Ethereum experienced a key network replace on Sept. 15, shifting from the proof-of-work (Bang) mining consensus to some proof-of-stake (PoS) one. The important thing upgrade is dubbed the Merge.

The Merge was slated like a critical change for that Ethereum network that will allow it to be more energy-efficient, with later enhancements to scalability and decentralization in the future.

Just a little more than a month later, however, some industry observers fear the PoS transition has pressed Ethereum toward more centralization and greater regulatory scrutiny.

The Merge replaced the way in which transactions were verified around the Ethereum network. Rather of miners investing in their computational capacity to verify a transition, validators now pledge Ether (ETH) tokens to ensure individuals transactions. The problem with this particular product is that validators having a greater quantity of Ether possess a bigger say, given there is a bigger number of validator nodes or staked ETH.

To become validator around the Ethereum network, you have to stake no less than 32 ETH. Thus, whales and large crypto exchanges have staked countless ETH to possess a bigger area of the validator nodes.

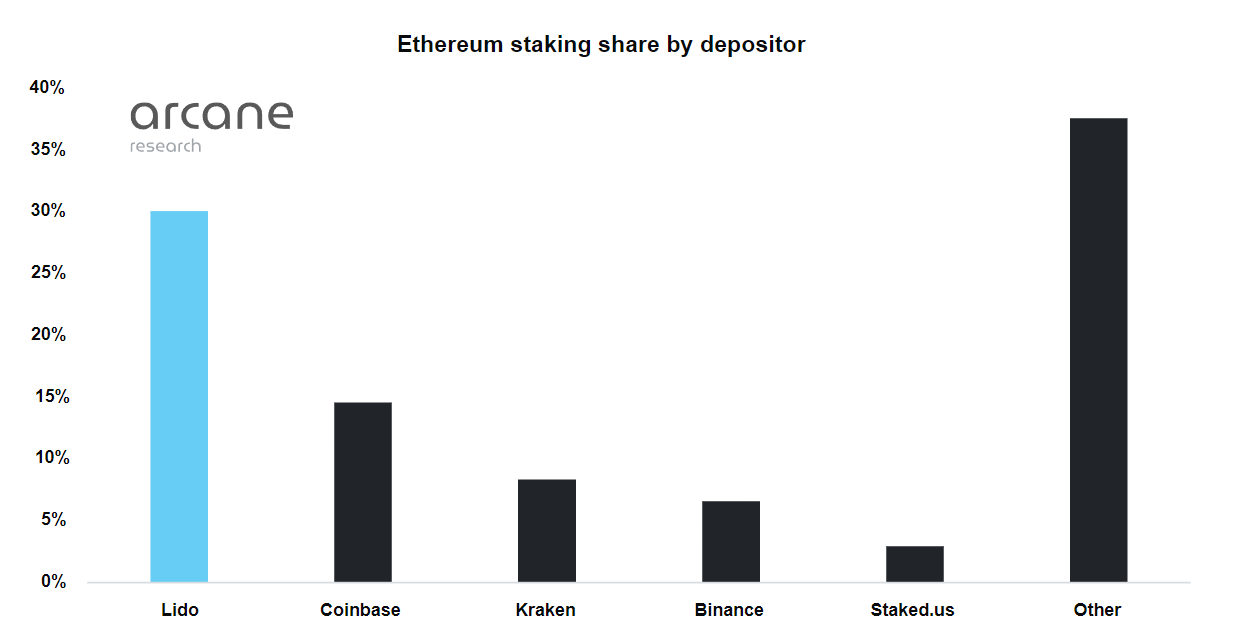

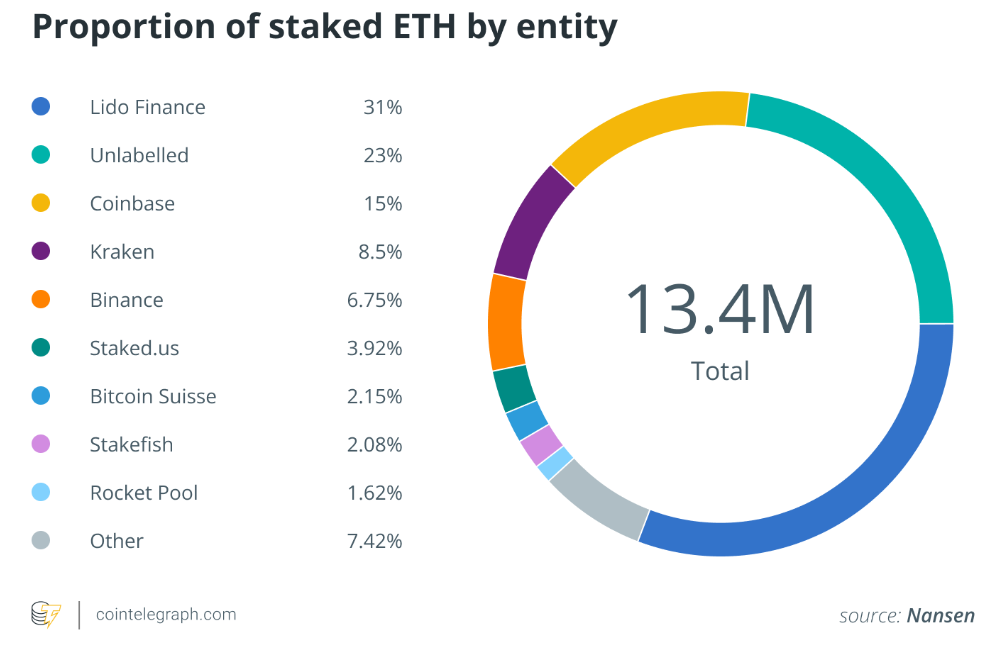

Current staking activities look very centralized, using the leading liquid staking protocol Lido and leading centralized exchanges for example Coinbase, Kraken and Binance comprising over 60% from the staked ETH.

RA Wilson, chief technology officer of crypto and carbon credits exchange 1GCX, told Cointelegraph the Merge has allowed large holders of Ether to achieve mass charge of the network, which makes it considerably more centralized and definitely less secure and described:

“Many ETH holders stake their crypto on centralized exchanges for example Coinbase, which enables these platforms to get dominant holders around the network, adding to stakeholder centralization.”

The centralization aspect was quite apparent immediately after the Merge, as 46.15% of the nodes for storing data, processing transactions and adding new blockchain blocks might be related to just two addresses.

Arcane Crypto analyst Vetle Lunde told Cointelegraph that although the PoS transition was essential for Ethereum’s lengthy-term goals of one’s efficiency and scalability, one should know the trade-offs:

“The largest validators being exchanges represent a possible lengthy-term risk. Exchanges already finish up in a hard regulatory landscape, and precautionary rejections of transactions may conflict with an important core principle within the crypto ethos, censorship resistance.”

While Ethereum proponents declare that anybody with 32 ETH may become a validator, you should observe that 32 ETH, or around $41,416, isn’t a bit for any newbie or common trader, added that the lock-in period is very lengthy.

Slava Demchuk, Chief executive officer of Web3 complaint platform PureFi, told Cointelegraph the centralization and complexities involved with staking will make centralized entities like Coinbase more effective:

“Most individuals will be staking with custodians (for example Coinbase) because of the simplicity cheap it normally won’t have 32ETH. By doing this, large companies have a majority share from the network, which makes it more centralized. This means that entities with increased ETH may have additional control.”

The worry of regulatory scrutiny

Earlier in 2018, the SEC claimed that Ether isn’t a security, because of its decentralized development and expansion with time. However, that could change using the proceed to PoS, that has complicated the connection between your Ethereum blockchain and regulators.

Gary Gensler, Chair from the U . s . States Registration (SEC), testified prior to the Senate Banking Committee at the time from the Merge, proclaiming that revenue from “expectation of profit to become produced from the efforts of others” would come with proof-of-stake digital assets.

Gensler also pointed out that staking from large centralized exchanges looks “very similar” to lending, calling out high-yield items that caused the current crypto market meltdown and lumping these items in to the financial instruments underneath the scrutiny from the SEC.

In addition, within an SEC suit filed only a week following the Merge, the SEC claimed jurisdiction within the Ethereum network since most of nodes are concentrated within the U . s . States.

As the SEC’s claims elevated some eyebrows with many criticizing the regulator because of its approach, some believe Ethereum has already established it coming, as Gensler has mentioned that relocating to PoS might trigger securities laws and regulations. Ruadhan, charge developer of Bang-based mining token developer Periodic Tokens, told Cointelegraph:

“The argument that lots of the validators come in the U.S. is weak because it isn’t a majority. However, this move demonstrates an intent to manage, also it would result in a major disruption towards the economy if Ethereum may be considered a burglar. Centralized exchanges will have to de-list Ethereum. The planet economy is presently very vulnerable, and Ethereum’s market cap is really large that the event such as this might have spillover effects and even result in a fiscal crisis.”

Ruadhan predicted when Ethereum was considered a burglar, then it might be a lot more heavily controlled it doesn’t matter how centralized it’s: “If you will find very couple of block proposers, all concentrated within the U . s . States, then they may be made to censor transactions that violate U.S. sanctions, which indicates Ethereum’s censorship resistance sheds.”

Kenneth Goodwin, director of regulatory and institutional matters at Blockchain Intelligence Group, told Cointelegraph the proceed to PoS has certainly provided the SEC with leverage to supervise validators as well as the nodes themselves as lengthy because they are of a U.S. person, entity or jurisdiction. However, there’s an irony towards the situation. Goodwin described:

“The irony here is this fact could be among the systems in consideration for that U.S. central bank digital currency given its central nature from it. Around the switch side, there’d become more regulatory oversight that could include developing a system of registration for validators and Ether protocol-based projects. Nonetheless, it appears as if the SEC needs to classify Ethereum like a security.”

Jae Yang, Chief executive officer and co-founding father of noncustodial crypto exchange Tacen, told Cointelegraph that centralization turn into an issue for Ethereum if regulators proceed to impose Anti-Money Washing (AML) rules on staking.

“Centralization is a concern when the FinCEN or any other regulators impose Know Your Customer, AML or any other AML compliance needs on users simply staking ether. Though a lengthy shot at this time, there’s a danger that centralized validators omit certain transactions, creating themselves because the third-party intermediary on decision-making which goes from the very guiding concepts from the decentralized economic climate,” he described.

Lengthy-term impact of PoS transition

Despite concerns well over-centralization and regulatory scrutiny, industry observers are certain that the Ethereum blockchain will overcome these short-term issues and then play a vital role in developing the ecosystem within the lengthy term.

Okcoin chief operating officer Jason Lau recommended to have an expanded look at the transition. He told Cointelegraph:

“When we consider the centralization versus decentralization debate, we have to consider the lengthy-term. Open blockchains require an advanced of decentralization to make sure censorship resistance, openness and security, so any shift towards more centralization could be worth keeping track of. The city is comfortable with the significance of encouraging and making certain an assorted group of participants, and we’ll observe how this plays out with time.”

Wilson noted the network can become a little more decentralized during the period of the following 6–8 several weeks, as lock-up periods on Ethereum start to expire and holders can withdraw their staked tokens.

Even though node and validator centralization is really a valid concern, Chen Zhuling, co-founder and Chief executive officer of noncustodial staking company RockX, noted Bang mining on Ethereum was as centralized as validators of the present PoS-based network.

Chen told Cointelegraph that within the Bang era, “Three mining pools dominated the Ethereum network’s hashrate. You can hardly contend with other miners to ensure blocks should you didn’t possess an enormous quantity of computing power, requiring costly, energy-guzzling mining rigs.”

Chen also recommended for any lengthy-term look at the PoS transition as presently, tokens are mainly controlled by large foundations with regard to security as well as on the goodwill assumption they wouldn’t do anything whatsoever to corrupt the network.

Demchuk was quick to indicate that centralization in staking does not necessarily mean it will likely be simple for a sizable malicious number of stakers to potentially seize control from the Ethereum network, as “there is the one other protective measure. ‘Bad’ validators can get slashed, and therefore their ‘stake’ could possibly get confiscated.”

Ethereum may have transitioned to some PoS network, but most scalability along with other features is only going to arrive following the completing the ultimate phase, expected through the finish of 2024.

On-going, it will likely be interesting to determine how Ethereum overcomes the centralization of validators and addresses the growing regulatory concerns facing the network.