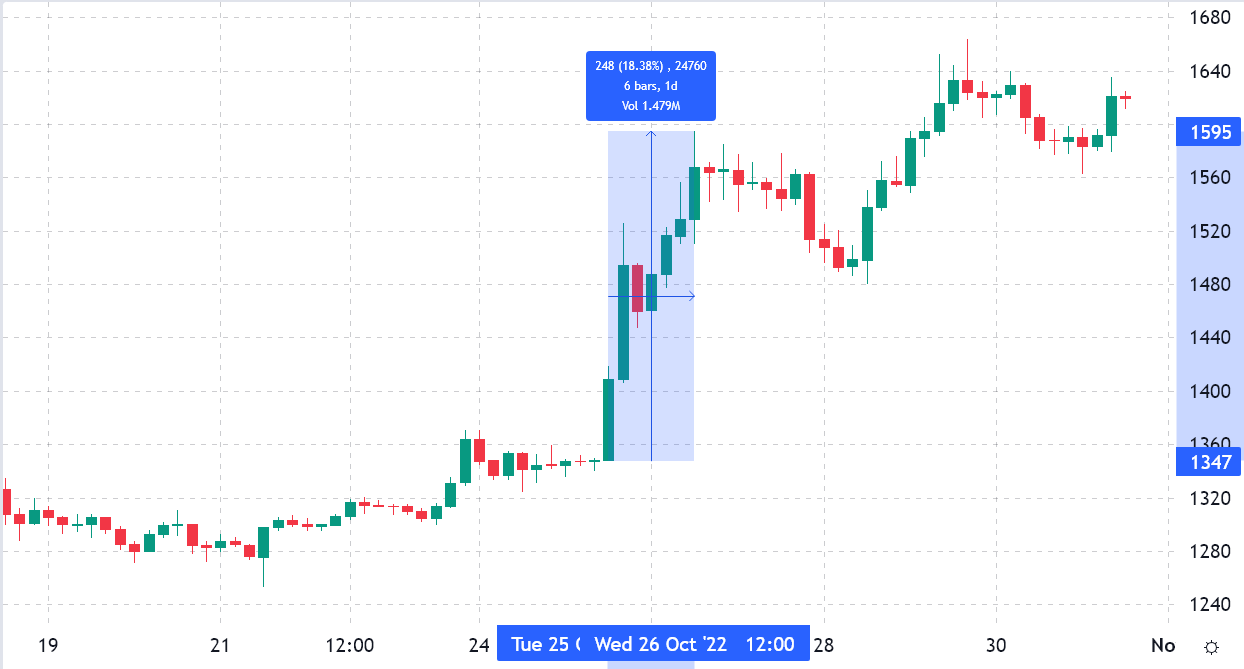

A $250 surprise rally required place between March. 25 and March. 26, pushing the cost of Ether (ETH) from $1,345 to $1,595. The movement caused $570 million in liquidations in Ether’s bearish bets at derivatives exchanges, that was the biggest event in additional than 12 several weeks. Ether’s cost also rallied over the $1,600 level, that was the greatest cost seen since Sept. 15.

Let’s explore whether this 27% rally in the last ten days reflects any indications of a pattern change.

It’s worth highlighting that another 10.3% rally toward $1,650 happened 72 hours afterwards March. 29, which triggered another $270 million of short seller liquidations on ETH futures contracts. As a whole, $840 million price of leveraged shorts was liquidated in 72 hours, representing over 9% from the total ETH futures open interest.

On March. 21, the marketplace grew to become positive after Bay Area Fed President Mary Daly pointed out intentions to step lower the interest rate of great interest rate hikes. However, the U . s . States central bank’s previous tightening movement has brought the S&P 500 stock exchange index to some 19% contraction in 2022.

Regardless of the 5.5% stock exchange rally between March. 20 and March. 31, analysts at ING noted on March. 28 that “we do indeed expect the Given to spread out the doorway to some slower pace through formal forward guidance, but it might not always feel it.” In addition, the ING report added, “It might be that people obtain a final 50bp in Feb that will then mark the very best. This could leave a terminal rate of four.75% to fivePercent.”

Thinking about the conflicting signals from traditional markets, let’s take a look at Ether’s derivatives data to know whether investors happen to be supporting the current cost rally.

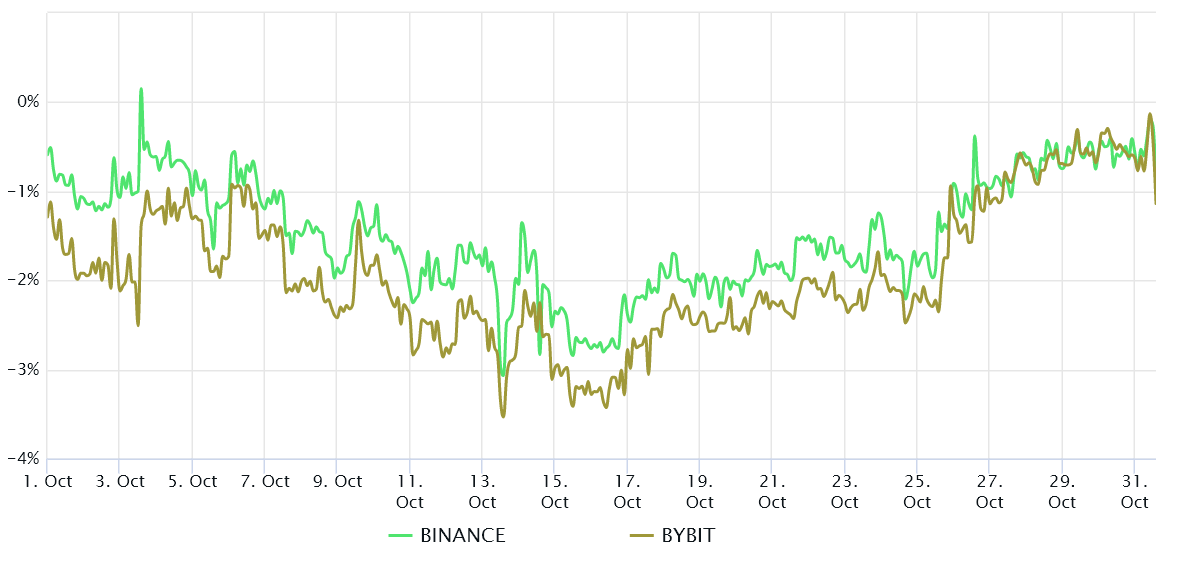

Futures traders stored a bearish stance regardless of the $1,600 rally

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they avoid the fluctuation of funding rates that frequently happens in a continuous futures contract.

The indicator should trade in a 4% to eightPercent annualized premium in healthy markets to pay for costs and connected risks. Hence, the above mentioned chart reveals a prevalence of bearish bets on ETH futures, since it’s premium was within the negative area in October. This type of scenario is unusual and usual for bearish markets, reflecting professional traders’ unwillingness to include leveraged lengthy (bull) positions.

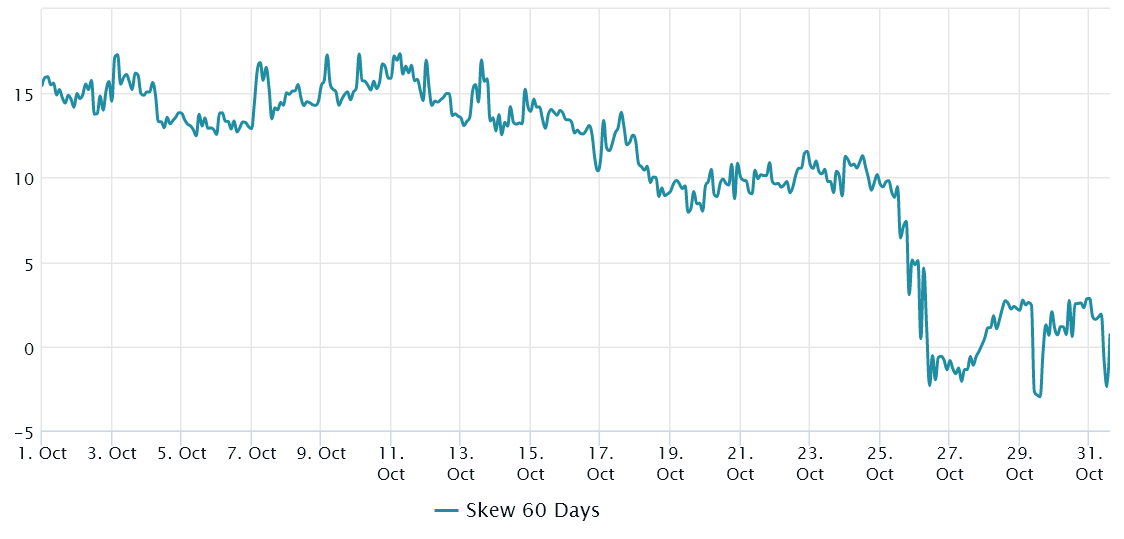

Traders also needs to evaluate Ether’s options markets to exclude externalities specific towards the futures instrument.

ETH options traders gone to live in an unbiased positioning

The 25% delta skew is really a telling manifestation of when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 10%. However, bullish markets have a tendency to drive the skew indicator below -10%, meaning the bearish put choices are discounted.

The 60-day delta skew have been over the 10% threshold until March. 25, and signaling options traders were less inclined to provide downside protection. However, a substantial change happened next days as whales and arbitrage desks began to cost a well-balanced risk for downward and upward cost swings.

Liquidations show an unexpected move, but minimal confidence from buyers

Both of these derivatives metrics claim that Ether’s 27% cost rally from March. 21 to March. 31 wasn’t expected, which is the large effect on liquidations. Compared, a 25% Ether rally from August. 4 to August. 14 caused $480 million price of leveraged short (sellers) liquidations, roughly 40% lower.

Presently, the current sentiment is neutral based on ETH options and futures markets. Therefore, traders will probably tread carefully, particularly when whales and arbitrage desks have was around the sidelines during this kind of impressive rally.

Until there’s confirmation from the $1,500 support level’s strength and pro traders’ elevated appetite for leverage longs, investors shouldn’t hurry towards the conclusion the Ether rally is sustainable.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.