Ethereum’s token Ether (ETH) might be entering a “bull trap” zone after rebounding back over the $1,000 mark from 18-month lows of $885.

Ether cost paints a “rising wedge”

The very first of these indicators is a “rising wedge,” a vintage bearish reversal setup that forms following the cost trends upward in the range based on two climbing but converging trendlines. The wedge setup gains further confirmation when the buying and selling volume drops plus the rising prices.

Theoretically, an increasing wedge resolves following the cost breaks below its lower trendline and eyes a run-lower toward the amount in more detail comparable to the utmost height between your wedge’s lower and upper trendline

Ether continues to be developing an increasing wedge since mid-June, as proven within the chart below.

Hence, its interim bias seems towards the downside, having a decisive breakdown underneath the lower trendline risking a decline toward the $870–$950, based on in which the breakdown begins.

Which means a 15%–25% decline from June 13’s ETH cost.

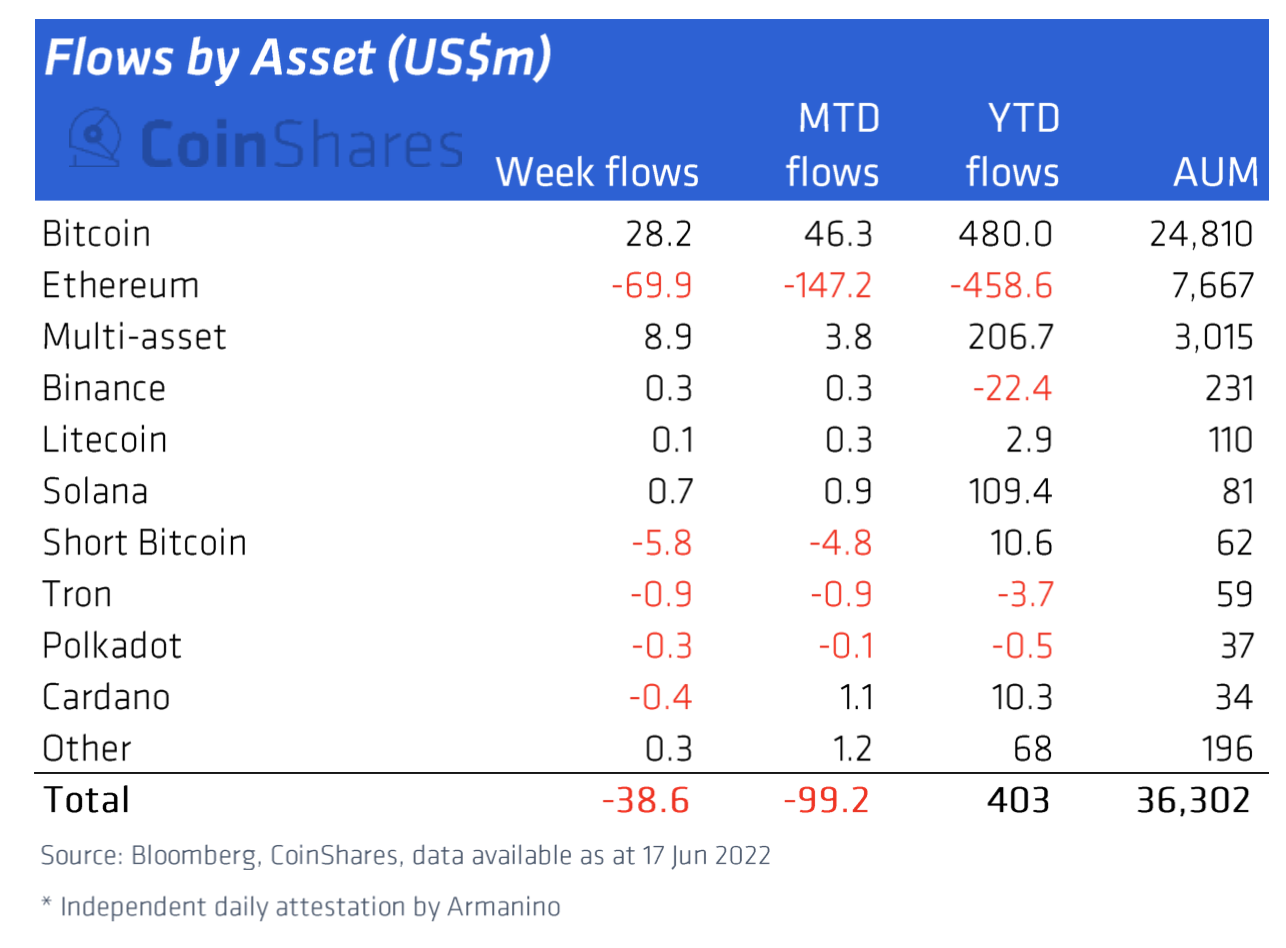

$70M exits Ethereum funds

Ethereum’s bearish situation is based on proof of significant outflows from investment funds.

Particularly, Ether-related investment products observed outflows worth $70 million within the week ending Next Month, according to data fetched by CoinShares.

Particularly, it was the eleventh-straight week of capital withdrawals, getting the entire year-to-date output total to $458.six million.

In comparison, Solana (SOL), certainly one of Ethereum’s top rivals within the smart contracts ecosystem, attracted $109 million in 2022 because of its related funds. While Bitcoin (BTC) saw $480 million flow into its investment products.

Related: DeFi Summer time 3.? Uniswap overtakes Ethereum on charges, DeFi outperforms

CoinShares reported investors’ worries over Ethereum’s “Merge” to proof-of-stake as the main reason behind its funds’ poor performance this season.

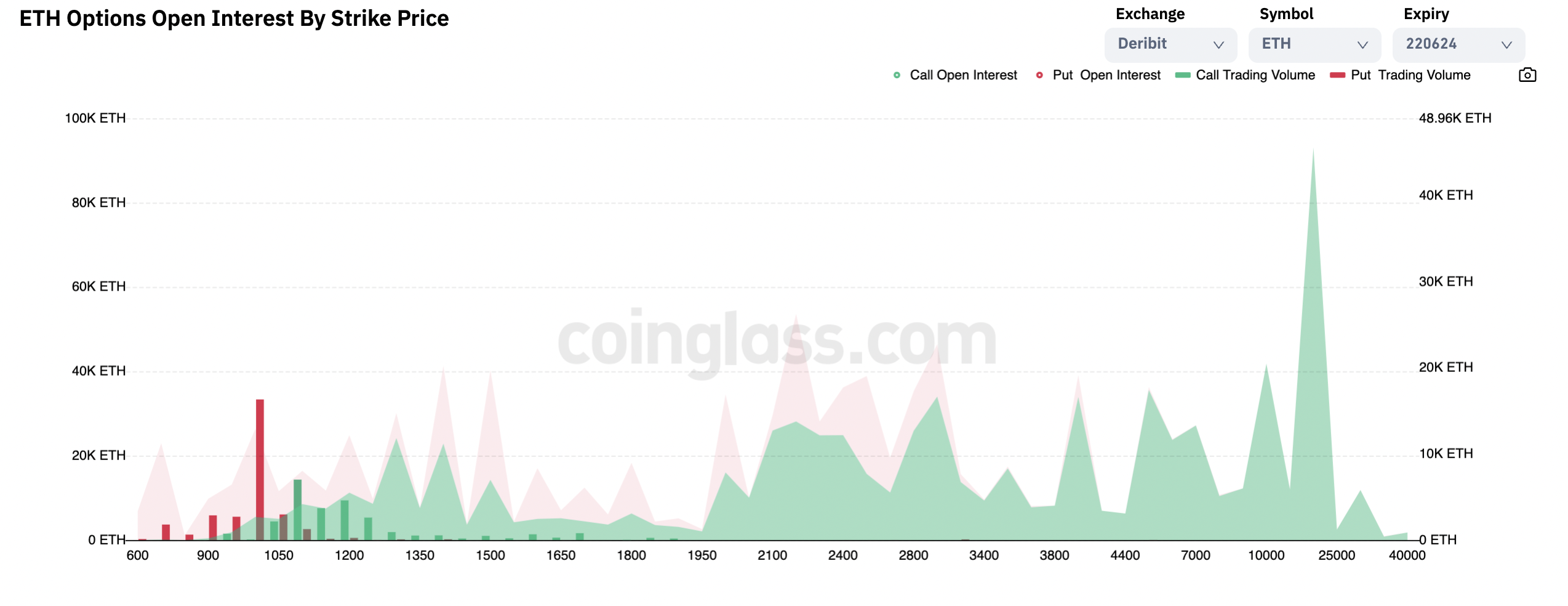

Ethereum options strike cost: $1K

ETH options’ open interest on Deribit shows over $1 billion in notional for Ether, waiting for the expiry on June 24. Interestingly, these Ether choices are major puts round the current cost levels, having a concentration round the $1,000 strike, according to data from Coinglass.

The June 24 expiration may potentially influence Ether’s cost action, mainly since it trades only 10% over the preferred strike cost of $1,000. Furthermore, moving toward $1,000 might trigger the increasing wedge setup.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.