Ethereum’s native token, Ether (ETH), is lower nearly 40% against Bitcoin (BTC) since December 2021. But more discomfort can be done for that ETH/BTC pair within the coming days, with different classic technical indicator.

Ethereum cost risks technical breakdown

The ETH/BTC chart continues to be developing a bear flag since early June 2022 around the three-day time-frame.

At length, bear flags are thought bearish continuation patterns that form because the cost consolidates greater in the range based on two climbing, parallel trendlines following a sharp decline. They resolve following the cost breaks underneath the lower trendline, i.e., in direction of its previous downtrend.

Usually of technical analysis, a bear flag’s downside target involves attend the space comparable to how big the prior downside move. Recently, ETH/BTC continues to be eyeing an identical breakdown, using its profit target hanging out .0439, lower almost 20% from today’s cost.

Nevertheless, bear flags come with an average rate of success close to 67% with regards to meeting its profit targets, based on Samurai Buying and selling Academy’s study. Furthermore, veteran analyst Tom Bulkowski sees the bear flag meeting its target only 46 occasions from 100 attempts.

Appears like “actual dying”

Another technical setup shared by analyst Pentoshi shows Ether facing the potential of falling reduced than bear flag’s profit target.

Pentoshi shows that ETH/BTC could dip toward an climbing trendline that’s been becoming its support since September 2019 — the amount comes near .036, lower 30% from today’s cost.

$ETH / $BTC appears like actual dying reaches the doorstep https://t.co/giJJgUDdzJ pic.twitter.com/NBEzWDx2Ks

— Pentoshi (@Pentosh1) This summer 12, 2022

Ethereum funds witness modest inflows

The bearish setups for ETH/BTC seems in comparison having a potential recovery across Ethereum-based investment funds.

Related: 3 key metrics suggest Bitcoin and also the wider crypto market have further to fall

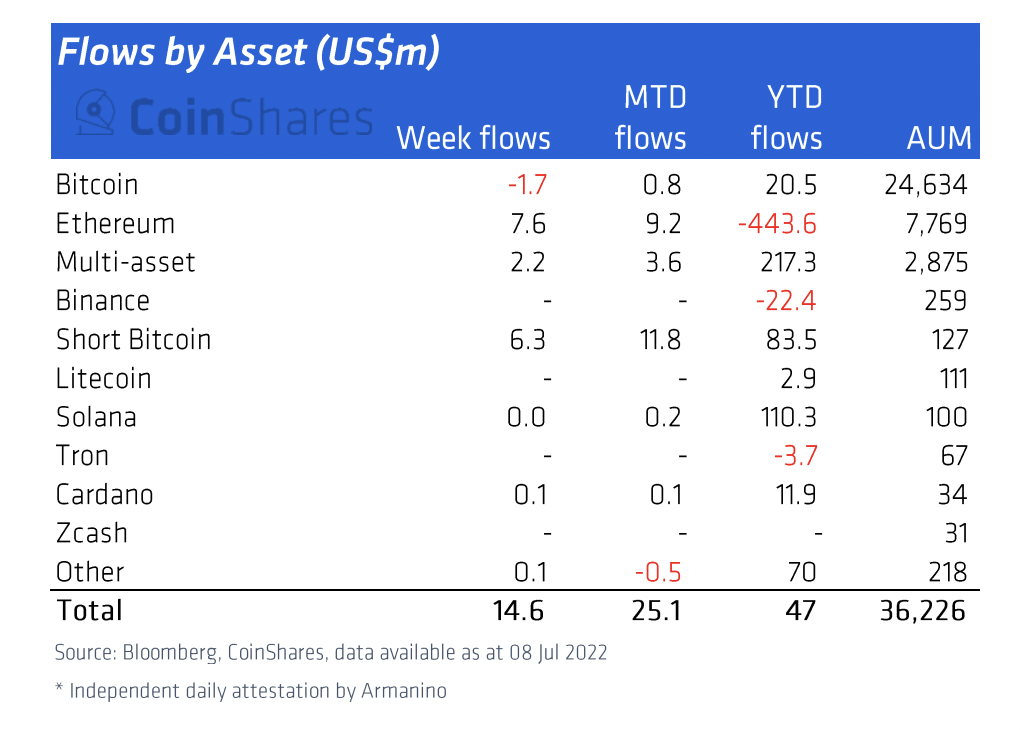

At length, Ethereum funds accumulated $7.six million within the week ending This summer 8, based on CoinShares’ latest report.

“The inflows advise a modest turnaround in sentiment, getting suffered 11 consecutive days of outflows that introduced 2022 outflows to some peak of $460 million,” the report notes, adding:

“This improvement in sentiment is are closely related towards the growing possibility of the Merge, where Ethereum moves from proof-of-try to proof-of-stake, happening later this season.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.