Ethereum’s native token Ether (ETH) is poised for any small bull run above $3,000 mainly as a result of classic bullish reversal pattern on its shorter-time-frame chart, along with a huge spike in ETH outflows from Coinbase.

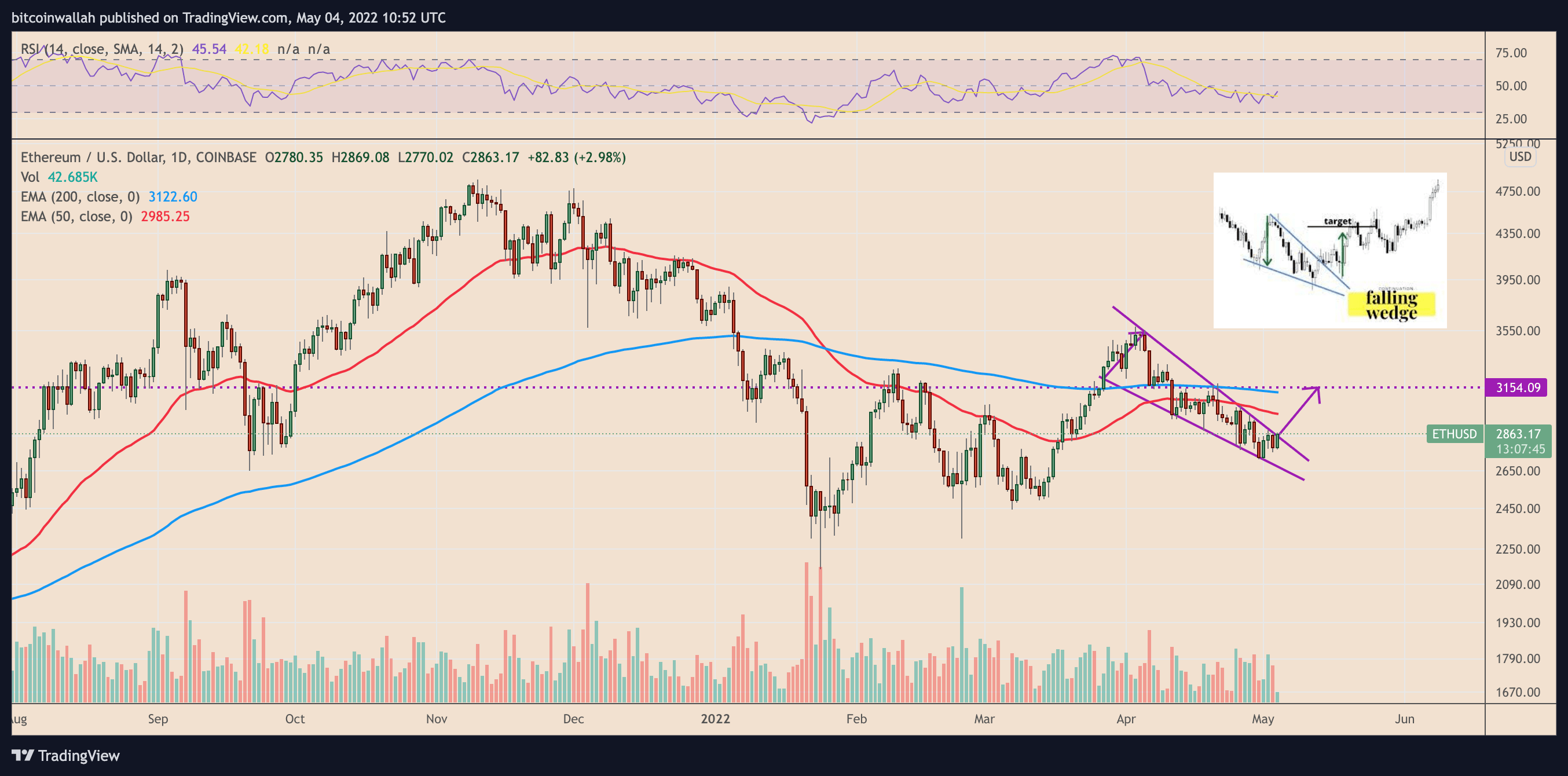

ETH cost developing falling wedge

ETH’s cost continues to be developing a falling wedge pattern since late March 2022, which raises its prospects of having a breakout relocate May.

Falling wedges appear once the cost trends lower in the range based on two climbing down and contracting trendlines.

Usually of technical analysis, these wedges resolve following the cost breaks from their range towards the upside and increases to an amount in more detail comparable to the utmost distance between your pattern’s lower and upper trendline when measured in the breakout point.

The utmost falling wedge height is about $395. Suppose ETH’s cost closes above $2,850, the possibility breakout point, supported by a rise in buying and selling volume, its probability of rising by another $395 toward $3,150 is going to be greater.

Coinbase ETH outflows hit all-time high

The interim upside outlook within the Ether market coincides with bullish on-chain data.

Particularly, the quantity of ETH departing Coinbase, the 2nd-largest crypto exchange by volume, arrived at its greatest level on May 3, data from CryptoQuant shows.

$ETH Coinbase Output hits an exciting-time-high

Live Chart https://t.co/PiITw2ZFf3 pic.twitter.com/tlFQndUhvQ

— CryptoQuant.com (@cryptoquant_com) May 4, 2022

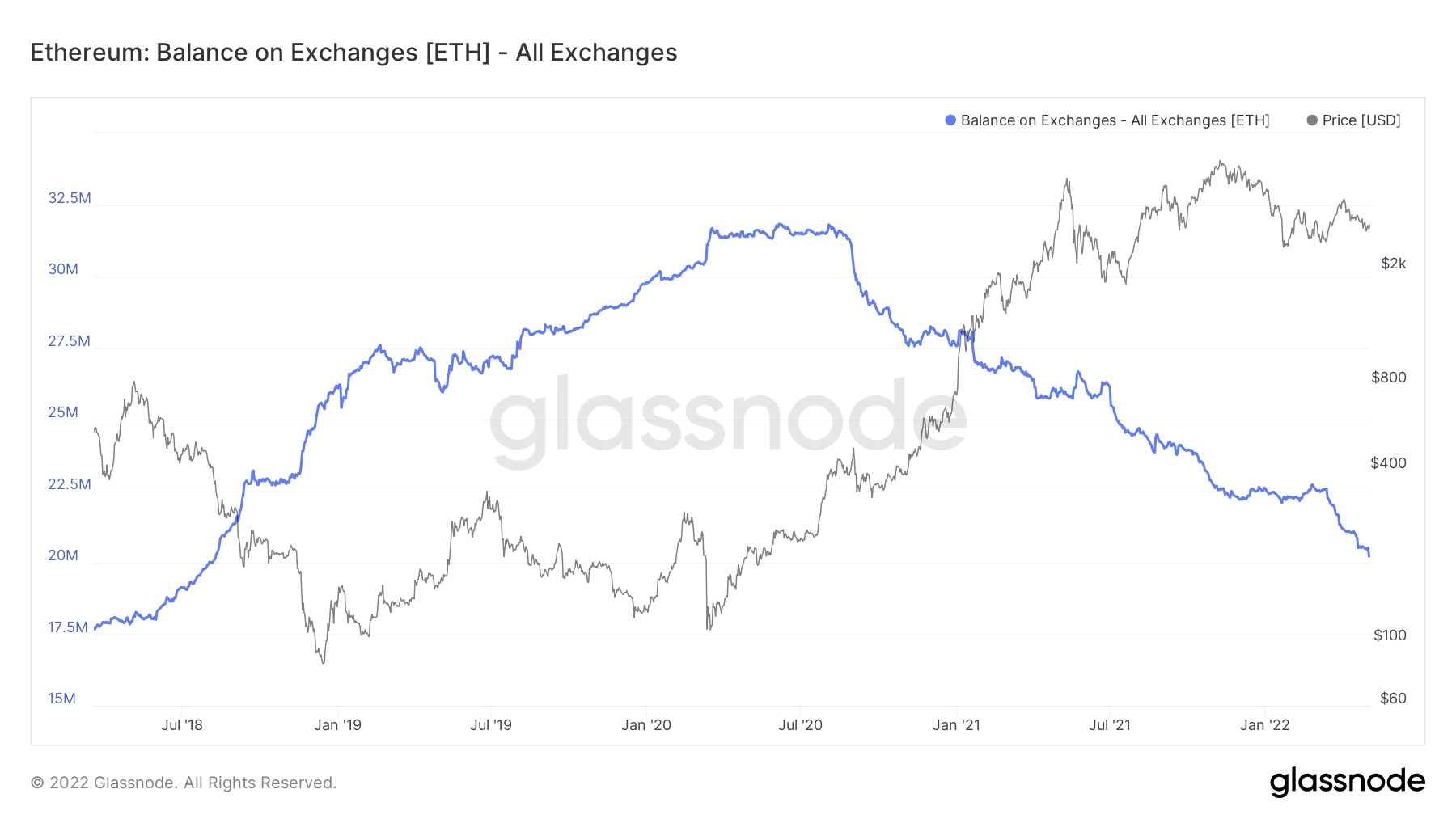

Concurrently, the ETH balance on all of the crypto exchanges fell on May 3 to the cheapest level since August 2018, based on certainly one of Glassnodes on-chain metrics.

Both indicators imply an outburst in traders’ preference to carry Ethereum tokens over buying and selling them for other assets.

Additionally they coincide having a recent recovery within the upside sentiment of small Ether traders, namely a rise in the amount of addresses which have the absolute minimum balance of .1 ETH, 1 ETH and 10 ETH.

The Ethereum balances tick greater over the retail addresses as Ether’s cost trends lower, indicating that traders happen to be buying ETH at local lows. That further props up falling wedge’s bullish reversal setup.

Bearish lengthy-term prospects

Ether’s probability of crossing the $3,000-level hasn’t plucked it of their prevailing, lengthy-term bearish setup, however.

As Cointelegraph lately reported, ETH risks breaking below its climbing triangular range in Q2/2022, using its downside target sitting between $1,820 and around $2,670, with respect to the breakout point.

Additional downside cues come from macro fronts, with Ether — like its top rival Bitcoin (BTC) — still holding its positive correlation with U . s . States stocks inside a sign it would tail the standard markets downward as a result of common factor: a hawkish Fed.

The U.S. central bank will to produce policy statement on May 4 at 2:00 pm EST, adopted by chairman Jerome Powell’s press conference at 2:30 pm EST. Officials have signaled they would increase benchmark rates by .5% and approve intends to unwind their $9-trillion asset portfolio.

Related: Smart cash is accumulating ETH even while traders warn of the drop to $2.4K

Researchers from Strategas Research Partners and Morgan Stanley anticipate the U.S. benchmark index, the S&P 500, will decline by another 15-16% into 2022, reported Bloomberg. Because of its consistent positive correlation, ETH also faces similar downside prospects this season.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.