Ethereum’s native token ETH is once more turning deflationary, as increasing numbers of tokens are burned than brand new ones issued, leading some proponents to suggest to ETH like a future seem money.

The most recent deflationary turn for ETH happened throughout the crypto market crash in the last couple of days, as transaction charges on ETH spiked as traders rushed to transmit tokens back and forth from exchanges. So that as Ethereum users know right now, the network initiated its new token burn mechanism using the EIP-1559 upgrade in August 2021. The upgrade produced a method in which a part of transaction charges are burned, making the issuance of ETH – at occasions – deflationary.

Because of this latest burn mechanism, more tokens are burned as increasing numbers of ETH is transacted with and transaction charges compensated.

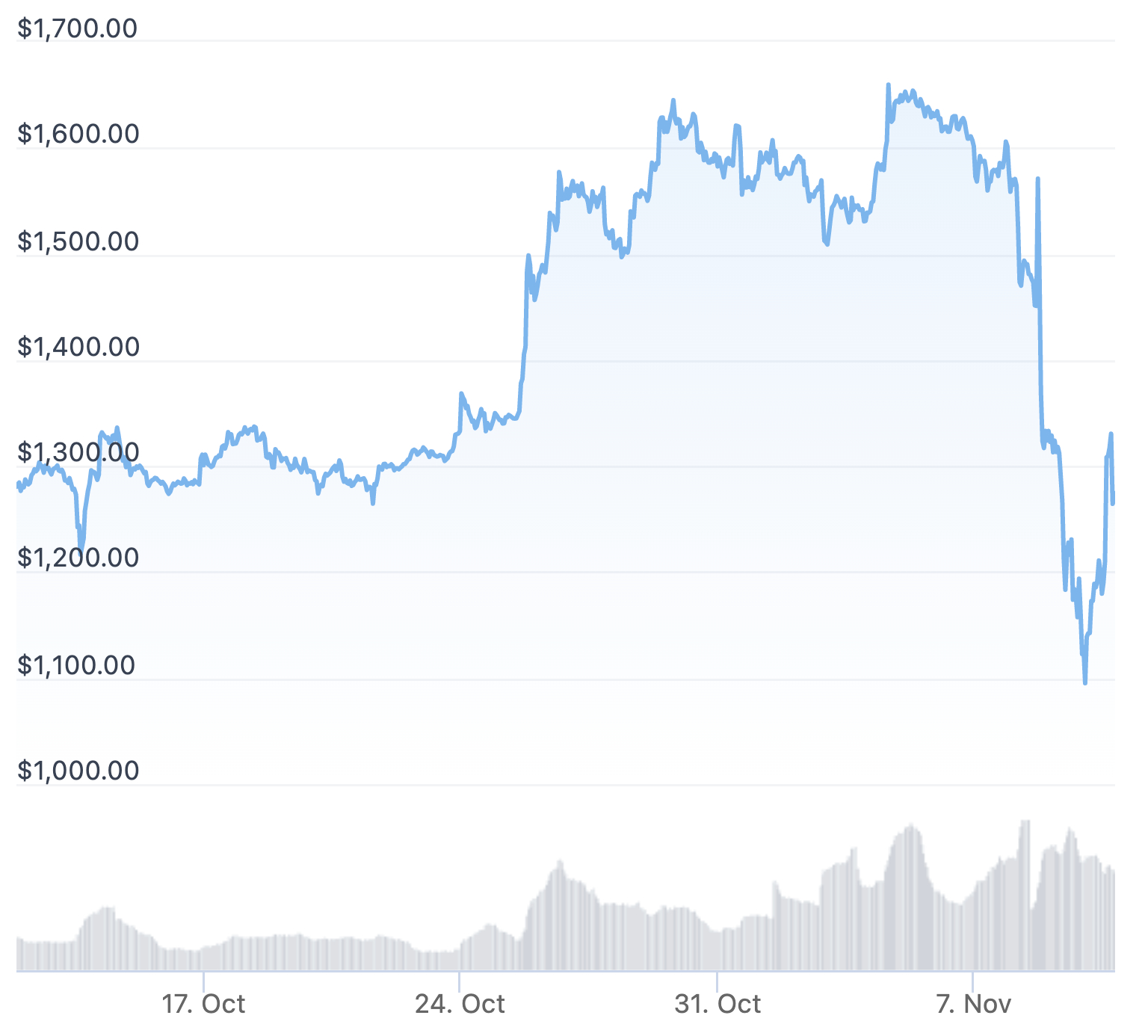

Based on data from ETH tracking website Ultrasound.money, the ETH supply has declined continuously since October 8, and switched negative on November 9. Since that time, the availability has ongoing to fall quicker, reaching a yearly -1% supply growth during the time of writing.

Important to note, however, would be that the decrease in ETH supply originates as prices from the token have nosedived combined with the broader crypto market. In the last seven days, the cost of ETH was lower by greater than 16% in the last seven days, even though it still continued to be almost unchanged when searching in the month overall.

Not really a break through

The thought of ETH as ultra seem money was introduced up as soon as in March of 2021 by Ethereum Foundation investigator Justin Drake within an interview around the Bankless podcast:

However, other medication is of the completely different view, with for example Bitcoin (BTC) proponents frequently quarrelling the foreseeable and unchangeable issuance of BTC is the reason why that seem money, which exactly the same can’t be stated about ETH.

Among individuals who’ve contended for this is actually the early bitcoiner Kyle Torpey, who this past year authored within an op-erectile dysfunction for Cryptonews.com that ETH is way from ultra seem money.

Quite simply, the problem of whether ETH is – or can ever become – ultra seem cash is still up for debate, and can most likely remain so for that near future.