Ethereum’s native token Ether (ETH) joined its “oversold” territory this June 12, the very first time since November 2018, based on its weekly relative strength index (RSI).

This is actually the before $ETH went oversold around the weekly (hasn’t confirmed here yet).

I’d no supporters, but macro bottom ticked it.

Note, you are able to push way lower on weekly rsi, not attempting to catch a bottom. https://t.co/kLCynTKTcS

— The Wolf Of Roads (@scottmelker) June 12, 2022

ETH eyes oversold bounce

Traditional analysts consider a good thing to become excessively offered after its RSI studying fall below 30. In addition, additionally they begin to see the drop being an chance to purchase the dip, believing an oversold signal would result in a trend reversal.

Ether’s previous oversold studying made an appearance within the week ending on November. 12, 2018, which preceded a roughly 400% cost rally, as proven below.

While past performances aren’t indicators of future trends, the most recent RSI’s move below 30 raises the potential of Ether having a similar—if no equally sharp—upside retracement later on.

Suppose ETH logs an oversold bounce. Then, the ETH/USD pair’s immediate challenge is always to reclaim its 200-week exponential moving average (200-week EMA nowhere wave) near $1,620 since it’s support.

Whether it does, bulls could eye a long upside move toward the 50-week EMA (the red wave) above $2,700, up almost 100% in the cost of June 12.

Otherwise, Ether could resume its downtrend, with $1,120 becoming the following target, an amount coinciding using the token’s .782 Fib line, as proven within the chart below.

Macro headwinds along with a $650 Ether cost target

The RSI-based bullish outlook seems against a flurry of bearish headwinds, varying from persistently greater inflation to some classic technical indicator having a downward bias.

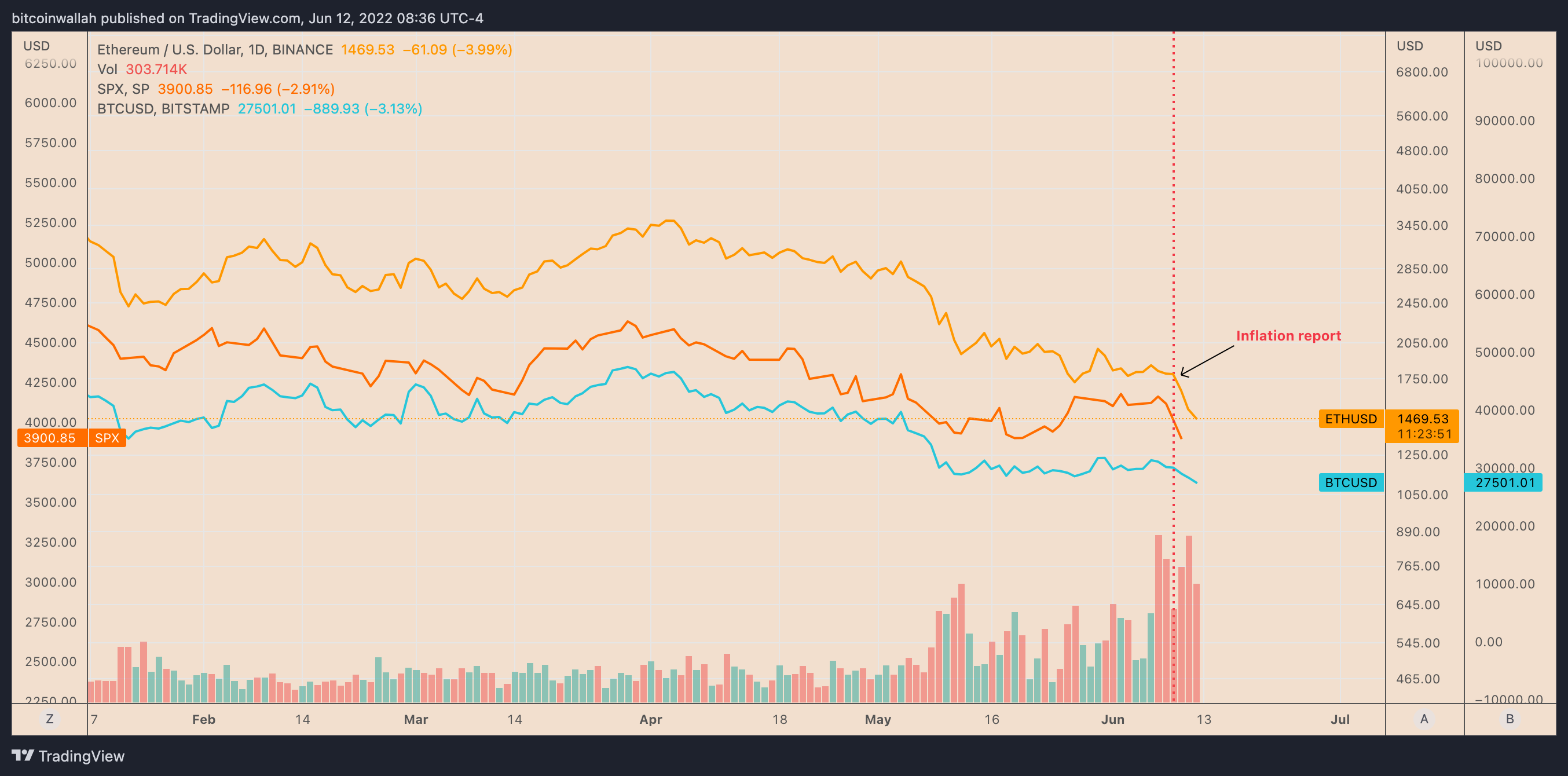

At length, Ether’s cost declined by greater than 20% within the last six days, with many losses coming after June 10, once the U . s . States Labor Department reported the inflation arrived at 8.6% in May, the greatest since December 1981.

Related: The entire crypto market cap drops under $1.2T, but data show traders are less inclined to market

The greater consumer cost index (CPI) strengthened fears among investors it would pressure the Fed to hike rates of interest more strongly while slashing its $9 trillion balance sheet. That dampened appetite for riskier assets, hurting stocks, Bitcoin (BTC) and ETH.

Independent analyst Vince Prince fears the most recent ETH decline could extend before the cost reaches $650. Fundamentally of his downside target is really a massive mind and shoulders — a vintage bearish reversal pattern by having an 85% rate of success in meeting its profit target, according to Samurai Buying and selling Academy.

The huge mind-and-shoulder formation forecasted earlier for #Ethereum has been completely confirmed…

… $ETH has become headed for the $650 USDT area!!! pic.twitter.com/R2KaqiorEd

— Vince Prince (@Vince_Prince_) June 12, 2022

Meanwhile, Glassnode’s add-chain analyst, known through the pseudonym Checkmate, highlighted a possible decentralized finance (DeFi) disaster that may crash Ether’s cost further into 2022.

The analyst noted the ratio between Ethereum’s and also the top three stablecoins’ market capital increased to 80% on June 11.

Ratio has become at 80%

Market Cap of:#Ethereum = $181.58B

Best Three Stablecoins = $144.28B

TVL in DeFi = $101.67B$ETH at $1215 creates equal Ethereum and Best Three stablecoin market caps.The key risk here’s levered $ETH collateral in DeFi loans getting liquidated inside a cascade https://t.co/26u0vXnMMY pic.twitter.com/q555clRaap

— _Checkɱate ⚡ (@_Checkmatey_) June 12, 2022

Since “most people borrow stablecoins” by supplying ETH as collateral, the potential for the Ethereum network becoming less valuable compared to a premium price-pegged tokens will make the debt’s value greater compared to collateral itself.

Checkmate noted:

“There is nuance as not every stablecoins are lent, as well as not every one is ON ethereum. But nonetheless, the chance of liquidations [is] a hell of the lot greater of computer was three several weeks ago.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.