Ethereum’s native token Ether (ETH) fell to as little as $950 on Uniswap—a decentralized crypto exchange— this June 13, about 20% less than its place rate across other exchanges.

Over $130M ETH offered in six hrs

The incident happened around 3:00 am UTC following a whale dumped 65,000 ETH for multiple “stablecoins,” including USD Gold coin (USDC), Tether (USDT) and Dai (DAI).

A bit of evidence noted the whale offered its ETH holdings to repay nearly $73 million price of debt at Oasis.application, a DeFi lending platform. The time period of the sell-off saw ETH’s liquidation cost shedding from $1,200 to $875.

not really a liquidation, someone selling collateral to repay debthttps://t.co/tceIla0xuF pic.twitter.com/KwIholu1St

— mariano.eth ✨ᕙ༼ຈل͜ຈ༽ᕗ✨ (@nanexcool) June 13, 2022

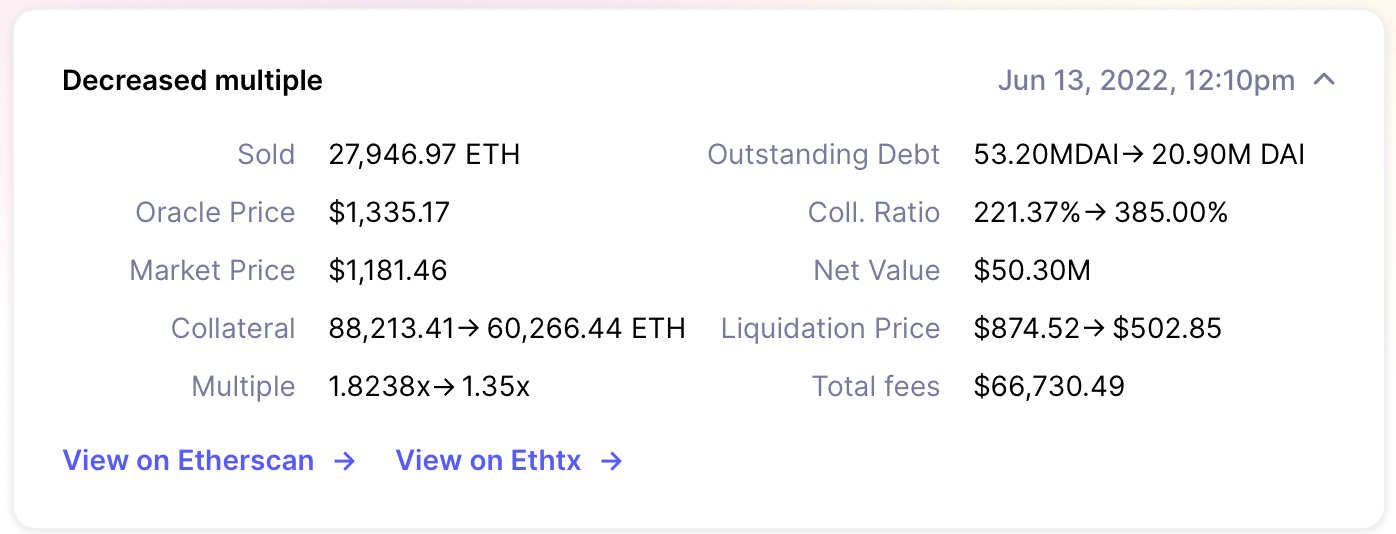

The Oasis customer ongoing the selling spree—dumping another stash of nearly 28,000 ETH five hrs following the first selloff—to repay another $32 million indebted. This time around, the liquidation cost rose from $892 to $1,200, as proven below.

Consequently, the whale dumped around 93,000 ETH in just six hrs. The quantity equals toroughly $112 million at June 13’s ETH/USD cost.

Interestingly, the Oasis borrower’s total outstanding debt involved $120 million (as measured in DAI stablecoin), suggesting that the whale endured heavy “slippage” losses.

wtf… was mtss is a misclick? https://t.co/POURtN4F6s

— Jonathan Howard (@staringispolite) June 13, 2022

Ether cost eyes $667 — veteran analyst

Ether’s visit to $950 was brief, suggesting sufficient interest in the tokens close to the level. Nevertheless, one separate analysis from veteran trader Peter Brandt pointed at ETH’s cost falling toward $650 within the coming days.

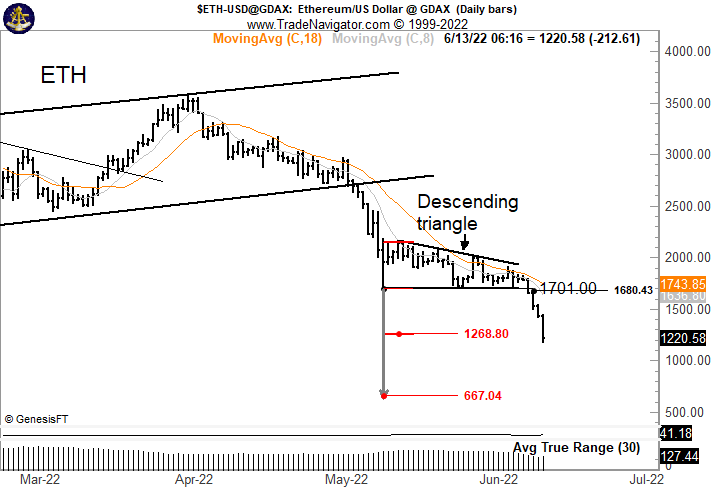

Brandt’s bearish outlook emerged from a vintage continuation pattern, dubbed the “climbing down triangular,” which resolves following the cost breaks out in direction of its previous trend.

Since Ether was falling prior to the triangle’s formation, its road to least resistance was skewed towards the downside.

Brandt states that ETH had arrived at the triangle’s first downside target of $1,268 because the cost declined 20% on June 13. He anticipates the declines to carry on, with ETH shedding almost by another 50% to $667.

Nevertheless, Ether’s oversold relative strength index (RSI) could result in a sharp cost reversal. Ethereum picks additional rebound cues from the 200-week simple moving average (200-week SMA the orange wave within the chart below) near $1,200, now becoming support.

If ETH cost undergoes an upside retracement, then your token’s interim bull target might be near $1,450, coinciding using the 1.00 Fib type of the Fibonacci retracement graph attracted from around $1,450-swing high towards the $84-swing low.

Related: Celsius exodus: $320M in crypto delivered to FTX, user withdrawals stopped

On the other hand, a decisive close underneath the 200-week SMA might have ETH eye $920 since it’s next downside target.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.