The Optimism Foundation has unveiled a brand new governance structure and token included in its ongoing efforts to create scalability and price efficiency to Ethereum (ETH), the world’s largest smart contract platform.

The “Optimism Collective” was introduced Tuesday mid-day inside a extended publish that outlined its mission and governance mandate. Referred to as a “large-scale experiment in digital democratic governance,” the Optimism Collective basically comprises a gang of communities and stakeholders dedicated to improving Ethereum’s technical abilities.

Based on the details, the Optimism Collective is going to be controlled by two components: the Citizens’ House and also the Token House. The Citizens’ House will “facilitate and govern a procedure to distribute retroactive public goods funding” via revenues collected through the network. The Token House, which is established through forthcoming airdrops, is given the job of voting on protocol upgrades and project incentives.

The Token House, to become operated by OP, Optimism’s new governance token, will result in overseeing protocol and network parameters in addition to creating incentives for users to go in the ecosystem.

Ethereum is prepared because of its next chapter.

We will be ready to scale not just Ethereum (the network), but the values that thrust it to the global stage to begin with.

The Optimism Collective is here now to rebuild the incentives from the internet

— Optimism (✨_✨) (@optimismPBC) April 26, 2022

The Optimism Foundation stated in the publish the blockchain community’s “calls for scalability are deafening,” talking about the growing interest in fast and efficient smart contract functionalities. Even though this demand has been clarified by several layer-1 competitors, all of them succumb to centralization flaws while abandoning “Ethereum’s security and values,” the building blocks stated, adding:

“Scaling we’ve got the technology alone isn’t enough. There exists a duty to scale our values together with our systems.”

Related: ‘People should invest in any major layer-1s,’ states an experienced trader

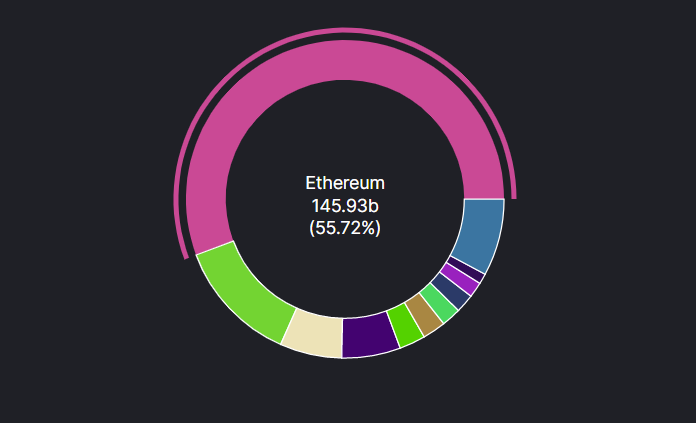

While Ethereum is constantly on the dominate the developer scene, its competition is growing in a faster clip, based on a The month of january report by crypto research firm Electric Capital. The report discovered that developer activity keeps growing for projects for example Polkadot (Us dot), Solana (SOL) and BNB Smart Chain (BNB), which may potentially eat away at Ethereum’s dominance. Meanwhile, Ethereum’s share from the decentralized finance (DeFi) market, as measured by total value locked, has additionally declined significantly in the last 12 several weeks, based on DeFi Llama.

As Cointelegraph reported, progress toward Ethereum’s proof-of-stake upgrade is going ahead, though delays have pressed the implementation timeline by a number of several weeks. On April 11, Ethereum developers implemented the network’s first-ever “shadow fork” to worry test their assumptions all around the approaching merge.