Ether (ETH) is lower 11.5% in 7 days despite the current confirmation from the “Ethereum merge” transition to some proof-of-stake (PoS) consensus network in September. Throughout the Ethereum core developers business call on This summer 14, developer Tim Beiko suggested Sept. 19 because the tentative target date.

The transition from energy-intensive mining continues to be delayed for a long time, and also the journey toward scalability using sharding technology — parallel processing capacity — is not yet been scheduled. Still, some analysts expect the network’s financial policy to improve the need for Ether.

Ethereum investigator Vivek Raman highlighted the result from the “supply shock” and based on the analyst, the “merge” will “reduce ETH’s total supply by 90%,” despite the fact that no benefit in transaction charges will be seen in the present transition stage.

Regulatory uncertainty might be partly accountable for Ether’s recent sharp correction. A category-action continues to be suggested against Yuga Labs for “inappropriately inducing” the city to purchase nonfungible tokens (NFTs) and also the ApeCoin (APE) token. In addition, what the law states firm claims that Yuga Labs used celebrity promoters and endorsements to “inflate the cost” from the BAYC NFTs and also the APE tokens.

Furthermore, on This summer 26, Infrawatch PH, a think tank within the Philippines, filed a complaint towards the local regulator to hack lower on Binance’s activities and alleged unregistered operations. The petition claims the exchange doesn’t have office in Manila and just uses “third-party companies” because of its technical and customer care services.

Options traders are not near positive

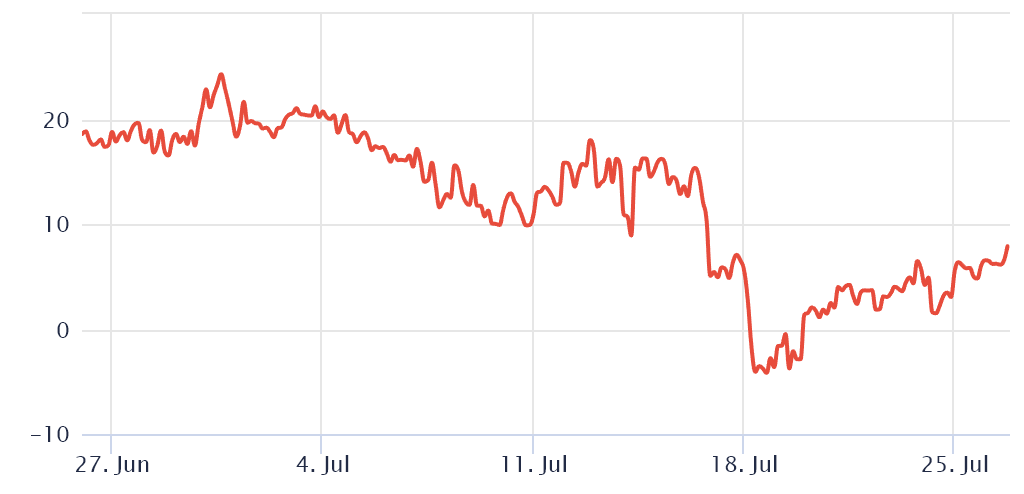

Investors need to look at Ether’s derivatives markets data to know how whales and arbitrage desks are situated. The 25% delta skew is really a telling sign whenever traders overcharge for upside or downside protection.

If individuals market participants feared an Ether cost crash, the skew indicator would move above 10%. However, generalized excitement reflects an adverse 10% skew.

The skew indicator exited the “fear” zone on This summer 16 as Ether broke above $1,300, its greatest level in 33 days. However, the advance in traders’ sentiment wasn’t enough to instill confidence because the metric has since continued to be in the “neutral” threshold. ETH option traders are presently assessing similar upside and downside cost movement risks.

Lengthy-to-short data show a modest improvement in sentiment

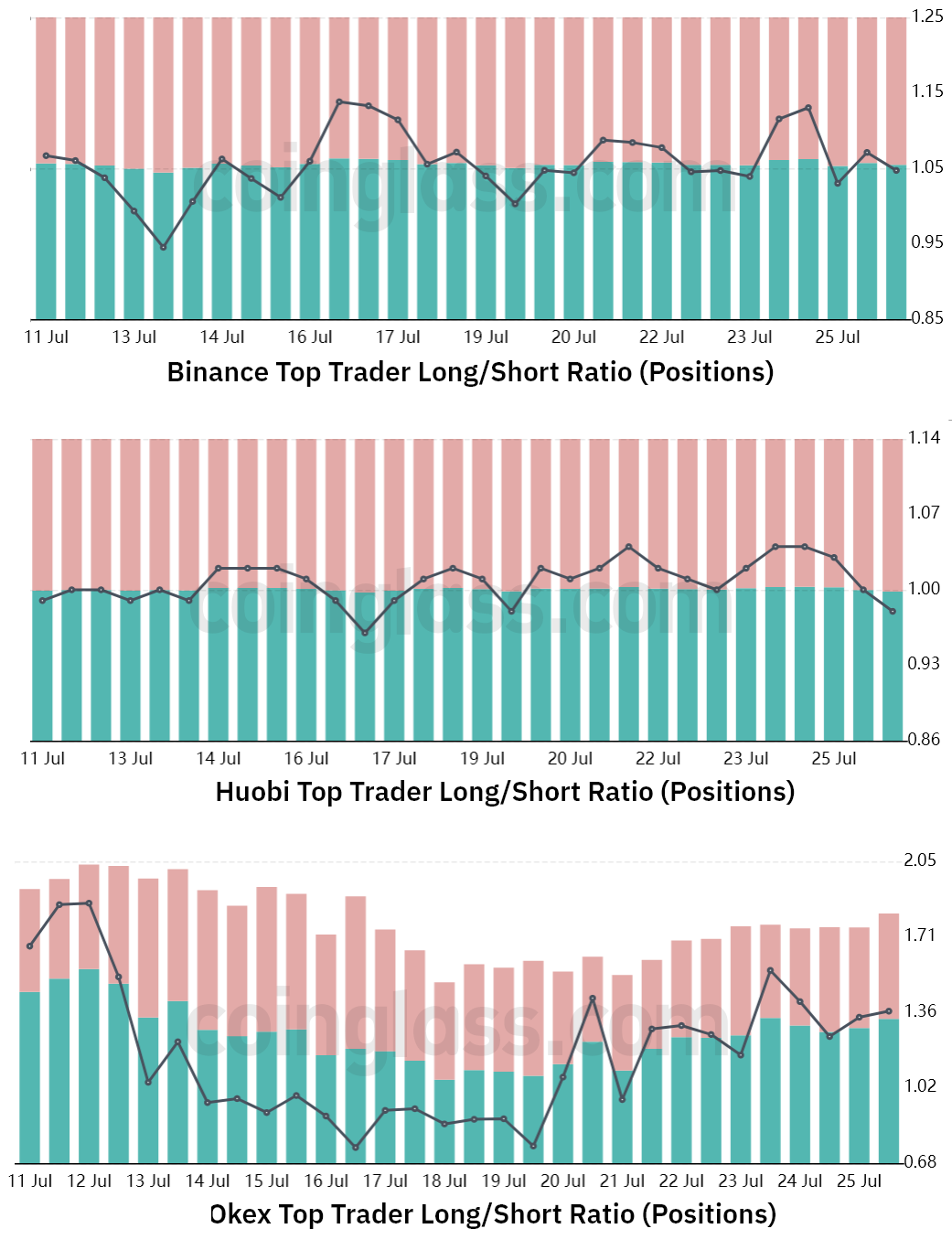

The very best traders’ lengthy-to-short internet ratio excludes externalities that may have exclusively impacted the choices markets. This metric gathers data from exchange clients’ positions around the place, perpetual and quarterly futures contracts, thus better informing about how professional traders are situated.

You will find periodic methodological discrepancies between different exchanges, so readers should monitor changes rather of absolute figures.

Despite the fact that Ether has unsuccessful to interrupt the $1,600 resistance, professional traders didn’t reduce their leverage lengthy positions between This summer 19 and 26, based on the lengthy-to-short indicator.

Binance traders lengthy-to-short ratio unsuccessful to carry the fir.13 mark but finished the time in the same level it began, near 1.05. Huobi displayed a modest reduction in its lengthy-to-short ratio, because the indicator moved from 1.02 to the present .98 in 7 days.

However, in the OKX exchange, the metric drastically elevated inside the period, from .88 on This summer 19 to the current 1.37. Thus, typically, traders elevated their bullish positions in 7 days.

There has not been a substantial alternation in whales and market makers’ leverage positions despite Ether’s 11.5% correction since This summer 19. In addition, options traders are prices similar risks for Ether’s upside and downside moves, while leverage futures players slightly elevated their bullish bets. The general derivatives metrics studying is positive despite the fact that ETH unsuccessful to interrupt the $1,600 resistance.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.