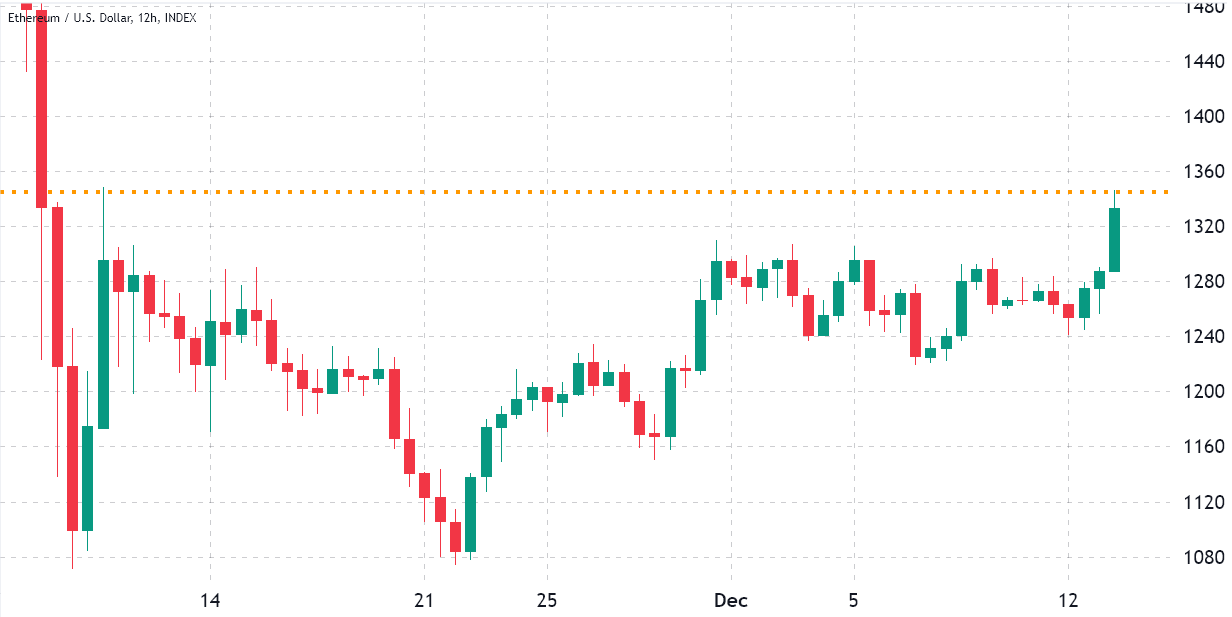

Ether (ETH) rallied 6.3% to $1,350 on 12 ,. 13, mimicking an identical unsuccessful attempt that required put on November. 10. Despite reaching the greatest level in 33 days, increases weren’t enough to instill confidence in traders based on two key derivatives metrics.

Bulls’ frustrations can partly be described by Binance facing an almost-record $1.1 billion in withdrawals more than a 24-hour period. The bizarre behavior may come as the exchange tries to released multiple disputes about its evidence of reserves and overall solvency on crypto Twitter. Based on Binance Chief executive officer Changpeng Zhao, the social networking posts add up to simply FUD.

However, Binance’s USD Gold coin (USDC) reserves were emptied after alleged troubles with commercial banking hrs.

The negative newsflow ongoing on 12 ,. 13, because the U . s . States Registration (SEC) filed charges against Mike Bankman-Fried, the previous Chief executive officer of now-bankrupt FTX crypto exchange. The new charges come only a next day of his arrest by Bahamian government bodies in the request from the U.S. government.

On 12 ,. 13, the U . s . States Commodity Futures Buying and selling Commission (CFTC) also filed a suit against Bankman-Fried, FTX and Alameda Research, claiming violations from the Commodity Exchange Act. It required a jury trial.

Traders are relieved that Ether is buying and selling over the $1,300 level, however the rebound continues to be mostly driven through the Consumer Cost Index print for November at 7.1% year-on-year, that was a little bit bit softer than expected. More to the point, the U.S. Fed is scheduled to select the most recent rate of interest hike on 12 ,. 14, with analysts expecting the interest rate of rate hikes to say no since inflation seems to possess peaked.

Consequently, investors think that Ether could retrace its recent gains if comments Fed Chair Jerome Powell have a hawkish position, a place highlighted by trader CryptoAceBTC:

Liquidity is lower in market

And retracing rapidly is just way to usher in consumersI believe Given meet is going to be Hawkish and cost will retrace this CPI pump

Bitcoin $18k $18.5k resistance

ETH $1350-$1400

Will watch for Given meet to load shorts— Cryptoce (@CryptoAceBTC) December 13, 2022

Let us take a look at Ether derivatives data to know when the surprise pump positively impacted investors’ sentiment.

The rally to $1,300 were built with a limited effect on confidence

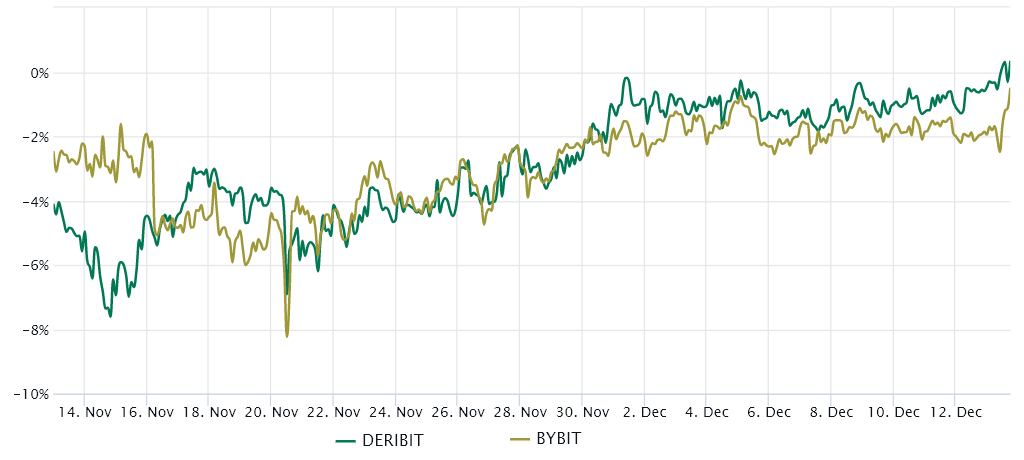

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Bu professional traders prefer these instruments simply because they avoid the fluctuation of funding rates inside a perpetual futures contract.

The 2-month futures annualized premium should trade between +4% to +8% in healthy markets to pay for costs and connected risks. Once the futures trade for a cheap price versus regular place markets, it shows too little confidence from leverage buyers, that is a bearish indicator.

The chart above implies that derivatives traders stay in “fear mode” since the Ether futures fees are below %, indicating the lack of leverage buyers’ demand. Still, such data doesn’t signal traders expect further adverse cost action.

Because of this, traders should evaluate Ether’s options markets to know whether investors are prices greater likelihood of surprise negative cost movements.

Options traders were near turning neutral

The 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 10%. However, bullish markets have a tendency to drive the skew indicator below -10%, meaning the bearish put choices are discounted.

Related: Binance internet withdrawals capped $3.6B during the last seven days — Report

The delta skew improved significantly between 12 ,. 7 and 12 ,. 11, declining from the fearful 16% to some neutral balanced-risk options prices at 9.5%. The movement signaled that options traders were at ease with downside risks. However, the problem altered on 12 ,. 13 after Ether unsuccessful to interrupt the $1,350 resistance.

Because the 60-day delta skew is 14%, whales and market makers are unwilling to offer downside protection, which appears odd thinking about that ETH is buying and selling at its greatest level in 32 days. Both options and futures markets indicate pro traders fearing the $1,300 resistance won’t hold in front of the Given meeting.

Presently, the chances favor Ether bears since the FTX exchange personal bankruptcy elevated the potential of stricter regulation and introduced discomfort to cryptocurrency investors.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.