Ethereum’s Merge on Sep. 15 switched out to become a sell-the-news event, which looks set to carry on.

Particularly, Ether (ETH) dropped significantly from the U.S. dollar and Bitcoin (BTC) following the Merge. As of Sep. 22, ETH/USD and ETH/BTC buying and selling pairs were lower by greater than 20% and 17%, correspondingly, since Ethereum’s change to Proof-of-Stake (PoS.

What’s eating Ether bulls?

Multiple catalysts led to Ether’s declines within the stated period. First, ETH’s cost fall from the dollar made an appearance synchronized concentrating on the same declines elsewhere within the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike.

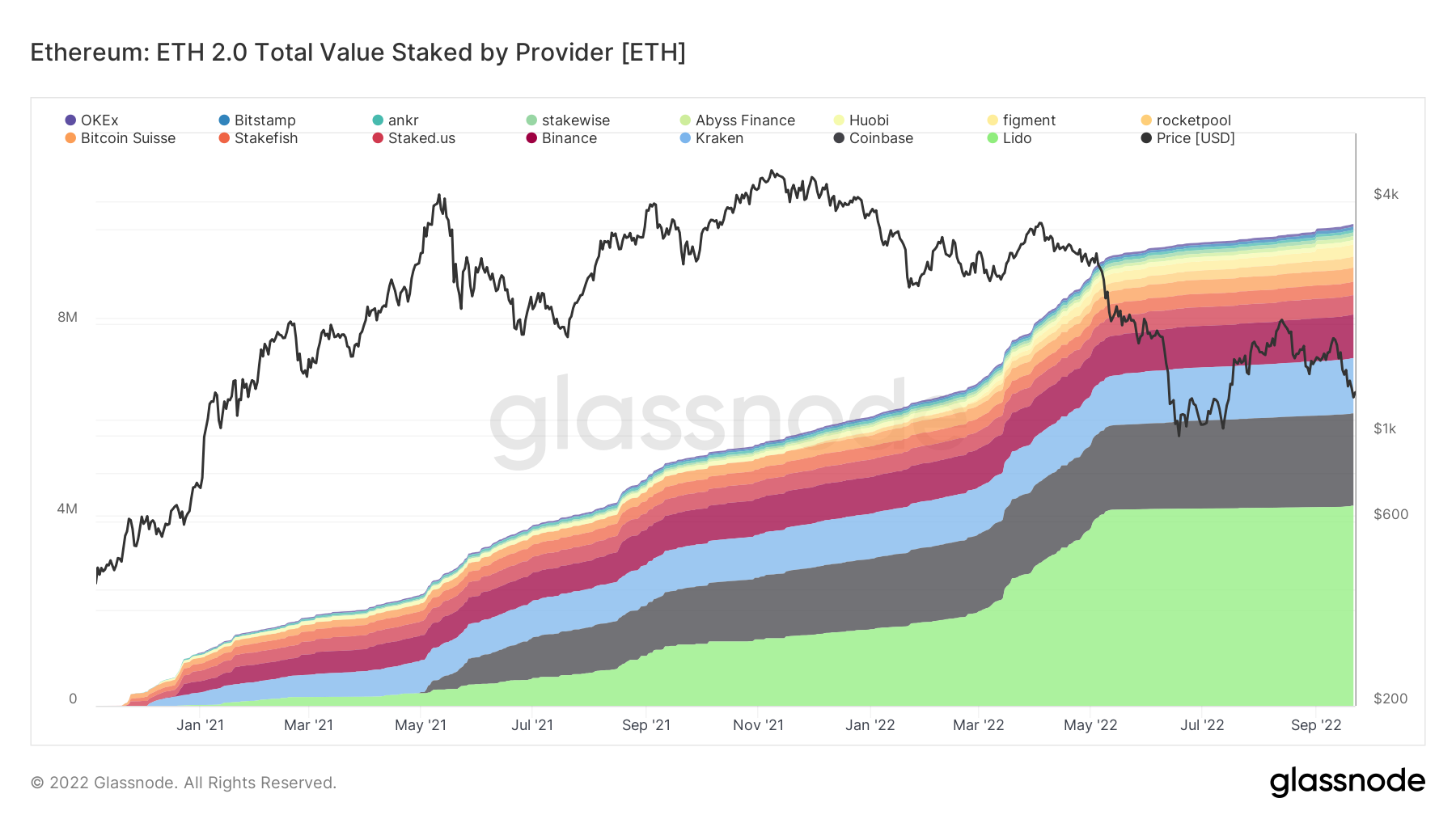

Second, Ethereum faced lots of flak for becoming too centralized publish-Merge.

Only five entities created 60% from the blocks to date. The greatest share is associated with Lido DAO, an Ethereum staking service, which has 4.19 million ETH deposited, or higher 30% of the quantity staked into Ethereum’s official PoS smart contract.

Third, institutional investors, or “smart money,” also reduced contact with the Ethereum-focused investment vehicles within the day prior to after the Merge.

Ethereum funds observed $15.4 million price of capital outflows using their coffers within the week ending Sep. 16, based on CoinShares’ weekly report. In comparison, Bitcoin-based investment funds attracted $17.4 million within the same week, suggesting capital migration publish-Merge.

Lastly, Ether also felt extreme selling pressure from the proof-of-work (Bang) miners, who offered $40 million price of Ether dads and moms prior to the PoS update.

Independent market analyst Tuur Demeester noted that Ether could continue its decline versus Bitcoin within the future, citing ETH/BTC’s previous response to key occasions within the Ethereum market, as proven below.

The chart shows Ether traders’ practice of pumping ETH against Bitcoin in front of adoption-related narratives, for example nonfungible tokens (NFT) and the Defi craze of 2021, and the ICO boom of 2017.

Many of these rallies fizzled out when the hype subsided. Demeester highlights Ethereum’s change to PoS like a similar hype phase that pressed ETH/BTC greater in 2022, expecting the happy couple to endure an in-depth correction within the coming days.

“I expect ETH/BTC to interrupt lower strongly sooner or later,” he stated, adding:

“ETH is really a ticking time explosive device.”

ETH/BTC technicals hint at 10% drop ahead

Placing these fundamentals against Ether’s technicals versus Bitcoin presents a likewise bearish setup.

Related: Jerome Powell is prolonging our economic agony

Around the three-day chart, ETH/BTC has came by nearly 25% after topping out at .085 BTC, an amount that coincides using its lengthy-serving level of resistance of .081 BTC.

Now,the happy couple eyes yet another drop toward its multi-month climbing trendline support, as highlighted below.

The trendline support falls synchronized with .06 BTC, an amount which has offered like a pullback focus 2022. Quite simply, another 10% decline is up for grabs.

ETH/USD’s bearish setup is worse

From the dollar, Ether could decline up to 45% because of what seems to become an climbing triangular pattern inside a downtrend.

Usually, the bearish continuation pattern resolves following the cost breaks below its lower trendline after which falls up to its maximum height. Therefore, the bearish target sits near $700 through the finish of the year, lower 45% from today’s cost.

On the other hand, a pullback in the triangle’s lower trendline might have Ether rise toward top of the trendline, meaning a rally toward $1,775, or perhaps a 35% profit from current cost levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.