Ethereum’s change to proof-of-stake (PoS) on Sept. 15 unsuccessful to increase Ether’s (ETH) upside momentum as ETH miners added sell pressure towards the market.

Around the daily chart, ETH cost declined from around $1,650 on Sept. 15 close to $1,350 on Sept. 20, a nearly 16% drop. The ETH/USD pair dropped synchronized along with other top cryptocurrencies, including Bitcoin (BTC), among worries about greater Fed rate hikes.

Ethereum remains inflationary

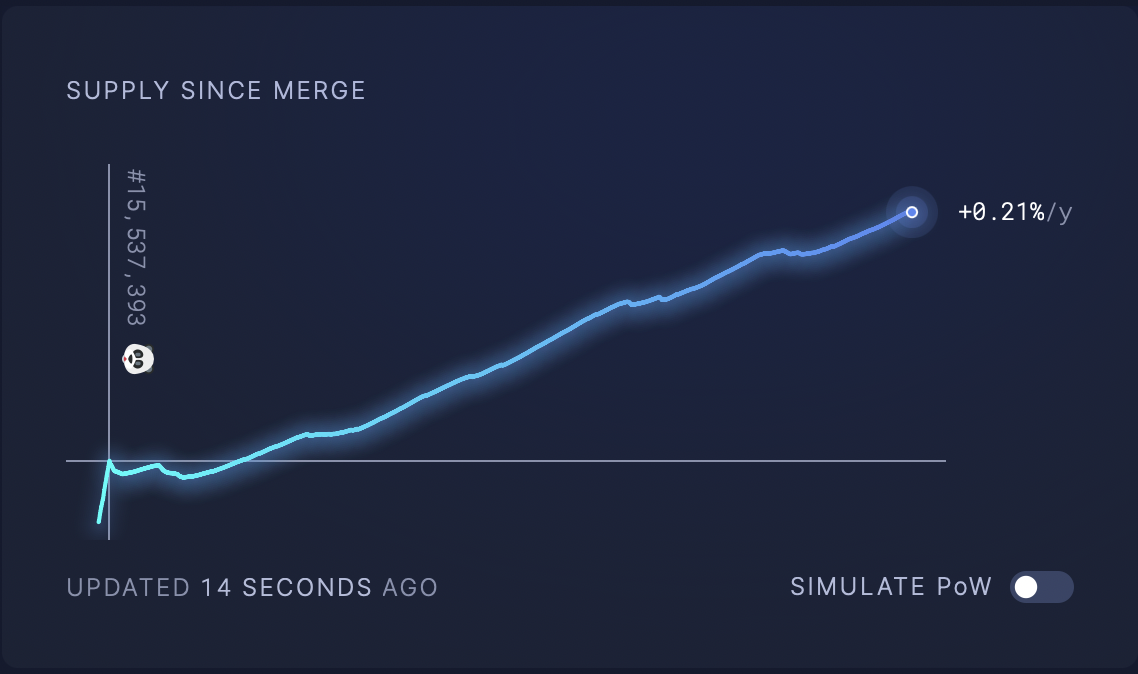

The Ether cost drop on Sept. 15 also coincided with a rise in ETH supply, although not immediately publish-Merge.

$ETH has become Ultra Seem Money pic.twitter.com/fKz6VmoWdR

— DavidHoffman.eth (@TrustlessState) September 15, 2022

Roughly 24 hrs later, the availability change flipped positive once again, flowing cold water around the “ultra seem money” narrative as a result of deflationary atmosphere that some proponents expected publish-Merge.

Pre-Merge, Ethereum distributed around 13,000 ETH each day to the proof-of-stake (Bang) miners contributing to 1,600 ETH to the PoS validators. However the rewards to miners dropped following the Merge went live and eat roughly 90%.

Meanwhile, validators receiving Ether rewards now only make 10.6% from the previous amount. Consequently, Ether’s annual emissions have came by around .5%, making ETH less inflationary, and possibly even deflationary under certain conditions.

Still, the Ether supply continues to be rising in an annual rate of .2% following the Merge, according to data supplied by Ultrasound Money.

The primary cause of the growing supply is gloomier transaction charges.

Particularly, Ethereum designed a switch to its protocol in August 2021 that introduced a charge-burning mechanism. Quite simply, the network began removing part of the fee it charges for every transaction permanently. This technique has burned 2.six million ETH since going live.

Data implies that the Ethereum network’s gas charges should be around 15 Gwei to cancel out the ETH rewarded to validators. However the fee was averaging around 14.3 Gwei on Sept. 20, meaning the ETH supply, overall, continues to be growing.

Nevertheless, ETH’s issuance rate has decreased publish-Merge, although the supply rate remains positive with roughly 3,700 ETH minted publish-Merge up to now.

Miners increase ETH selling pressure

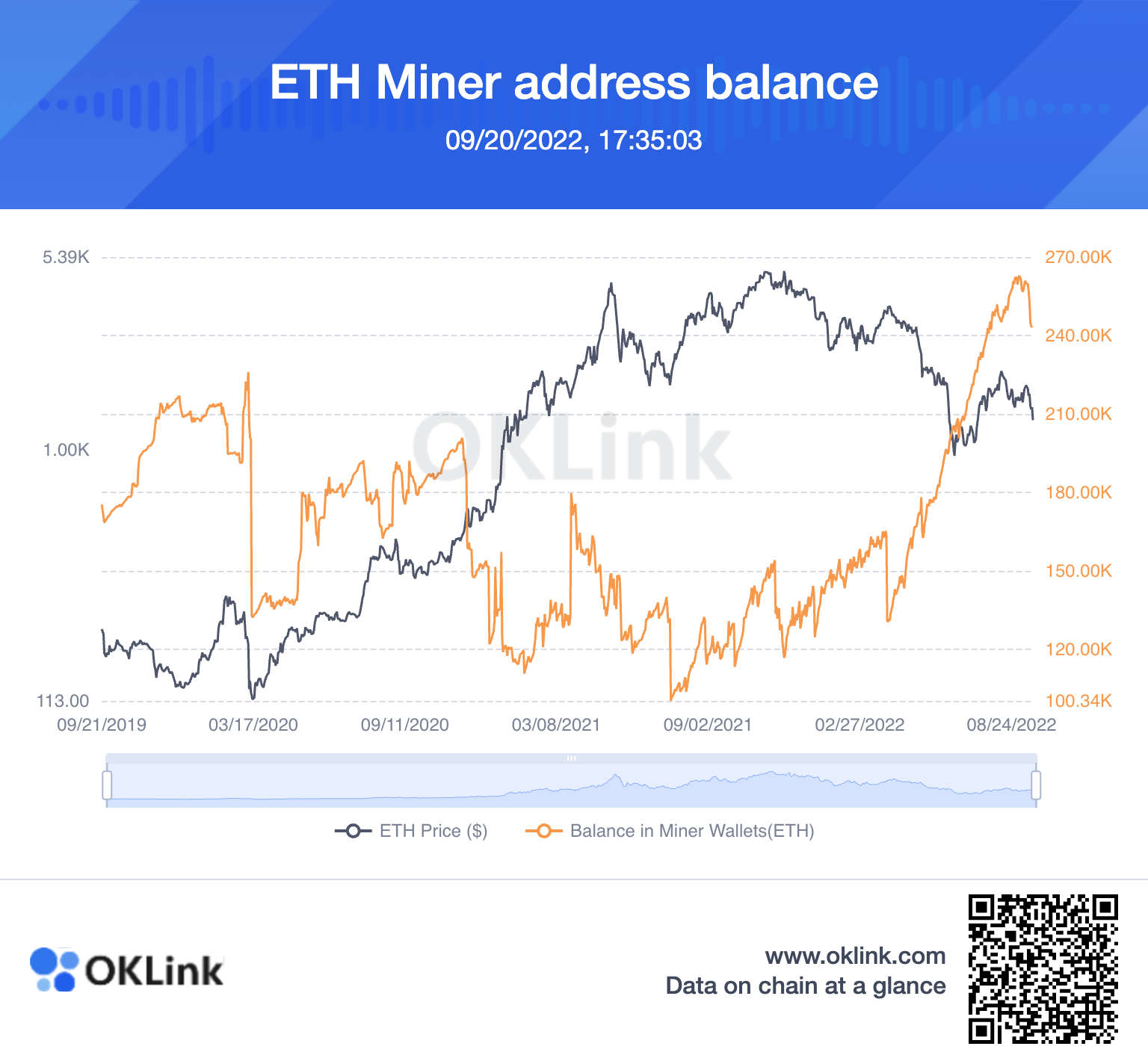

Additionally, Ether’s cost drop publish-Merge uses Ethereum miners’ mass exit in the ETH market.

Related: Will the Ethereum Merge provide a new place to go for institutional investors?

Miners offered about 30,000 ETH (~$40.seven million) dads and moms prior to the Ethereum’s PoS update, based on data supplied by OKLink.

Pseudonymous analyst “BakedEnt.eth” noted the miners’ ETH selling-spree counterbalance the impact from the slowdown in Ether’s issuance reduction.

“The Merge continues to be live for a few days, however, many miss out on the outcome from the 95% daily issuance reduction for as many as 49.000 $ETH in 4 days,” he authored, adding:

“Miners happen to be selling non-stop into this reduction and also have dumped over 30.000 $ETH within the same time-frame.”

ETH’s cost now risks shedding an additional $750 considering current macroeconomic headwinds, that are putting pressure on risk-on assets overall.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.