Ethereum (ETH), the cryptocurrency that forces the smart-contract-enabled Ethereum blockchain network, has mounted a good recovery on Thursday together having a more risk-friendly tone to exchange traditional asset classes (US stocks are up and also the US dollar is lower).

ETH/USD was last altering hands within the $1,250 area, up .75% within the last 24 hrs, and it is up a couple of.5% versus weekly lows within the $1,220 area.

However, ETH continues to be buying and selling lower by about 4.5% versus its early weekly highs just above $1,300. Ether bulls have battled to reclaim control because the abrupt collapse of major cryptocurrency exchange FTX roughly 30 days ago. Before the exchange’s implosion, ETH continues to be buying and selling within the $1,500-$1,600 area. Because the collapse, rallies to $1,300 have constantly been offered through the market.

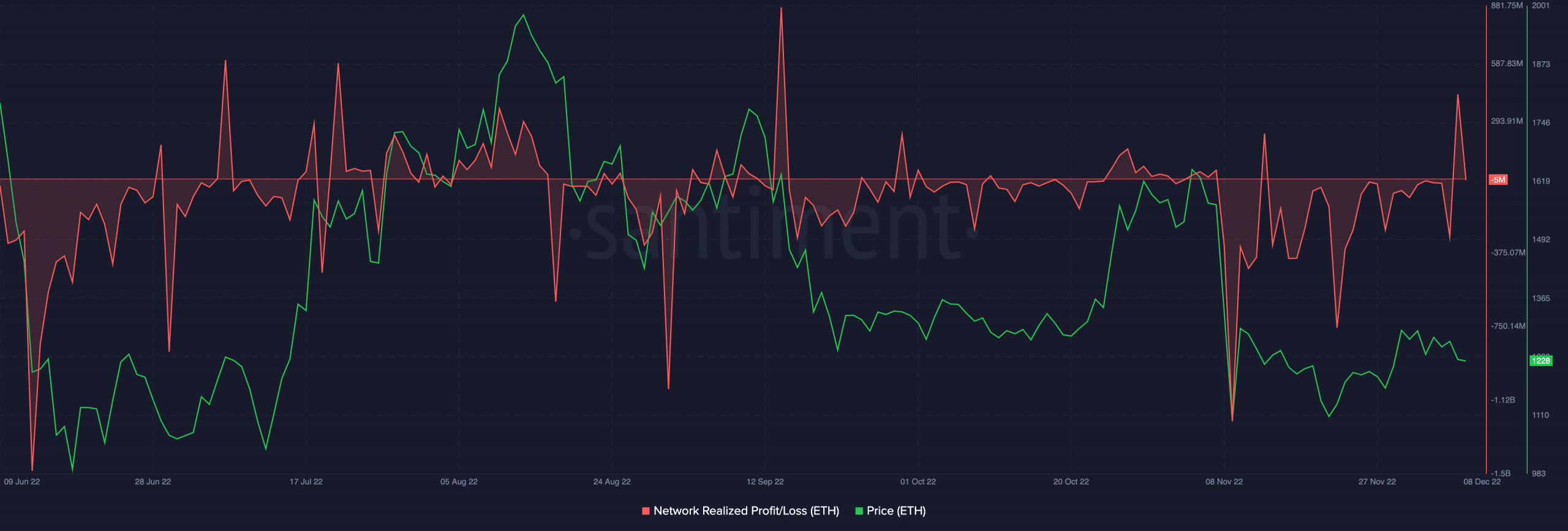

Data from crypto analytics firm Santiment concerning the recognized profit-and-lack of ETH tokens moving forward the Ethereum network show an increase in traders selling baffled in wake from the FTX collapse. Selling from so-known as “weak hands” could still weigh on ETH’s cost soon.

Cost Conjecture – Recovery to $1,300 Around The Cards?

Searching at ETH cost more than a shorter time horizon, the cryptocurrency seems to become heading lower in a bearish flag. ETH is presently testing top of the bounds of the flag structure, however, and appears as if it might break greater towards $1,300 once more.

An additional recovery in US stock markets and additional weakness in america dollar because the finish each week approaches, possibly aided if Friday’s US inflation figures are available in softer-than-forecast, might be only the catalyst the Ethereum bulls need. Technical buying also may help in wake of ETH getting lately found support at its 21-Day Moving Average and also the 23.6% Fibonacci retracement level in the publish-FTX collapse lows under $1,100 to the pre-FTX collapse highs within the $1,600s.

Lengthy-term Bearish ETH Headwinds Remain Dominant

An ETH recovery to $1,300, or even a break above this level, won’t do much to alter the cryptocurrency’s longer-term technical outlook, which remains bearish. Indeed, ETH remains locked inside a downtrend that’s been in play since summer time 2020 and appears ultimately prone to cap any near-term ETH upside.

For ETH to get away from the present bear trend, it will have to muster a sustained break to northern the $1,500 area, an additional 20% up from current levels. To obtain here, ETH will have to get most importantly of their 50, 100 and 200DMAs. Most longer-term bears will probably remain positive about their technique of selling significant short-term ETH rallies.

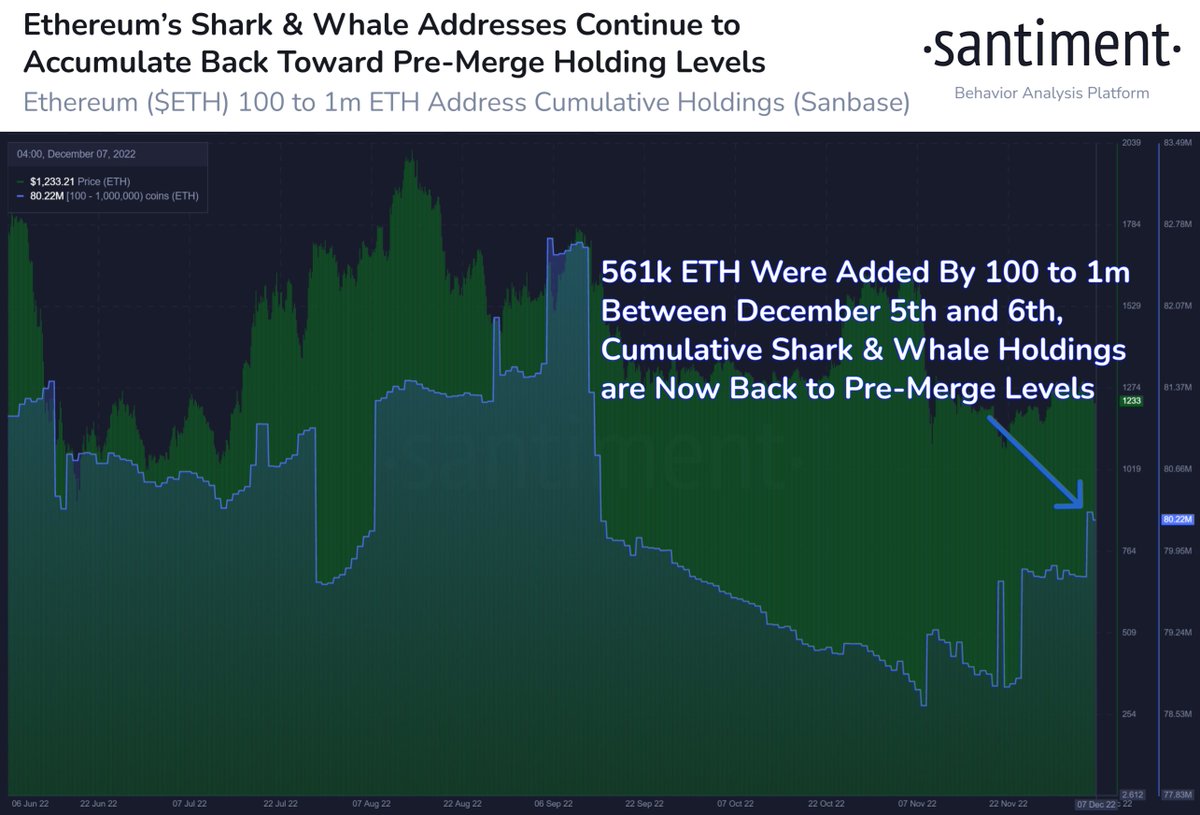

Ethereum Whales Keep Accumulating

While longer-term cost speculators may be bearish, on-chain data implies that whale HODLers remain positive about the ETH’s lengthy-term prospects. Based on Santiment, Ethereum wallets that hold between 100 and a million ETH tokens added a collective 561K ETH tokens between your 5th and 6th of December. Which brings the holdings of so-known as Ethereum “sharks and whales” to the greatest levels since prior to the Ethereum merge at the begining of September.

Altcoins Offering Faster Returns

Cryptocurrencies happen to be buying and selling sideways for any couple of days now, leading some traders to begin searching at alternatives with increased potential for the short term. The following are the leading presales on the market, allowing investors to obtain the floor floor.

Dash 2 Trade (D2T)

Individuals thinking about buying a promising crypto buying and selling platform start-up should take a look at Dash 2 Trade. The up-and-coming analytics and social buying and selling platform hopes to accept crypto buying and selling space by storm using its host of improvements.

Included in this are buying and selling signals, social sentiment as well as on-chain indicators, a pre-purchase token scoring system, an expression listing alert system along with a strategy back-testing tool. Dash 2 Trade’s ecosystem is going to be operated by the D2T token, which users will have to buy and hold to be able to connect to the platform’s features.

Dash 2 Trade is presently performing an expression pre-purchase at highly discounted rates. D2T token sales lately surpassed $9.055 million. The purchase has joined its 4th and final phase and purchasers continue to be going strong, with $400K arriving within the last 24 hrs. The pre-purchase dashboard will probably be released soon, using the team of developers presently running in front of schedule. Token are presently selling for $.0533 each, which observers are calling highly discounted.

Dash 2 Trade was lately listed because the third-best presale token of 2022 by CoinCodex.

IMPT

Among the development in recognition recently of eco and socially friendly investments, investors searching for any eco-friendly cryptocurrency should think about the IMPT token. IMPT.io has partnered with a large number of the world’s largest retailers to assist offset their carbon footprints and enables users to trade carbon credits around the blockchain.

IMPT tokens are presently within their second stage from the presale with IMPT getting elevated over $15.six million. That comes down to $a million in token sales in only the final 24 hrs. Investors have only another 72 hours to buy tokens in the current discounted cost of $.023. IMPT token exchange listings come from a couple of days.

IMPT was lately listed because the best presale token of 2022 by CoinCodex.

Calvaria (RIA)

Major blockchain-based games like Axie Infinity lost significant traction in 2022. Consequently, many investors thinking about the crypto gaming space are searching for alternative avenues. Calvaria, an up-and-coming play-to-earn fight card crypto game, might be a good option. Calvaria seeks to improve crypto adoption by developing a bridge between your real life and crypto, an enjoyable and accessible crypto game.

Investors should think about Calvaria’s RIA token pre-purchase. Calvaria has elevated $2.36 million, having a crypto whale scooping up $97.5K in a single purchase on Thursday. The presale is incorporated in the final stage, with simply 24% of tokens left.