Ether’s (ETH) performance in the last three several weeks continues to be under satisfying for holders and also the 50% correction since April 3 caused the altcoin to check the $1,800 support the very first time since This summer 2021.

Because of the volatility in stocks, investors have been seeking shelter within the U . s . States dollar as well as on May 13, the DXY index arrived at its greatest level in twenty years. DXY measures the USD against a gift basket of major foreign currency, such as the British pound (GBP), the euro (EUR) and also the Japanese yen (JPY).

Furthermore, the 5-year U.S. Treasury yield arrived at its greatest level since August 2018, buying and selling at 3.10% on May 9 and signaling that investors demand bigger returns to pay for inflation. The bottom line is, macroeconomic data reflects risk-averse sentiment from investors which partly explains Ether’s downturn.

Further creating panic among Ether traders would be a seven-block chain reorg on Ethereum’s Beacon Chain on May 25. A legitimate transaction sequence was pushed off the chain as a result of competing block getting good support from network participants. Fortunately, this case isn’t uncommon also it may have emerged from the miner rich in sources or perhaps a bug.

The primary victims of Ether’s 11% cost correction were leverage traders (longs) who saw $160 million in aggregate liquidations at derivatives exchanges, according to data from Coinglass.

Bulls placed their bets at $2,100 and greater

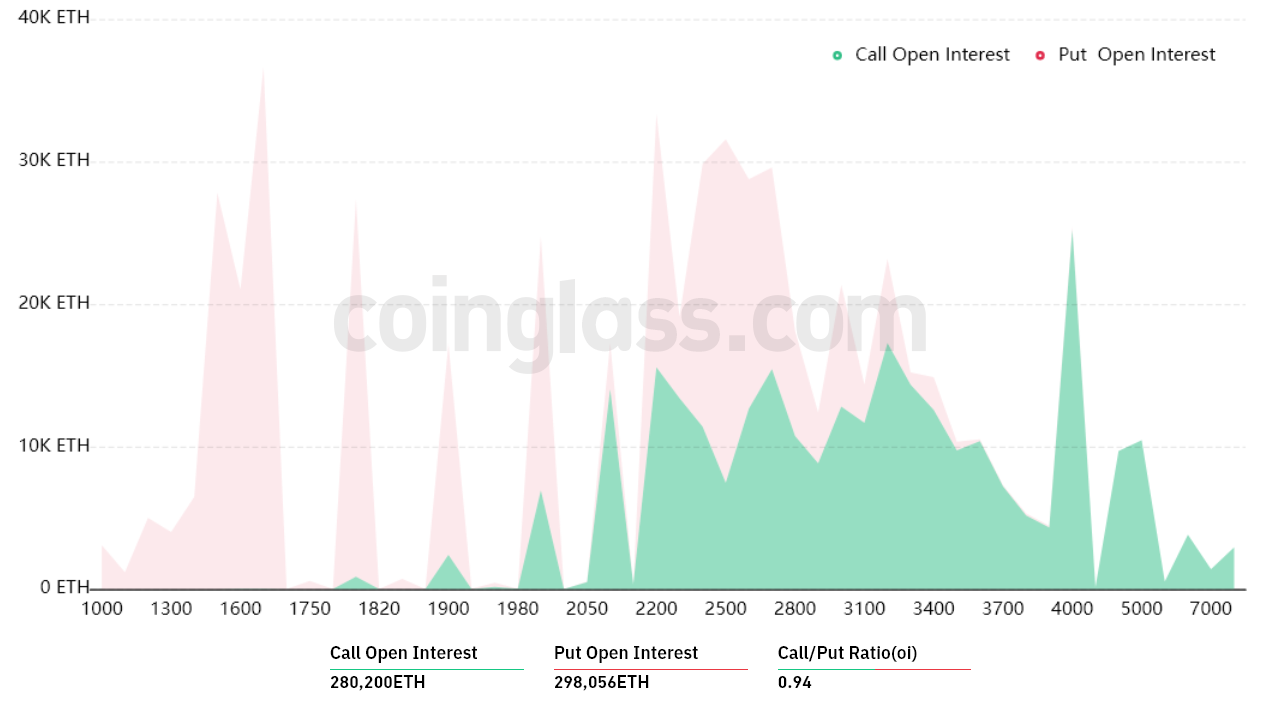

Outdoors interest for that Ether’s May monthly options expiry is $1.04 billion, however the actual figure is going to be reduced since bulls were excessively-positive. These traders may have been fooled through the short-resided pump to $2,950 on May 4 as their bets for that May 27 options expiry extend beyond $3,000.

The drop below $1,800 required bulls unexpectedly because virtually no call (buy) choices for May 27 happen to be placed below that cost level.

The .94 call-to-put ratio shows the slight dominance from the $540 million put (sell) open interest from the $505 million call (buy) options. Nonetheless, as Ether stands near $1,800, every bullish bet will probably become useless.

If Ether’s cost remains below $1,800 at 8:00 am UTC on May 27, no $505 million call options is going to be available. This difference is really because the right to purchase Ether at $1,800 or greater is useless if Ether trades below that much cla on expiry.

Bears strive for a $325 million profit

Here are the 3 probably scenarios in line with the current cost action. The amount of options contracts on May 27 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $1,600 and $1,700: calls versus. 230,000 puts. The internet result favors the put (bear) instruments by $370 million.

- Between $1,700 and $1,800: 50 calls versus. 192,300 puts. The internet result favors bears by $325 million.

- Between $1,800 and $2,000: 3,300 calls versus. 150,000 puts. The internet result favors the put (bear) instruments by $280 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For example, an investor might have offered a put option, effectively gaining positive contact with Ether over a specific cost, but regrettably, there is no good way to estimate this effect.

Bulls should toss the towel and concentrate on the June expiry

Ether bears have to sustain the cost below $1,800 on May 27 to have a $325 million profit. However, the bulls’ best situation scenario needs a push above $1,800 to lessen the harm by $45 million.

Ether bulls had $160 million leverage lengthy positions liquidated on May 26, so that they must have less margin they are driving the cost greater. With this particular stated, bears will unquestionably attempt to suppress Ether below $1,800 in front of the May 27 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.