Ethereum’s upgrade to proof-of-stake (PoS) could make it more susceptible to government intervention and censorship, based on the lead investigator of Merkle Science.

Talking with Cointelegraph following a Ethereum Merge, Coby Morgan, an old FBI analyst and also the lead investigator for crypto compliance and forensic firm Merkle Science, expressed his ideas on a few of the risks resulting from Ethereum’s transition to PoS.

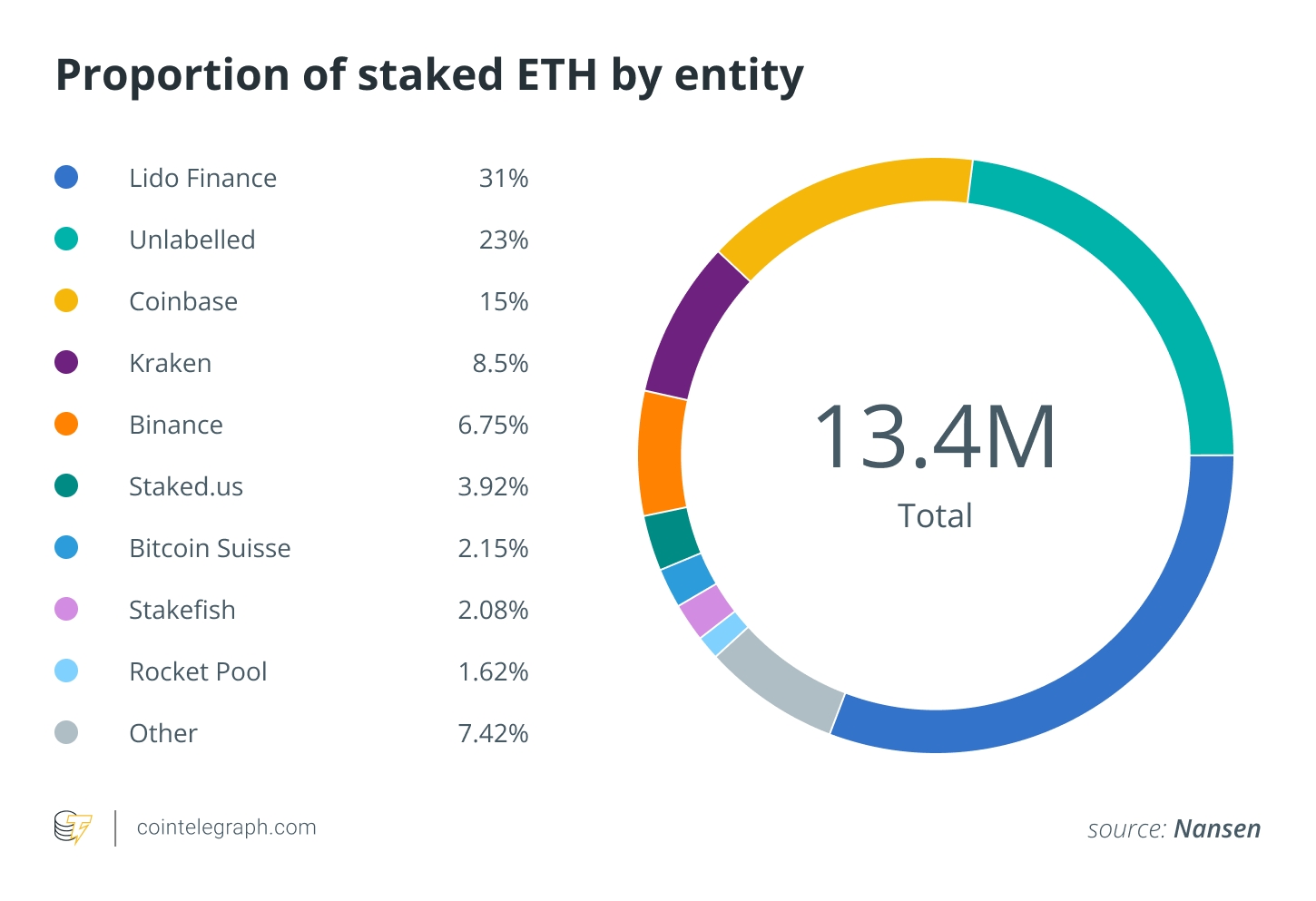

While centralization issues happen to be broadly discussed prior to the Merge, Moran recommended the prohibitive price of being a validator could cause the consolidation of validator nodes towards the bigger crypto firms like Binance, Coinbase and Kraken.

In order to be a complete validator for that Ethereum network, the first is needed to stake 32 Ether (ETH), that is worth around $47,000 during the time of writing.

A pre-Merge report from blockchain analytics platform from Nansen earlier this year says 64% of staked ETH is controlled just by five entities.

Morgan ongoing to state these bigger institutions is going to be “subject towards the whims of governments on the planet,” so when validator nodes identify sanctioned addresses they are able to “be slashed rewards after which eventually began the machine,” with companies avoided from getting together with them:

“Either you’ll comply and you’ll siphon off that kind of interaction […] or else you risk being fined, being scrutinized, or potentially being sanctioned yourself.”

Vitalik Buterin spoke relating to this risk within an August. 18 developer call, suggesting among the forms censorship might take is validators selecting to exclude or filter sanctioned transactions.

Vitalik continued to state that as lengthy as some validators don’t adhere to the sanctions, then these transactions would eventually become selected in later blocks and also the censorship would simply be temporary.

On August. 8, crypto mixer Tornado Cash grew to become the first smart contract sanctioned with a U . s . States government body.

Related: Repetition. Emmer demands a reason of OFAC’s Tornado Cash sanction from Sec. Yellen

Responding, various entities have complied using the sanctions and avoided the sanctioned addresses from being able to access their services and products.

The event has already established a sizable impact on the Ethereum community, with EthHub co-founder Anthony Sassano tweeting on August. 16 he would consider Ethereum failing and move ahead if permanent censorship occurs.

I wish to be very obvious about this:

When the Ethereum base-layer winds up participating in *permanent* censorship i then will think about the Ethereum experiment failing and i’ll move ahead.

Thankfully, In my opinion the Ethereum community is powerful enough to battle off base-layer censorship.

— sassal.eth (@sassal0x) August 16, 2022