Ethereum’s native token Ether (ETH) is showing indications of bottoming out as ETH cost bounced off a vital support zone. Notably, ETH cost has become holding over the key support degree of the 200-week simple moving average (SMA) near $1,196.

The 200-week SMA support appears purely mental, partially because of its capability to function as bottom levels in the last Bitcoin bear markets.

Independent market analyst “Bluntz” argues that the curvy level would also function as a strong cost floor for Ether where accumulation is probably.

He notes:

“BTC has bottomed 4x in the 200wma dating back 2014. [Most likely] safe to visualize it is a pretty strong level. Sure we are able to wick below it, but there [are] also six days left within the week.”

Presently, ETH/USD is nearly 75% below its record high, seven several weeks after hitting around $4,950.

This massive correction makes the Ethereum token an “oversold” asset, per its below-30 relative strength (RSI) readings, another technical indicator showing that ETH is really a “buy.”

The final time Ether switched oversold is at November 2018, which preceded the finish of the 12-month lengthy bear cycle that saw ETH losing 94% of their value.

Regrettably, exactly the same bearish exhaustion can’t be guaranteed in 2022 as Ether continues facing some serious macro headwinds.

ETH’s technical bull signals aren’t enough

Ether’s look for a concrete bottom seems from the backdrop of the selling craze happening over the crypto and traditional markets.

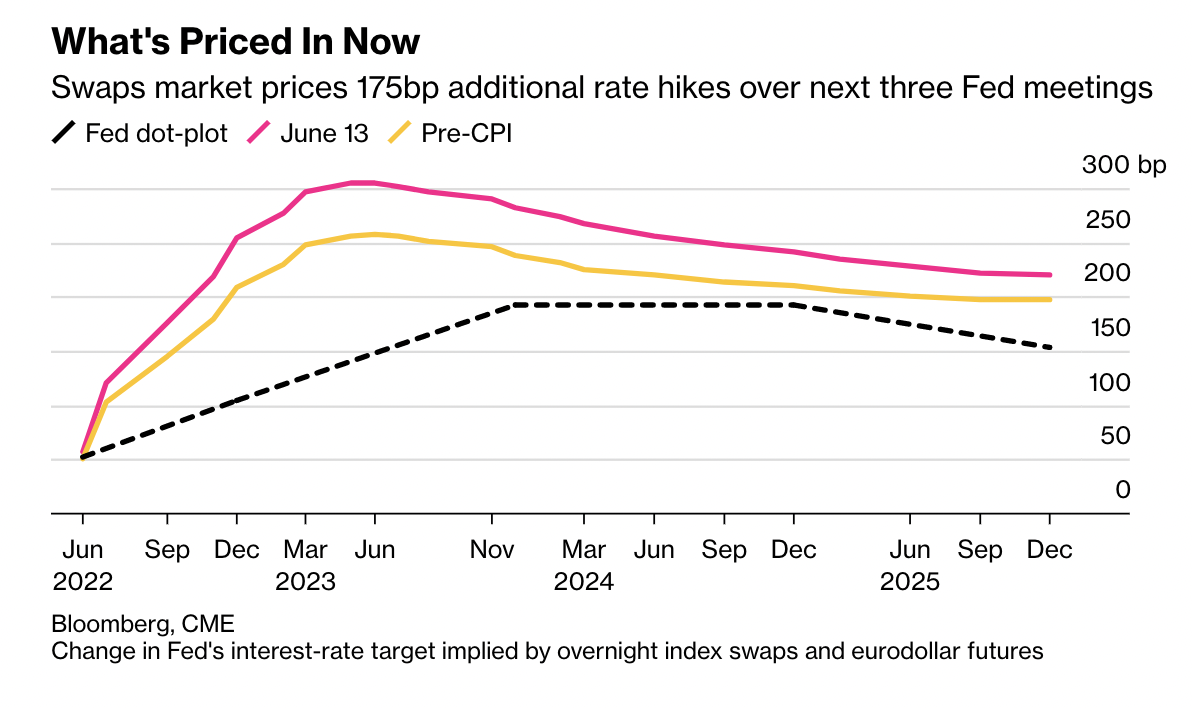

Fundamentally of their 75% cost correction is really a hawkish Fed using its chance of raising rates of interest by 175 basis points by September’s finish, according to rate of interest swaps associated with FOMC policy outcome dates.

Quite simply, riskier assets would suffer as lending costs rise. This might hurt Ether’s recovery prospects despite it holding over a so-known as “strong” support level.

1-2 several weeks because the Ethereum merge could be implemented between August and October. And traders will front-run it. It will not matter much when the Given will get more aggressive, but when it does not, then that’s your catalyst.

— Alex Krüger (@krugermacro) June 2, 2022

Ether cost targets

ETH’s cost continues to be testing the .786 Fib line (near $1,057) since it’s interim support. This cost level serves is part of the Fibonacci retracement graph, attracted in the $1,323-swing high towards the $82-swing low, as proven within the chart below.

A 2018-like 94% cost decline would risk getting ETH towards the .236 Fib line near $375, lower 70% from June 1’s cost.

Related: This key Ethereum cost metric shows ETH traders aren’t as bearish because they appear

On the other hand, if Ether indeed bottoms out near its 200-week SMA, its road to least resistance seems to become toward $2,000. A long upside retracement above $2,000 might have the Ethereum token test $3,500 since it’s next bull target.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.