Ether (ETH) cost is lower on 12 ,. 16 and also the pre-FOMC rally to $1,350 was obliterated after Fed chair Jerome Powell issued hawkish statements carrying out a .50% hike in rates of interest.

The Ether sell-off follows an industry-wide decline which has sent Ethereum network charges plummeting by 39.90% previously 30-days.

The entire value kept in Ethereum-based smart contracts also decreased by decentralized finance by 4.49% in 24-hrs.

Following a FTX exchange scandal, regulators are trying to fast-track new rules around the cryptocurrency sector.

Although some analysts believe Ethereum still offers multiple bullish catalysts that warrant purchasing the asset, on-chain data paints a harsh picture of their short-term cost prospects.

Listed here are three good reasons why Ether cost is lower today.

Ethereum turns inflationary as total revenue falls

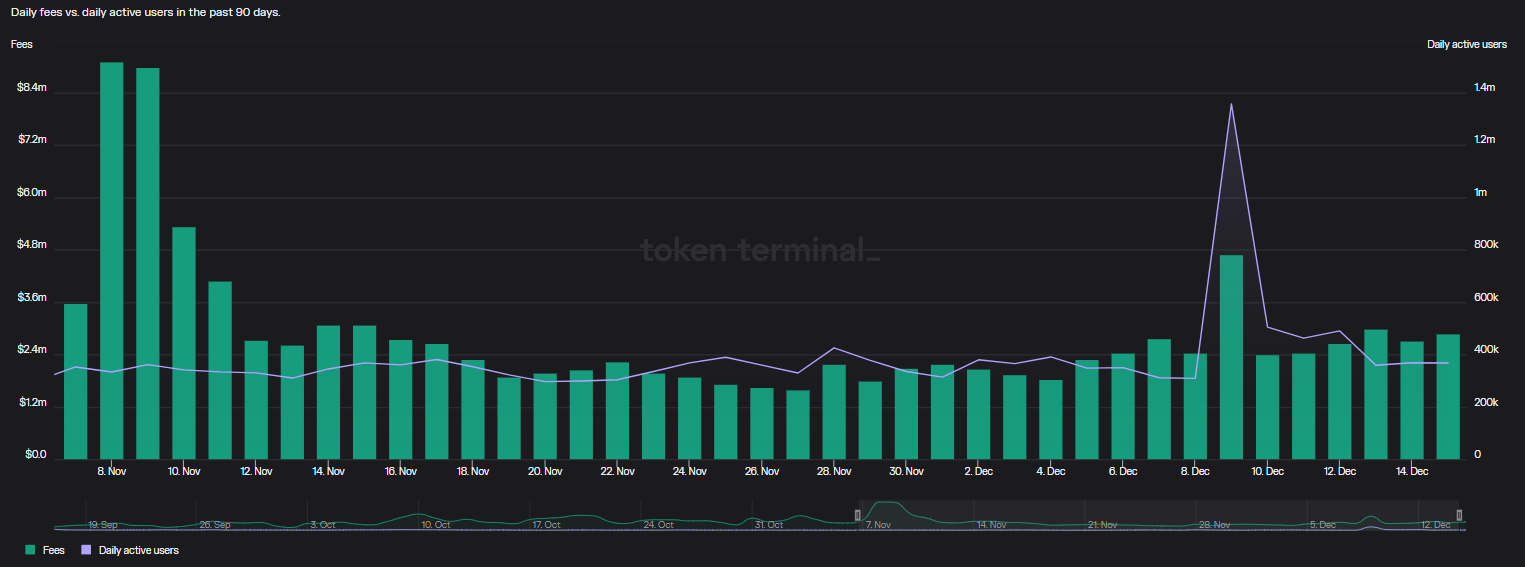

Ether cost fell as daily charges around the Ethereum network plummeted to $2.9 million, lower from pre-FTX amounts of $12.8 million on June 13. Additionally towards the decreasing charges, the network registered lower daily active users (DAUs) from the This summer 26 peak at 961,196 users to simply 367,000 DAUs on 12 ,. 16.

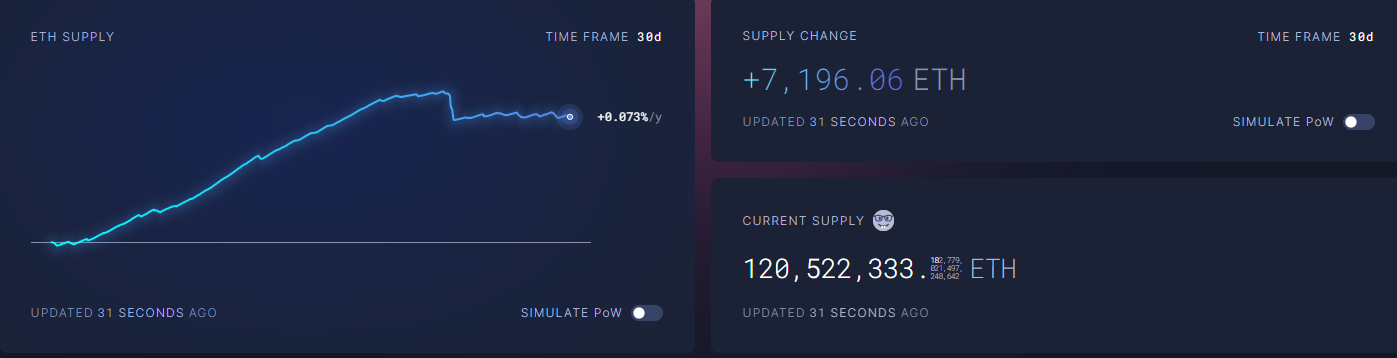

Publish-Ethereum merge tokenomics specified for to assist Ether become deflationary. However, with gas charges declining and reduced DAUs, Ethereum has switched inflationary by .073% previously 30-days and added over 7,100 Ether. Based on ultra seem money, because the merge, Ethereum’s network is inflationary by over 1,192 Ether.

A loss of DeFi use aligns with Ether’s cost action

The entire value locked metric is a very common method to check out the health insurance and sentiment of the Evidence of stake (PoS) blockchain like Ethereum. Ethereum’s TVL arrived at an annual high at $83.9 billion on March 31, consider that time, it’s shed nearly $60 billion. By 12 ,. 15, the network’s TVL is $23.46 billion.

The very best 10 Ethereum protocols by market cap faced headwinds, with all of visiting a stop by TVL and charges more than a 7-day period. Particularly, MakerDao and Uniswap (UNI) saw 5.82% and three.49% particular declines in TVL.

Regulatory pressure is constantly on the weigh on investor confidence

On August 9, the Purchase America Act (infrastructure bill) passed Congress and it was signed by President Joe Biden. People from the blockchain community blasted the balance for which they viewed to become dangerous language. The legislation is placed to consider effect in The month of january 2024.

If Ether is considered a burglar within the U . s . States, centralized exchanges (CEX) may have to delist the altcoin for all of us-based customers. The safety classification may also negatively impact altcoins, DApps and decentralized exchanges (DEX) built on Ethereum. The Registration (SEC) has yet to determine if Ether passes the Howey test.

The announcement through the Commodity Futures Buying and selling Commission (CFTC) which declared Ether an investment also doesn’t appear to become relieving any investor fears.

Investor expectations for 2023

Regardless of the looming Shanghai hard fork, which enables users to unstake Ether in March 2023, the Ether cost will probably remain pressurized.

While investors’ appetite for top-risk assets as well as their curiosity about DeFi could still diminish, factors such as clearness on regulators’ stance on cryptocurrencies and also the eventual rise in Ethereum network-based protocols may end up being a lengthy-term catalyst for cost growth.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.