Ethereum 2. is a long awaited rise in the crypto industry. A current Cointelegraph research report asks if Ethereum continues to be on the right track to protect its crown because the prime network backing the decentralized finance world.

The report slices popular misconceptions investors may hold while offering a comparative analysis of Ethereum and it is competitors. Meanwhile, the Ethereum foundation rebranded the Eth2 project at the beginning of this season. Could it be attempting to manage expectations or educate?

New talk of consensus and execution layers

Inside a blog publish in The month of january, the Ethereum foundation mentioned that developers have been leaving the Eth1-Eth2 terminology since late 2021. Rather, Eth1 will be known as the “execution layer” and Eth2 the “consensus layer.” This isn’t a small twist toward more technical language. It’s an attempt for expectation management because of common misconceptions.

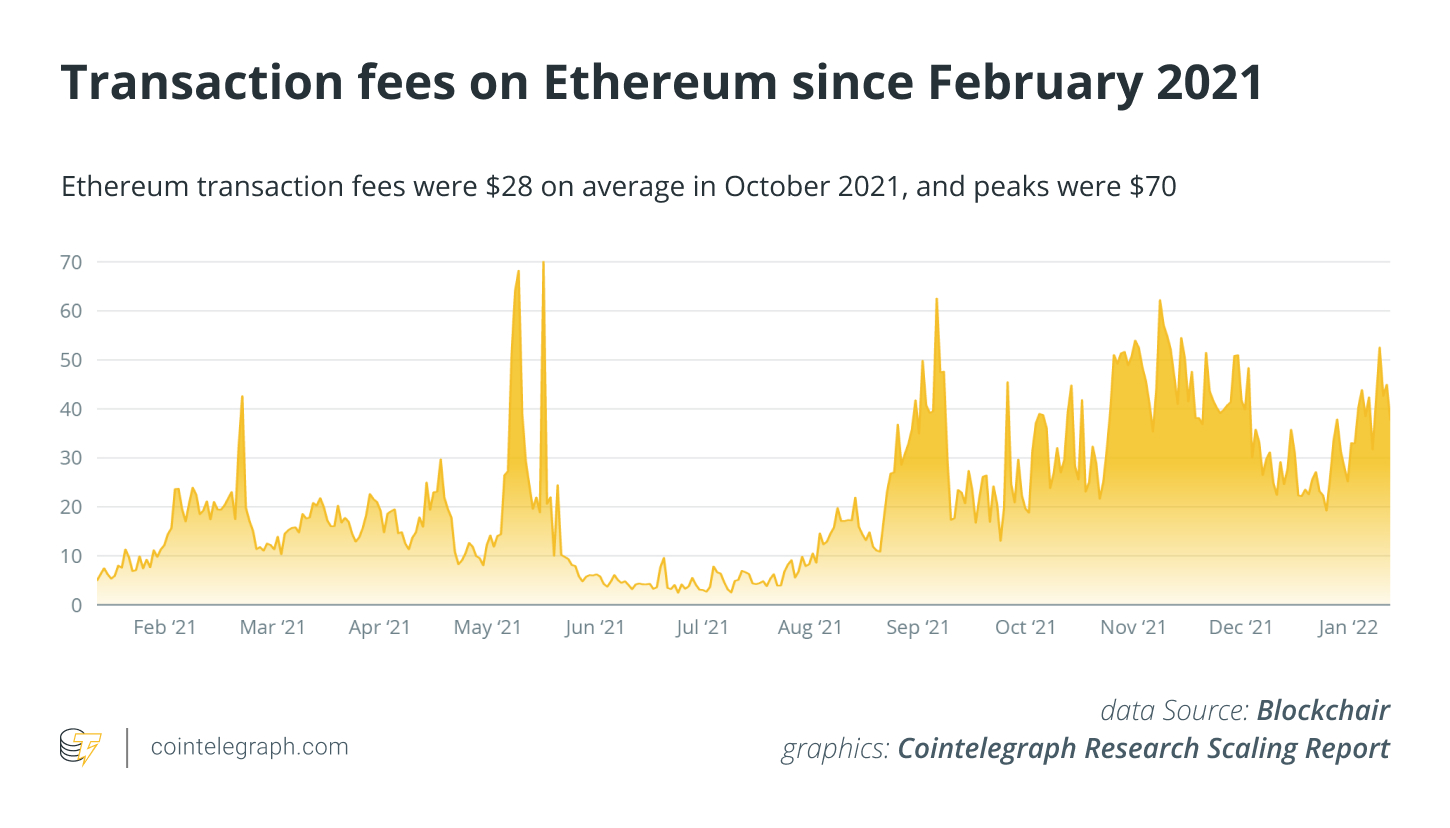

For individuals only superficially acquainted with Ethereum, the name Eth2 might suggest you will see just one large update that magically fixes the issues and notoriously high gas charges by switching from your energy-intensive proof-of-work (Bang) consensus mechanism to proof-of-stake (PoS). However, this can be a harmful oversimplification.

The disposable scaling report printed by Cointelegraph Research supplies a seem summary of Eth2. It provides more information around the planned technical updates and just what they mean for Ethereum’s developers, competitors, and investors. The report is liberated to access around the Cointelegraph Report Terminal.

Download the entire report here, filled with charts and infographics.

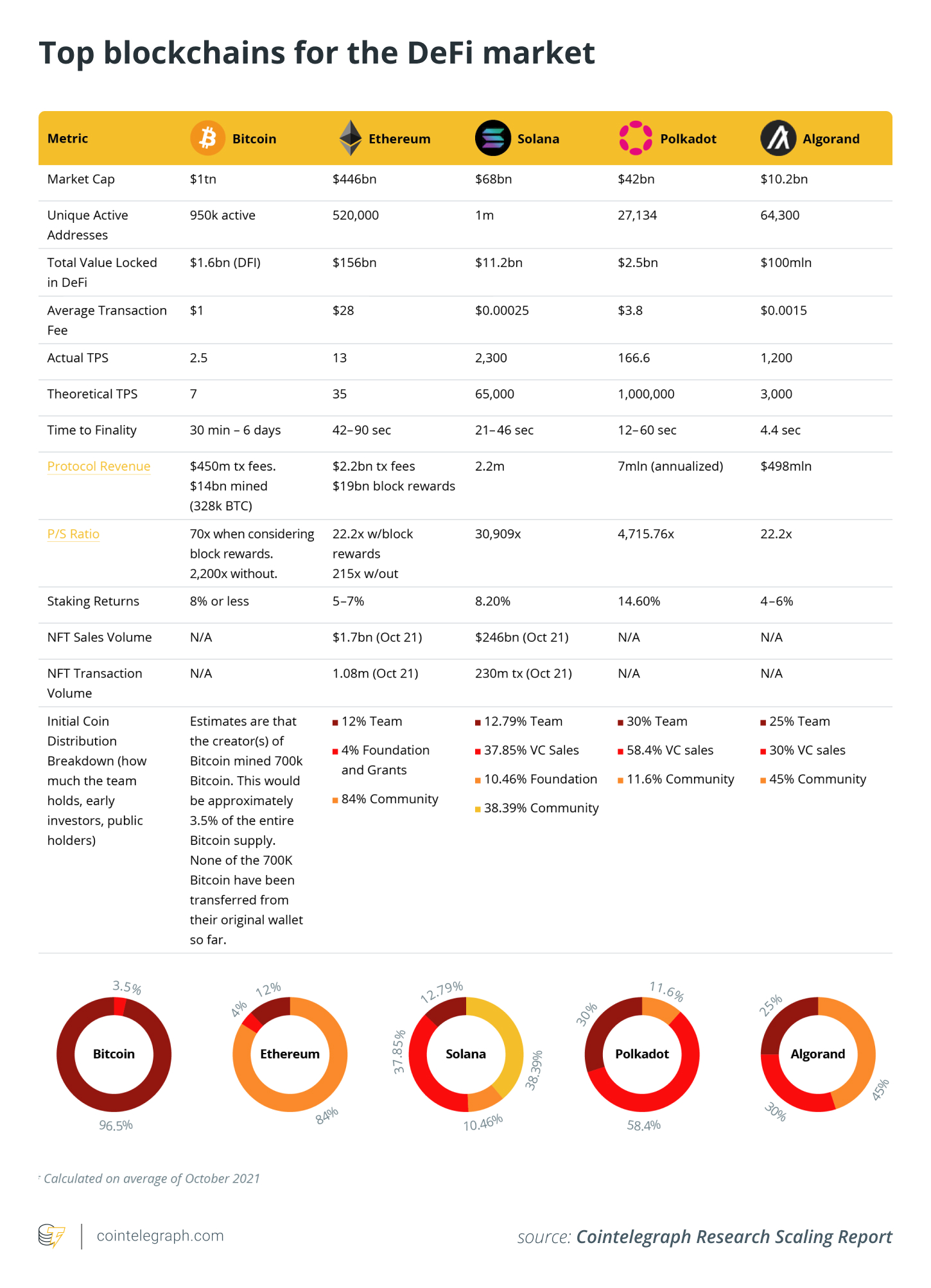

The complexness and chance of moving a multi-big blockchain project in one consensus mechanism to a different means the roll-from Eth2 continues to be slower than expected and also the Ethereum foundation initially gave no definite timeline. Meanwhile, up-and-coming competitors with scalable projects happen to be vying to remove share of the market from Ethereum.

The report also assesses these challenges at length. On 74 pages, it provides a comparative research into the major players for example Solana, Polkadot, Algorand and Radix which are attempting to snatch the very best place in DeFi. Curated by our industry-leading group of researchers, it possesses a balanced look at the large picture and seems to cut with the noise of social networking and also the daily press.

Eth2 — Understanding a nuanced reality

The switch from Eth1 to Eth2 is much better regarded as a carefully engineered number of upgrades which will gradually transition the blockchain to the envisioned future. Eth2’s primary chain, the PoS Beacon chain, had been launched in December 2020. The merging of Eth1 using the Beacon chain is anticipated in Q2 or Q3 of 2022.

Although to some casual observer this may imply that all Ethereum’s problems is going to be solved, the update later this season isn’t likely to possess a big effect on gas charges or even the capacity from the network. While PoS will considerably lessen the energy use of Ethereum, improved scalability is only going to come once data sharding is introduced in 2023. Sharding was going to take place prior to the merge but continues to be delayed underneath the new timeline. The state rationale with this is the fact that scalability has become a smaller priority because layer-2 solutions have grown to be available.

The brand new terminology of “consensus layer” and “execution layer” seeks to banish talk of the mythical time when Ethereum’s problems will immediately disappear. Connecting Eth1 using the consensus layer and Eth2 strictly using the execution layer also shifts the main focus in the third so-known as data availability layer that could have been susceptible to the delayed data sharding update.

Using the merge scheduled later on this season, it might be tempting to consider the times of alternative decentralized finance (DeFi) blockchains are numbered. However, it’s important for investors to not jump to conclusions prematurely. As Eth2 won’t be an immediate magic fix, monitoring the competitive landscape remains invaluable.

This information is for information purposes only to represent neither investment recommendations nor a good investment analysis or perhaps an invitation to purchase or sell financial instruments. Particularly, the document doesn’t function as a replacement for individual investment or any other advice.