Ethereum’s native token, Ether (ETH), looks prepared to undergo an enormous rally as a result of mixture of technical and fundamental factors.

Theoretically speaking, ETH’s cost now eyes a 35% rebound through the finish of October after holding testing a vital support level. This level is really a rising trendline which has capped Ether’s downside attempts since June 2022, as proven below.

Quite simply, traders have proven curiosity about buying Ethereum tokens near this level in recent days. Meanwhile, the buildup sentiment has motivated the cost to increase toward another critical level — a horizontal trendline resistance near $1,800, about 35% over the current cost.

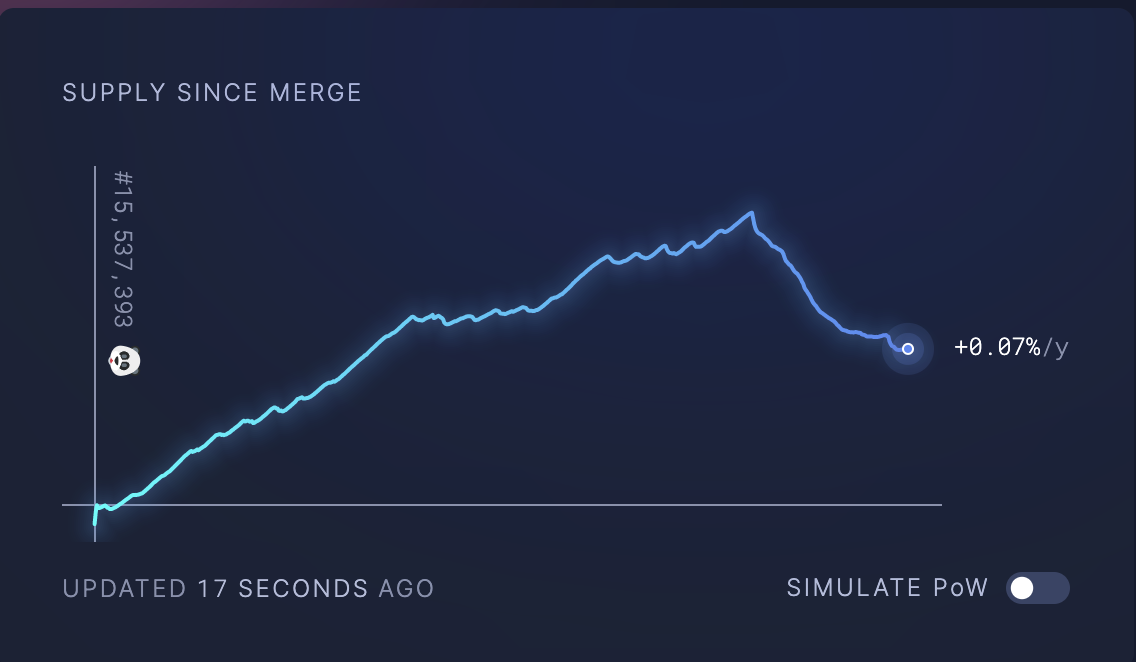

Ether supply drops by 6K ETH

The bullish technical outlook for Ether takes further take cues from the depleting supply in recent days.

Ether supply has came by nearly 6,000 ETH, or around $7.9 million, since March. 8. That marks the Ethereum network’s first deflationary move — where more ETH has been destroyed than produced — since its switch from proof-of-work (Bang) to proof-of-stake (PoS) via the Merge 30 days ago.

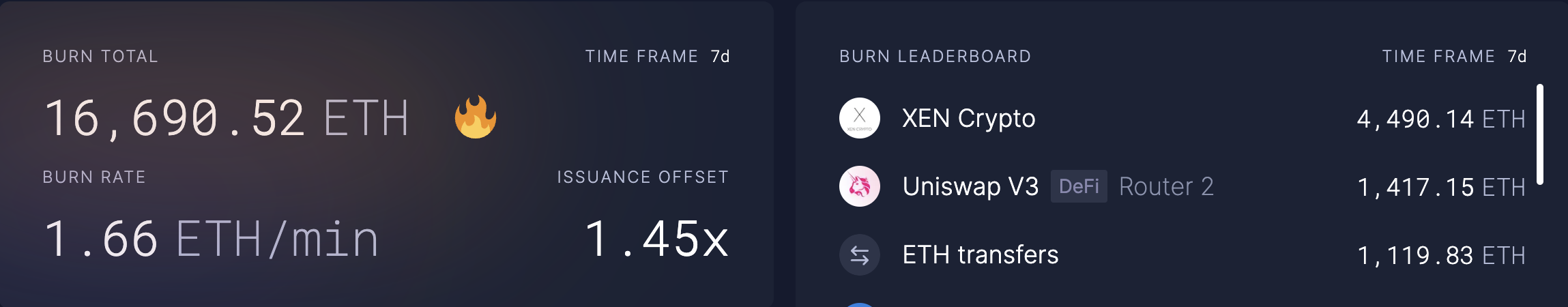

Users be forced to pay so-known as gas charges to validators to verify their on-chain Ethereum transactions. In the past, more Ethereum network traffic led to greater gas charges and much more revenue for validators.

But following the August 2021 EIP-1559 update, part of the gas fee is permanently taken off Ether circulation. To put it simply, more ETH will get burned inside a high-demand atmosphere.

Exactly the same began happening after March. 8, with evidence showing that the new crypto project named XEN Crypto is growing network traffic. Within the last 7 days, XEN Crypto has led to the burning of four,490 ETH tokens against 16,690.52 ETH tokens.

XEN Crypto began over the past weekend without any supply.

Still, it had been liberated to mint, requiring users to simply pay ETH gas charges. Quite simply, a brand new project made Ether deflationary the very first time since Merge, presently comprising over 40% of Ethereum transactions.

XEN has ended 40% of Ethereum Transactions. pic.twitter.com/Y5HO5MLN9U

— XEN Crypto Official (@XEN_Crypto) October 8, 2022

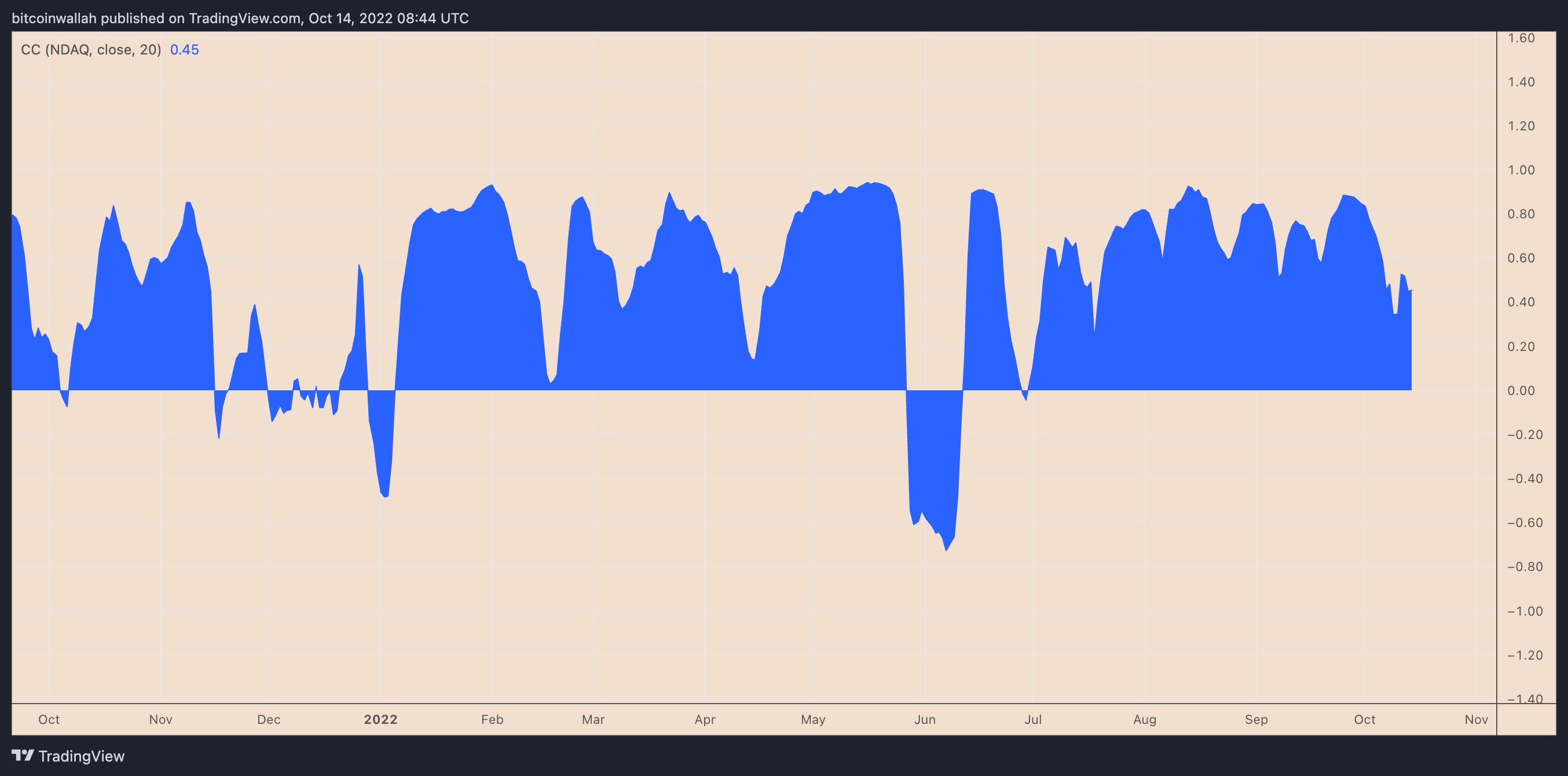

ETH cost lengthy-term outlook remains bearish

Ethereum’s outlook for that lengthy term tilts bearish, nonetheless, because of constant macro warnings brought through the U . s . Condition Federal Reserve’s rate of interest hikes to hot inflation. Ether remains prone to these risks because of its consistently positive correlation with U.S. equities.

Thus, a drop below Ether’s current rising trendline support — as described above — can often mean further declines in case of a technical breakdown, as proven within the chart below.

Climbing Triangles are continuation patterns that resolve following the cost breaks out in direction of its previous trend. In ETH’s situation, the current trend is downward, suggesting the token’s next course is going to be bearish whether it breaks underneath the triangle’s rising trendline support.

Related: Exactly why is the crypto market lower today?

Usually, an climbing triangular breakdown prompts the cost to fall to an amount in a length comparable to the triangle’s height. Therefore, ETH’s profit target involves be near $750, lower roughly 40% from today’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.