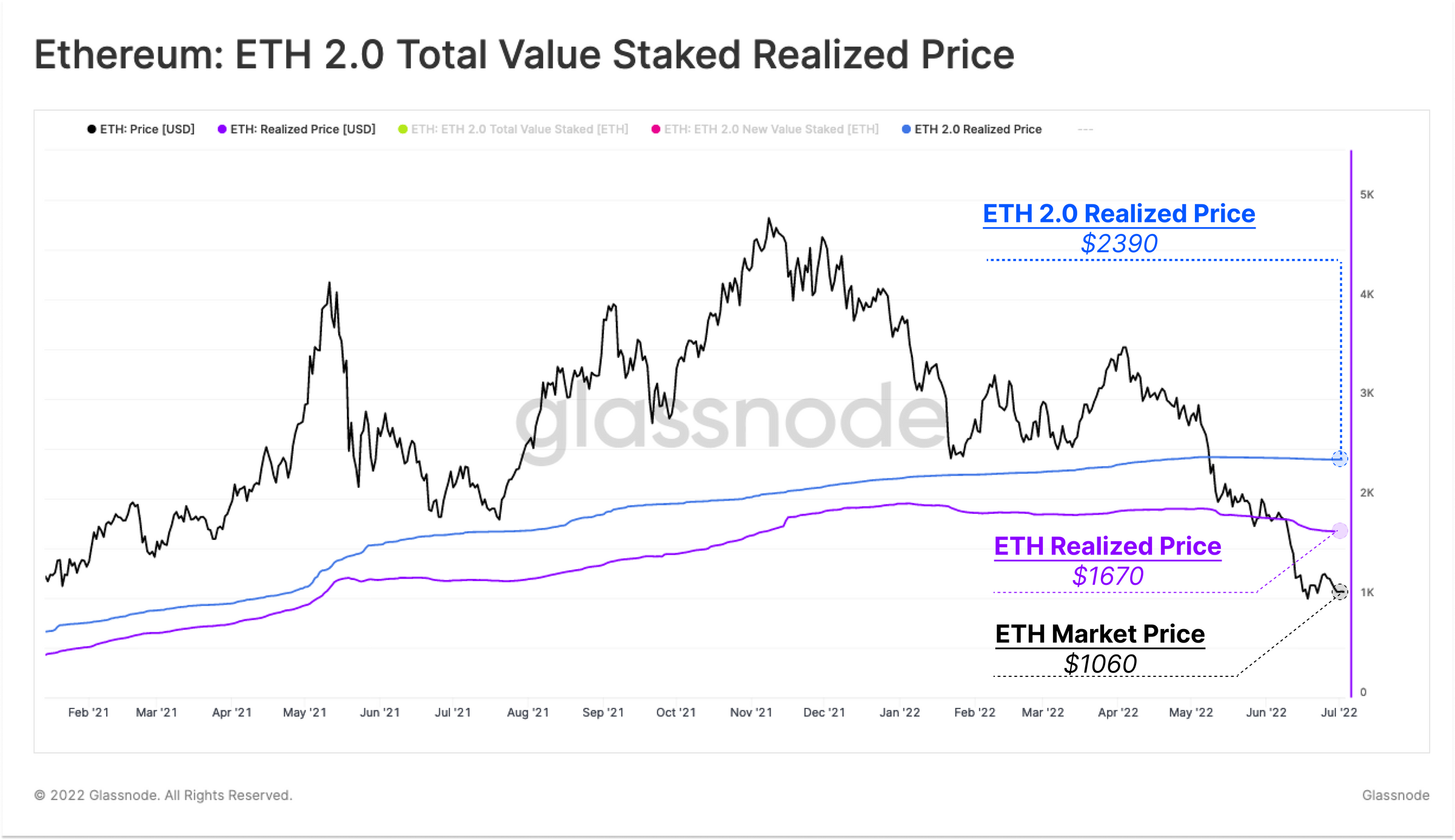

Ethereum 2. stakers deposited ETH towards the network’s PoS contract in an average cost of $2,390. So, ETH stakers are actually holding a typical lack of 55% because of ETH’s 75% crash since November 2021, Glassnode noted.

Excerpts from the report:

“When we match it up towards the Recognized Cost for the whole ETH supply, 2. stakers are presently shouldering 36.5% bigger losses when compared to general Ethereum market.”

Possible bullish and bearish scenarios

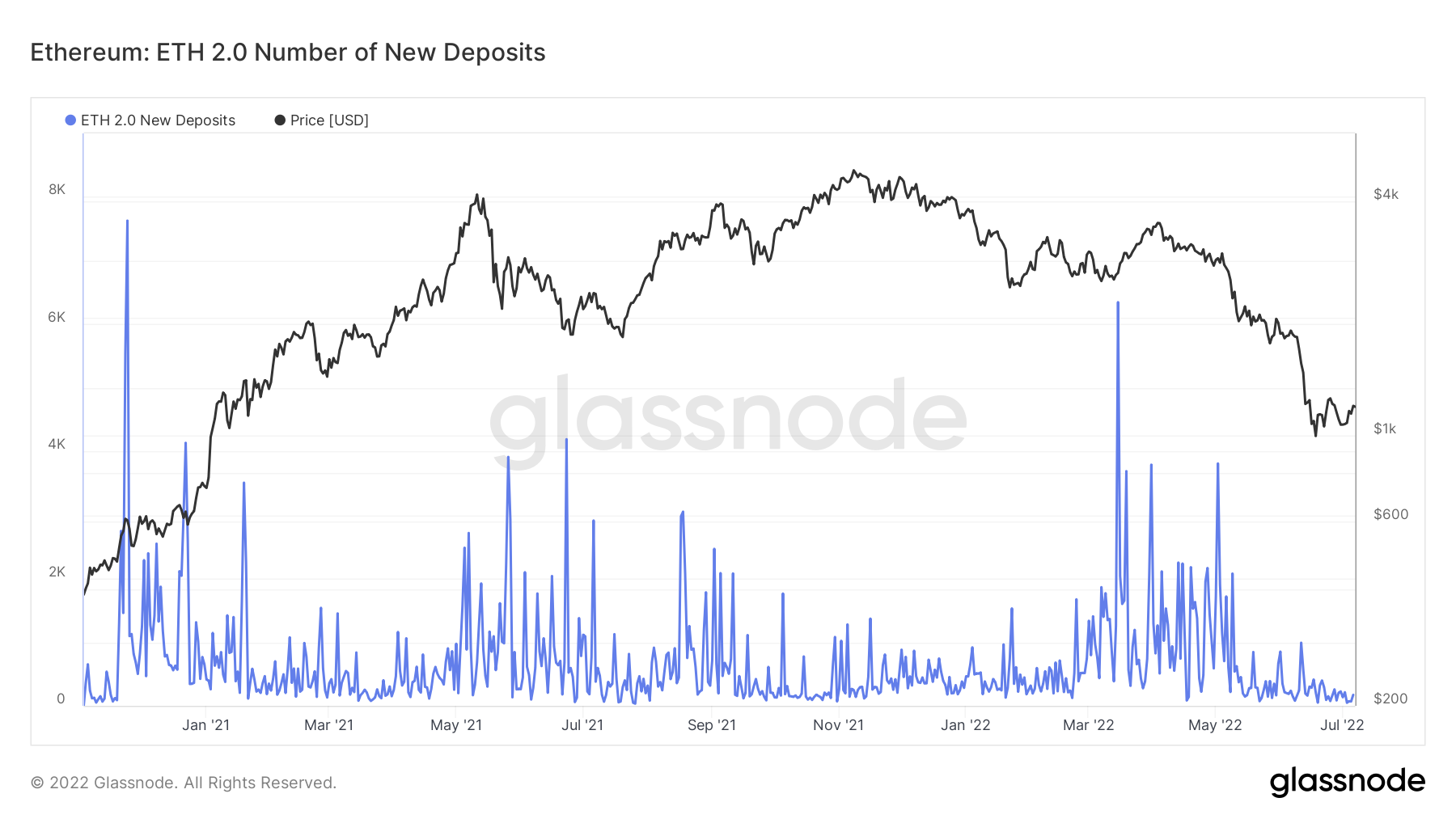

Ether’s bear market has additionally affected Ethereum 2. contract inflows.

Particularly, the weekly average of 32 ETH deposits in to the Ethereum 2. contract has fallen to 122 each day compared to 500 to at least one,000 each day in 2021. This means investors’ desire not to lock their ETH holdings away among a bear market.

Theoretically speaking, investors’ fears appear to become legitimate.

Ether risks having a major breakdown in Q3/2022 since it’s been painting a vintage continuation pattern known as the climbing triangular, as highlighted within the chart below. Therefore, ETH’s cost could decline to almost $800, almost 32% less than This summer 7’s cost.

On the other hand, Ethereum’s change to PoS is nearly near after a effective trial on This summer 6, as Cointelegraph covered. That may have ETH hold above its interim support close to $1,070, as proven within the chart below.

Along with an “oversold” relative strength index (RSI) studying (below 30), ETH could rebound toward its 200-week exponential moving average (EMA) (nowhere wave) near $1,600. That will mark a 35%-plus rally from Jul’s cost.

Related: Exactly what does a bear-market ‘cleanse’ really mean?

An identical setup seems within the ETH/BTC instrument, which tracks Ether’s strength against Bitcoin (BTC). Ethereum’s effective change to PoS might have ETH hold above .057 BTC, adopted with a move upside toward .06 BTC, based on Fibonacci retracement graph levels proven below.

Meanwhile, macro risks remain the primary danger for ETH cost namely, the Federal Reserve’s potential 75 basis point rate hike in This summer.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.