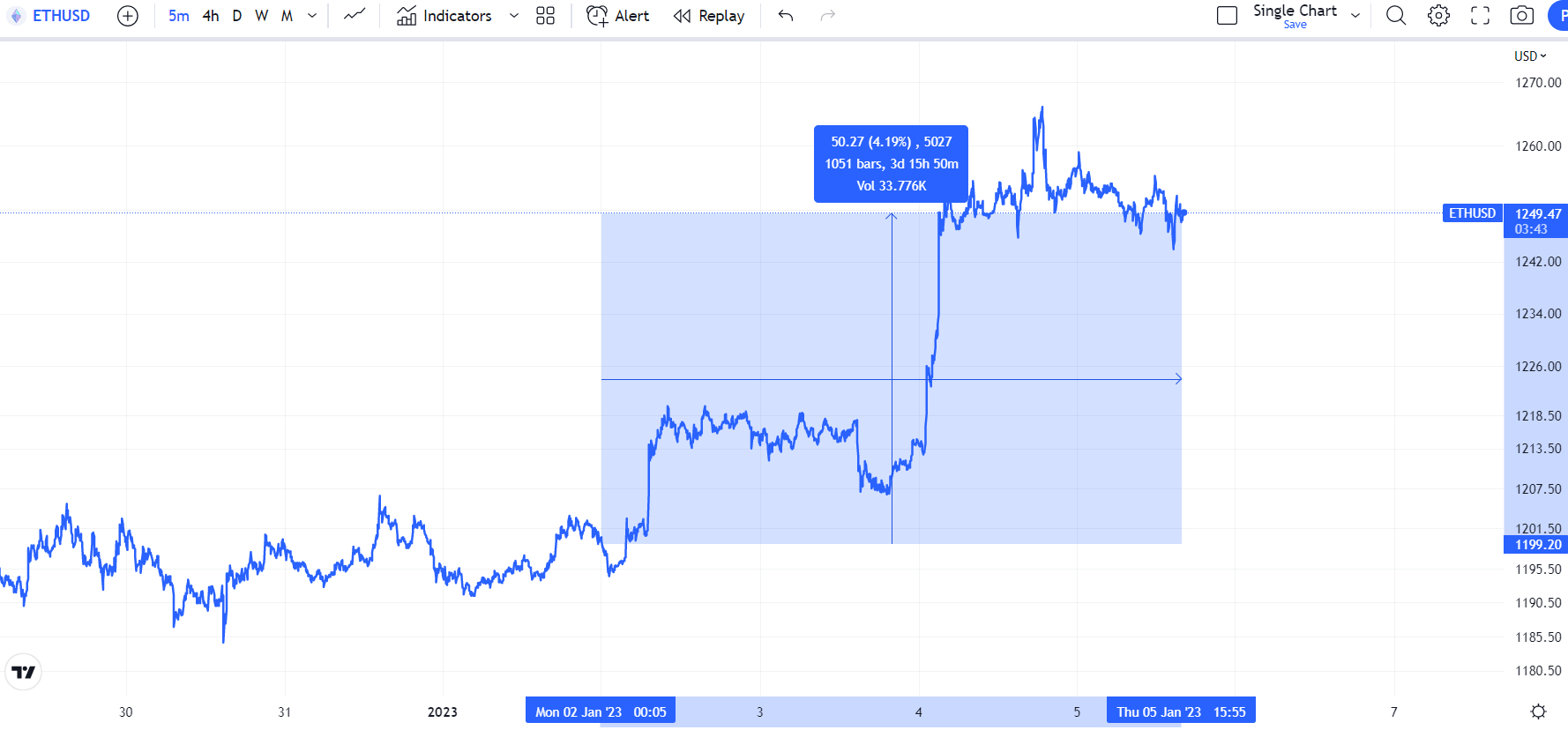

ETH, the native cryptocurrency that forces the smart contract-enabled decentralized Ethereum blockchain, is consolidating on Thursday close to the $1,250 mark after posting decent gains within the first couple of times of now. Indeed, despite now getting pulled near to 2% lower versus Wednesday’s highs within the $1,270 area, ETH continues to be up about 4.% now, after mustering a clear upside break of each of its 21 and 50-Day Moving Averages on Wednesday.

In wake from the recent push greater, which appears to possess been more technically driven among too little any notable Ethereum-specific catalysts, short-term cost predictions have grown to be more bullish. However, macro headwinds might be a problem for that bulls, with Given officials (in speeches and via Wednesday meeting minutes release) sounding hawkish and US labor market data (to date) arriving strong.

Cost Conjecture – Where Next For ETH?

So perhaps Given tightening bets could push ETH back towards where it began a few days within the $1,200 area. But among an optimistic technical picture, a retest of those levels could attract substantial buying interest. After breaking from a medium-term downtrend the 2009 week, ETH bulls are targeting an eventual test from the December highs within the $1,340 area, in addition to a potential test from the 200DMA at $1,390.

However, whether ETH could press on beyond these levels is yet another factor. The cryptocurrency remains locked inside a downward trend funnel that’s been in play since This summer 2022. And continuing headwinds towards the broader crypto sector because of a still very hawkish Given and weakening US economy advise a big break greater may not be imminent within the coming days of several weeks.

How High Can ETH Use 2023?

That being stated, many do expect macro headwinds to help ease later this season. Many economists expect US inflation to carry on its rapid drop back for the Fed’s 2.% target which should eventually provide the US central bank room to start cutting rates of interest to aid growth, also is likely to weaken substantially. This could cause an extensive pumping of risk assets. ETH bulls will cling to the hope the world’s second-largest cryptocurrency by market capital can return to its pre-“merge” highs within the $2000 area from last August.

Ethereum Upgrades also to Boost ETH?

Apart from potential macro tailwinds that may lift Ethereum this season, the Ethereum blockchain protocol may also be undergoing numerous key changes/upgrades that may also bolster investor appetite. The very first major upgrade would be the so-known as “Shanghai” hard fork, that is scheduled for March.

The primary advantage of this tough fork is going to be that ETH network validators will ultimately have the ability to withdraw the ETH they have staked to be able to secure the network. Analysts believe that by enabling staked ETH withdrawals, more investors is going to be attracted towards ETH staking, which normally yields somewhere around 4-5%. This might substantially boost interest in the cryptocurrency, some predict.

Ethereum developers also are hoping to make progress on making the Ethereum blockchain more scalable via “sharding” – this really is basically in which the Ethereum network is split up into multiple parallel blockchains (shards), letting it process more data and transactions. Developers have tentatively scheduled a sharding upgrade for that fall.

Altcoins to think about

Using the broader cryptocurrency market still battling at the begining of 2023, traders/investors may be searching to diversify their holdings with assets that stand an improved chance of posting short-term gains. This is a listing of a number of Cryptonews.com’s favorite presale tokens of highly promising crypto projects.

Fight Out (FGHT) – Presale Launches

Fight Out, a brandname-new move-to-earn (M2E) fitness application and gym chain that seeks to create the fitness lifestyle into web3, has opened up its pre-purchase and investors think the work could transform the present web3 M2E landscape. While existing M2E applications for example STEPN only track steps and wish costly non-fungible token (NFT) buy-ins to participate, Fight Out requires a more holistic method of tracking and rewarding its users for his or her exercise and activity, and doesn’t require any costly buy-ins to participate.

Fight Out’s FGHT tokens are presently selling for 60.06 per 1 USDT, and interested investors ought to move fast to secure their tokens, using the pre-purchase getting already elevated over $2.sixty five million in a couple of days. FGHT may be the token which will power the battle Out crypto ecosystem.

Dash 2 Trade (D2T) – Presale Enters Final Stage

Individuals thinking about buying a promising crypto buying and selling platform start-up should take a look at Dash 2 Trade. The up-and-coming analytics and social buying and selling platform hopes to accept crypto buying and selling space by storm using its host of improvements.

Included in this are buying and selling signals, social sentiment as well as on-chain indicators, a pre-purchase token scoring system, an expression listing alert system along with a strategy back-testing tool. Dash 2 Trade’s ecosystem is going to be operated by the D2T token, which users will have to buy and hold to be able to connect to the platform’s features.

Dash 2 Trade’s pre-purchase has really now offered out but, fortunately, because of massive investor demand, the work continues to be selling tokens to investors. Sales just surpassed $13.seven million and also the pre-purchase dashboard will probably be released soon, using the team of developers presently running in front of schedule. Tokens are presently selling for $.0533 each and will also be for auction on multiple centralized exchanges beginning this month.

C+Charge (CCHG) – Presale Now On

The carbon credit market is forecasted to become worth $2.4 trillion by 2027. Democratizing use of accrue these benefits will massive business within the years ahead which is something crypto start-up C+Charge wishes to achieve. C+Charge is presently creating a blockchain-based Peer-to-Peer (P2P) payment system for EV charging stations that will permit the motorists of electrical vehicles (EVs) to earn carbon credits.

C+Charge aims to improve the function of carbon credits like a key incentive for that adoption of EVs. At the moment, large manufacturers of EVs like Tesla earn millions from selling carbon credits to polluters. C+Charge really wants to democratize the carbon credit market by permitting greater number of these rewards to locate themselves at the disposal of the EV proprietors, as opposed to just the large companies.

C+Charge just began its pre-purchase from the CCHG token that it is platform uses to pay for at EV charging stations. Tokens are presently selling for $.013 each, though through the finish from the presale, this can have risen by 80%. The work has elevated near to $78,000 in a couple of days. Thus, investors thinking about getting into in early stages an encouraging eco-friendly cryptocurrency project should move fast.