The amount of Ethereum addresses holding a non-zero balance hit a brand new record at the top of Monday of 92.5 million. 2022’s bear market, which culminated within the collapse of among the world’s former largest cryptocurrency exchanges in November, doesn’t have the symptoms of impacted development in the amount of non-zero balance addresses.

Some analysts view the amount of Ethereum addresses holding a non-zero balance like a proxy for that second-largest cryptocurrency by market capitalization’s broader “adoption”. Viewed using that lense, the ongoing, apparently unstoppable rise of the amount of non-zero balance Ethereum addresses could be construed like a lengthy-term bullish sign for that ETH cryptocurrency.

100 Million Non-zero Address Wallets in Q2?

During the last 3 years, Ethereum has added about 20 million addresses holding a non-zero balance each year. Back from the fag box calculation thus signifies that, with simply around 7.5 million to visit, the 100 million address mark will most likely get hit between Q2 2023.

This can unquestionably be big news. Cryptocurrency financial markets are notoriously unpredictable with regards to answering market narratives. Traders should not be too surprised to determine ETH obtain a increase in the run-up/immediate aftermath from the 100 million non-zero address mark getting hit among all of the hype and positive press the accomplishment will probably attract.

Other Metrics Also Signal Ongoing Strong Network Growth

Development in the amount of non-zero balance Ethereum is observed by a few being an excessively crude metric – each new non-zero address doesn’t always mean a brand new Ethereum user. Fortunately for that Ethereum bulls, there’s a lengthy listing of other metrics which indicate strong ongoing network growth.

A lately released report from blockchain software development company Alchemy, the amount of smart contracts deployed around the Ethereum mainnet increased an astounding near 300% in 2022. This means that smart contract deployment growth roughly matched its rate of increase observed in 2021, despite 2022’s bear market. There have been 4.six million smart contracts deployed around the Ethereum blockchain in the finish of Q4 2022, the report noted.

“The Web3 developer community is showing to become very resilient,” commented Jason Shah, Alchemy’s mind of growth. “This report implies that they are as focused and motivated as always to construct the way forward for this ecosystem—while honestly acknowledging the unwanted setbacks we view in 2022,” he added.

Elsewhere, the amount of Ethereum network validators lately surpassed 500,000. It surpassed 400,000 only as lately as last This summer. A network validator is really a computer that runs software that verifies and validates transactions around the blockchain. A greater quantity of validators is viewed as an indication of network strength, because it implies it might be harder for any malicious number of validators to achieve charge of the network and corrupt the blockchain.

Ethereum Deflation Another Narrative to achieve Ground in 2023

The bear market in cryptocurrency markets that started just more than a year ago implies that Ethereum’s cost decline (ETH is lower about 67.5% from the record highs printed in November 2021) continues to be the dominant story in recent quarters.

However a key change is made in September 2022 towards the Ethereum protocol that will probably provide the cryptocurrency a significant lengthy-term boost. Last September, Ethereum transitioned by using an evidence-of-work consensus mechanism to presenting balance less energy-intensive proof-of-stake consensus mechanism.

Besides that reduce concerns concerning the cryptocurrency’s ecological impact, that might help it to attract institutional capital flows in in the future where Ethereum’s a lot more energy-intensive rival Bitcoin might struggle, but Ethereum’s inflation rate has additionally dropped dramatically.

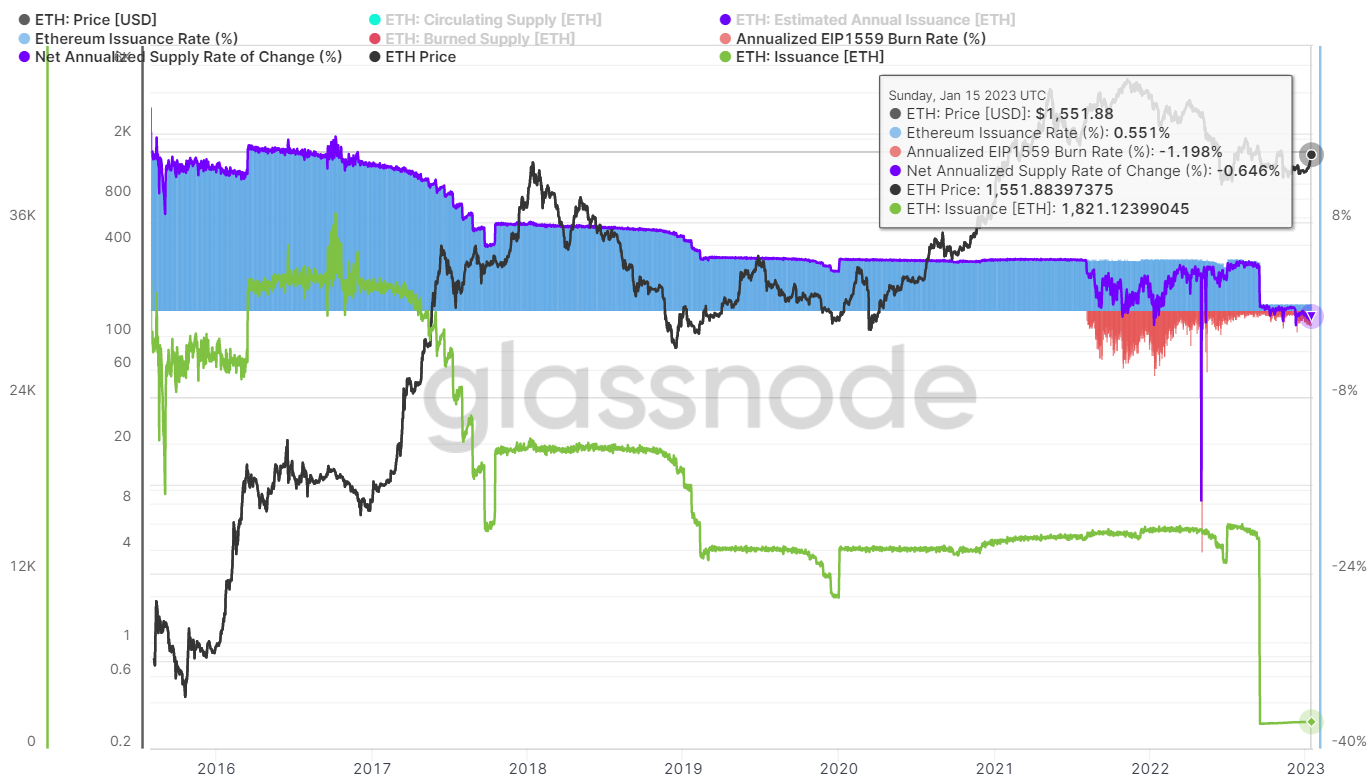

Indeed, by Sunday the 15th of The month of january, Ethereum’s annual issuance rate was around .55%, while its burn rate only agreed to be under 1.2%. Consequently, Ethereum is presently experiencing deflation for a price close to .65% each year. When Ethereum was still being an evidence-of-work blockchain, its inflation rate was 4-5%.

Some analysts have posited the deflationary impact from the Merge might have been what helped prevent ETH from falling back under $1,000 and hitting fresh annual lows within the immediate aftermath from the FTX collapse. For contrast, Bitcoin did hit fresh annual lows in wake from the FTX debacle.

Ethereum will quickly undergo its next major upgrade. The “Shanghai” hard-fork is anticipated in March and can allow staked ETH to become withdrawn the very first time, a big change that is touted to become a big positive for that protocol because it will probably encourage more investors to stake their ETH.