Ethereum’s native token Ether (ETH) rose by greater than 5% to achieve its intraday high above $1,930 on May 30. Nevertheless, the ETH/USD pair risks facing another sell-off round because of concerns in regards to a massive ETH inflow into an exchange.

58.7K Ether used in FTX in May

On May 30, the Ether address allegedly connected with Three Arrow Capital — a Singapore-based crypto hedge fund, sent 32,000 ETH worth $60 million towards the FTX crypto exchange inside a length of an hour or so, on-chain data shows.

The majority transfer, which follows the fund’s 26,700 ETH deposit towards the same exchange earlier in May, elevated accusations it would dump the Ether stash. That’s mainly because, theoretically, investors transfer crypto for their exchange wallets only if they would like to sell them for other assets.

dump eeth? https://t.co/7xdI80P8rZ

— Tim Copeland (@Timccopeland) May 30, 2022

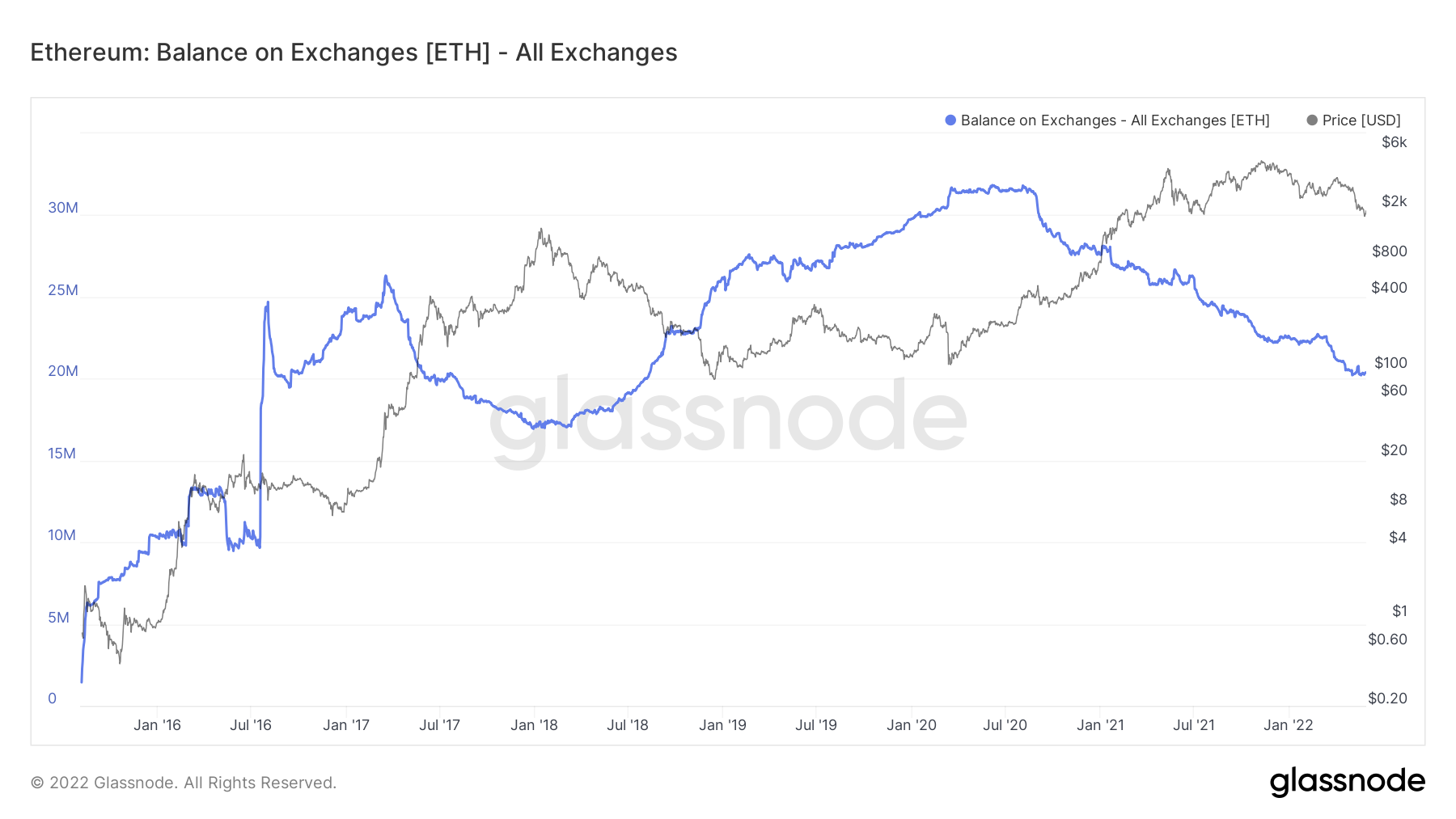

Nevertheless, the amount of Ether held by exchanges ongoing to decrease in May, based on on-chain data tracked by Glassnode.

The ETH balance across all of the crypto exchanges dropped from 20.45 million to twenty.38 million month-to-date (MTD), underscoring that investors are holding their investments for that lengthy term.

ETH rebound weakens

Three Arrow’s massive Ether transfer to FTX coincides with ETH testing a vital support-switched-level of resistance near $1,920 for any breakout, as proven below.

Concurrently, Ether’s relative strength index is near its “overbought” threshold of 70, which usually of technical analysis has a tendency to precede a sell-off. Quite simply, ETH could consolidate around $1,920 within the future before pulling to its rising trendline support near $1,850.

Related: ‘Mega bullish signal’ or ‘real breakdown?’ 5 items to know in Bitcoin now

On the other hand, a decisive move over the $1,920-level, supported by a boost in buying and selling volumes, might trigger a lengthy-term upside setup shared by “Wolf,” a pseudonymous market analyst, as proven below.

The setup showcases the amount around $1,820 as support inside a so-known as accumulation range, with $4,000 becoming resistance alternatively finish. Wolf noted the cost could rally toward $4,000 “a couple of several weeks in the Merge,” a very-anticipated upgrade that will make Ethereum an evidence-of-stake protocol.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.