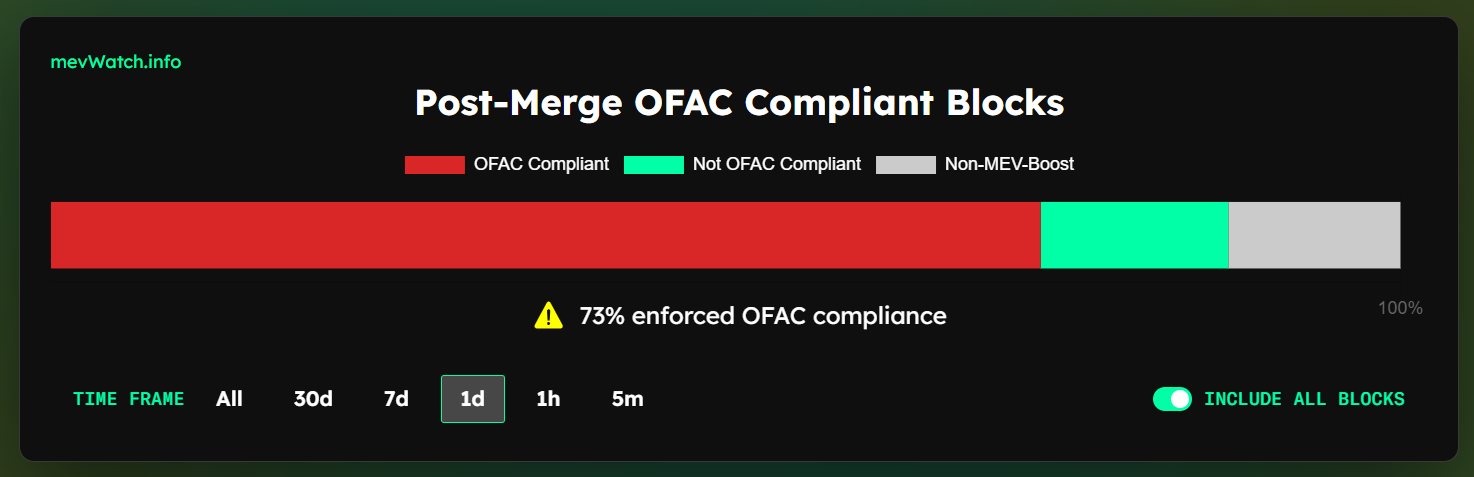

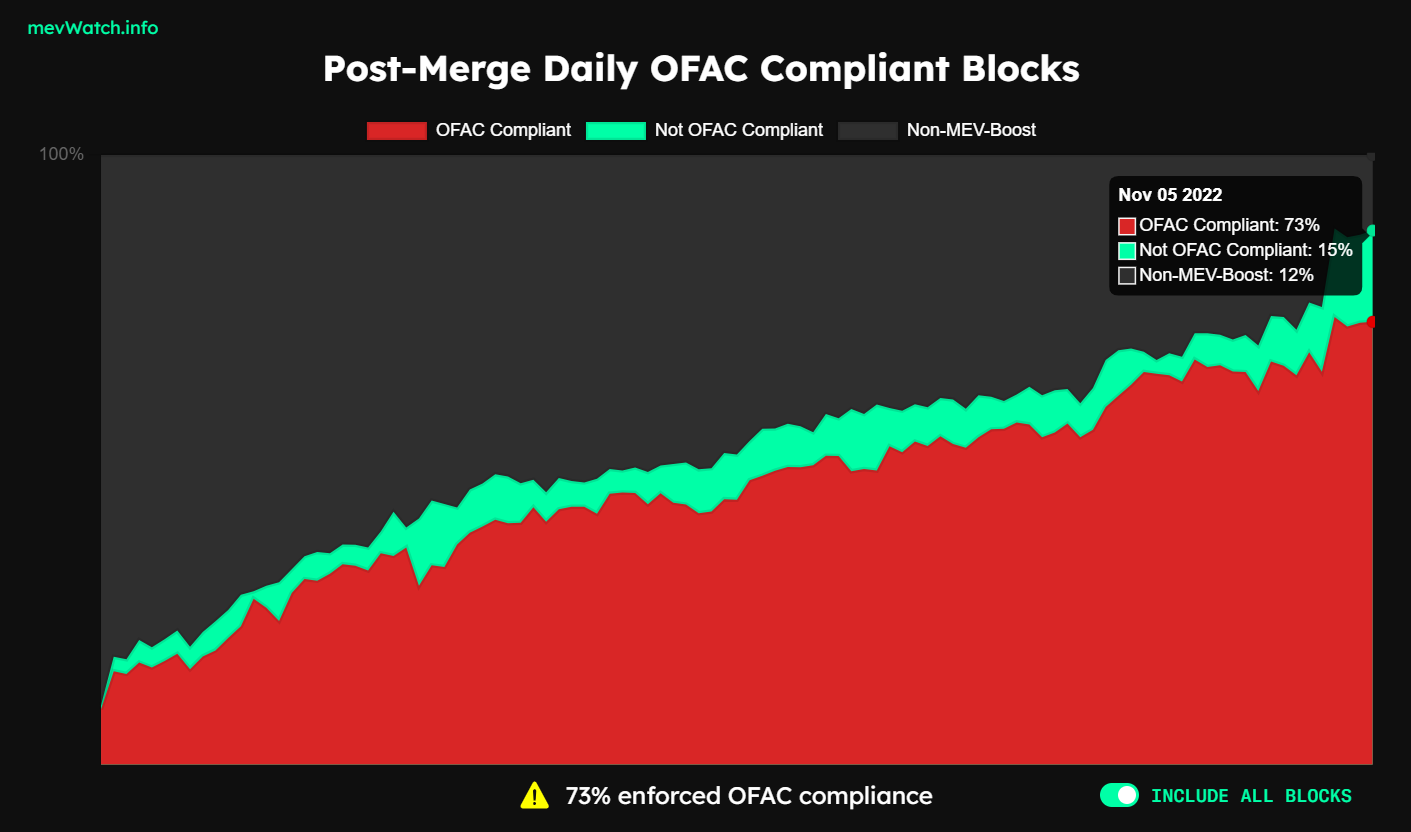

Thinking about that protocol-level censorship is deterrent towards the crypto ecosystem’s objective of highly open and accessible finance, the city continues to be monitoring Ethereum’s growing compliance with standards set through the Office of Foreign Assets Control (OFAC). During the last 24 hrs, the Ethereum network was discovered to enforce OFAC compliance on over 73% of their blocks.

In March. 2022, Cointelegraph reported around the rising censorship concerns after 51% of Ethereum blocks put together compliant with OFAC standards. However, data from mevWatch confirmed the minting of OFAC-compliant blocks every day is continuing to grow to 73% by November. 3.

Some MEV-Boost relays — which are controlled under OFAC — will censor certain transactions. Consequently, to guarantee the neutrality of Ethereum (ETH), the network must adopt a non-censoring MEV-Boost relay.

Ethereum validators can help to eliminate OFAC compliance by discarding relays within their MEV-Boost configuration that censor transactions, for example BloXroute Max Profit, BloxRoute Ethical, Manifold and Relayooor.

Compliance with OFAC enables the federal government agency to enforce economic and trade sanctions. Formerly, the company sanctioned Tornado Cash and many Ethereum addresses.

Currently, 45% of Ethereum blocks are thought compliant with OFAC.

Related: Ethereum sets record ETH short liquidations, eliminating $500 million by 50 percent days

The mainstream adoption of Bitcoin (BTC) and Ethereum increased after UnionBank, among the largest universal banks within the Philippines, debuted cryptocurrency buying and selling together with a Swiss crypto firm Metaco.

“We are proud to carry on UnionBank’s number of industry firsts, this time around to be the first controlled bank in the united states allowing digital foreign exchange features for clients,” stated Henry Aguda, chief technology officer and chief transformation officer at UnionBank.