Ether (ETH) is battling to keep the $2,000 support by November. 27, following its third unsuccessful attempt in 15 days to exceed the $2,100 mark. This downturn in Ether’s performance may come as the broader cryptocurrency market sentiment deteriorates, thus one should evaluate whether

It’s entirely possible that recent developments, like the U.S. Department of Justice (DOJ) signaling potential severe repercussions for Binance founder Changpeng “CZ” Zhao, have led to the negative outlook.

Inside a filing on November. 22 to some San antonio federal court, U.S. prosecutors searched for an evaluation and turnaround of a judge’s decision permitting CZ to go back to the Uae on the $175-million bond. The DOJ argues that Zhao poses an “unacceptable chance of flight and nonappearance” if permitted to depart the U.S. pending sentencing.

Ethereum DApps and DeFi face new challenges

The current $46 million KyberSwap exploit on November. 23 has further dampened interest in decentralized finance (DeFi) applications on Ethereum. Despite being formerly audited by security experts, together with a couple in 2023, the incident has increased concerns concerning the safety from the overall DeFi industry. Fortunately for investors, the attacker expressed readiness to come back a few of the funds, the event underscored the sector’s vulnerabilities.

Furthermore, investor confidence was shaken with a November. 21 blog publish from Tether, the firm behind the $88.7 billion stablecoin USD Tether (USDT). The publish announced the U.S. Secret Service’s recent integration into its platform and hinted at forthcoming participation in the Fbi.

The possible lack of details within the announcement has brought to speculation a good more and more stringent regulatory landscape for cryptocurrencies, particularly with Binance facing increased scrutiny and Tether’s closer collaboration with government bodies. These 4 elements are most likely adding to Ether’s underperformance, with assorted on-chain and market indicators suggesting a loss of ETH demand.

Investors become careful as ETH on-chain data reflects weakness

Ether exchange-traded products (ETPs) saw merely a $34 million inflow within the last week, based on CoinShares. This figure is really a modest 10% from the inflow seen by equivalent Bitcoin (BTC) crypto funds throughout the same period. Your competition backward and forward assets for place exchange-traded fund (ETF) approval within the U.S. makes this disparity particularly significant.

Furthermore, the present 7-day average annualized yield of four.2% on Ethereum staking is less appealing when compared to 5.25% return provided by traditional fixed-earnings assets. This disparity brought to some significant $349 million output from Ethereum staking in the last week, reported by StakingRewards.

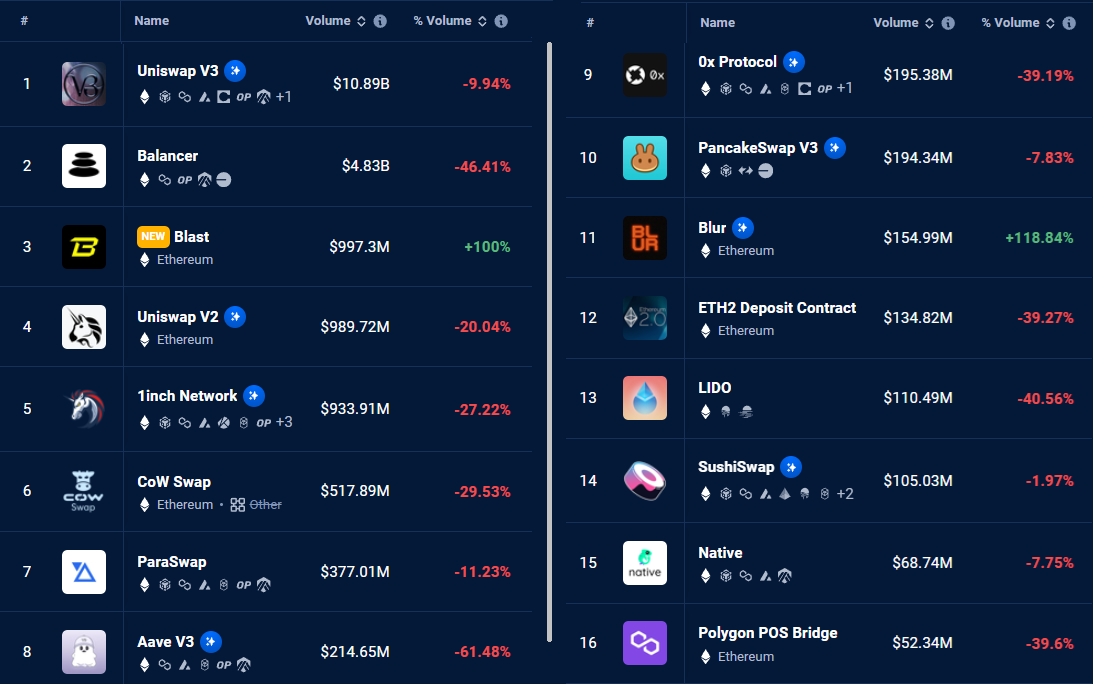

High transaction costs continue being challenging, using the seven-day average transaction fee standing around $7.40. This expense has adversely affected the interest in decentralized applications (DApps), resulting in a 21.8% loss of DApps volume around the network within the last week, according to DappRadar.

Particularly, some Ethereum DeFi applications saw a substantial stop by activity, competing chains like BNB Chain and Solana experienced an 11% increase and stable activity, correspondingly.

Related: Changpeng Zhao might not leave the united states pending court review, states judge

Consequently, Ethereum network protocol charges have decreased for four consecutive days, amounting to $5.4 million on November. 26, over a daily average of $ten million between November. 20 and November. 23, reported by DefiLlama. This trend may potentially produce a negative spiral, driving users towards competing chains looking for better yields.

Ether’s current cost pullback on November. 27 reflects growing concerns over regulatory challenges and also the potential impact of exploits and sanctions on stablecoins utilized in DeFi applications.

The growing participation from the DOJ and FBI with Tether elevates the systemic risk for liquidity pools and also the entire oracle-based prices mechanism. While there is no immediate reason for panic selling or fears of the drop to $1,800, the lackluster demand from institutional investors, as shown by ETP flows, is not an optimistic sign for that market.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.