Ethereum’s native token Ether (ETH) slumped on June 16, suggesting that it is relief rally coinciding using the Fed announcing it will hike the benchmark rate by .75%, reaches risk.

Ether bulls trapped?

Ether’s cost tucked by 9.2% close to $1,120 per token each day after it rebounded by 23% after shedding to just about $1,000, its worst level since The month of january 2021.

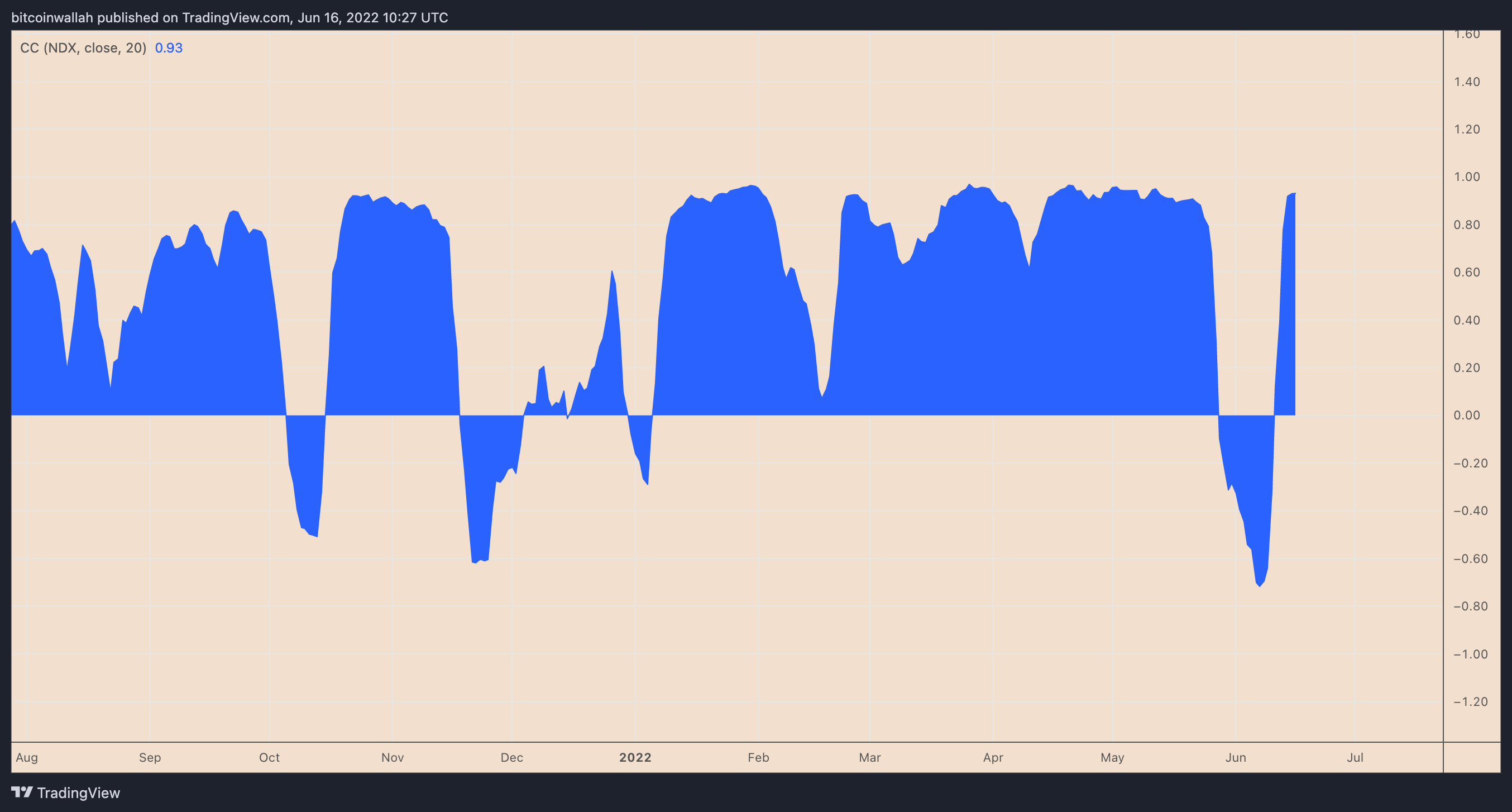

The ETH/USD pair’s upside move, adopted with a sharp correction, made an appearance together with U.S. stocks, confirming it traded just like a risk-asset.

The decline implies that Ether has shed 77% of their value since November 2021 and it is now buying and selling below its “recognized cost” of $1,740, data from Glassnode shows.

Additionally, a greater rate of interest atmosphere adds more selling pressure, with investors departing high-risk trades and looking safety in traditional hedging assets, for example cash.

Investors’ belief in cryptocurrencies has additionally eroded following a collapse of Terra, a $40 billion algorithmic stablecoin project, and lending platform Celsius Network’s decision to prevent withdrawals.

Atop that, Three Arrow Capital, a crypto hedge fund that oversaw nearly $10 billion in May 2022, apparently faces insolvency risks. Fears about systemic risks have further limited the crypto market’s recovery bias, hurting Ether.

ALERT: 3AC $250 Million $ETH Position Is Going To Be Liquidated at ≈1000

— Market Meditations (@MrktMeditations) June 15, 2022

Theoretically speaking, Ether’s recent gains seem like a bear market rally, that could be because of investors covering their short trades.

At length, investors close their short positions by purchasing the actual asset back around the market—typically in a cost lesser compared to one during the time of borrowing—and coming back these to the loan provider. That prompts the focal point in rally between large downside moves, but it doesn’t signify a bullish reversal.

Related: Bitcoin may be the ‘Amazon of crypto’ and anything else are bets, states Blocktower founder

These minor rallies might be a bull trap for investors that mistakenly begin to see the rebound like a manifestation of bottoming out.

However, experienced bears make use of the pump to spread out new short positions in the local cost top, understanding that nothing has essentially altered concerning the market.

ETH “bear pennant” shows more losses ahead

Ether’s “bear pennant” on shorter-time-frame charts will also support a bull trap scenario.

Bear pennants are bearish continuation patterns that form because the cost consolidates in the triangular-formed structure following a strong downside move.

Usually of technical analysis, traders measure a bear pennant’s profit target by subtracting the breakdow point in the height from the previous decline (known as “flagpole”), as proven below.

Thi puts the following bear target for ETH cost at $850, lower almost 25% from today’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.