The blockchain industry demonstrated some surprising resilience in This summer, which might indicate a time period of greater fundamental support for that crypto space overall for the short term. In searching at a multitude of indicators, including Bitcoin’s (BTC) cost action, open interest on Ether (ETH) and activity in GameFi, there are several strong signals to point out that the bullish sentiment is coming back for this space.

Touring to any extent further isn’t a given, though. Cointelegraph Research’s latest Investor Insights analyzes key indicators from various sectors from the blockchain industry to navigate individuals potentially treacherous crypto waters. Within the latest edition, Cointelegraph Research’s bearish-to-bullish index was an amount C indicating a brief-term cautionary time. While you may still find mixed signals, the general sentiment was leaning toward the bulls for This summer.

Download and buy this set of the Cointelegraph Research Terminal.

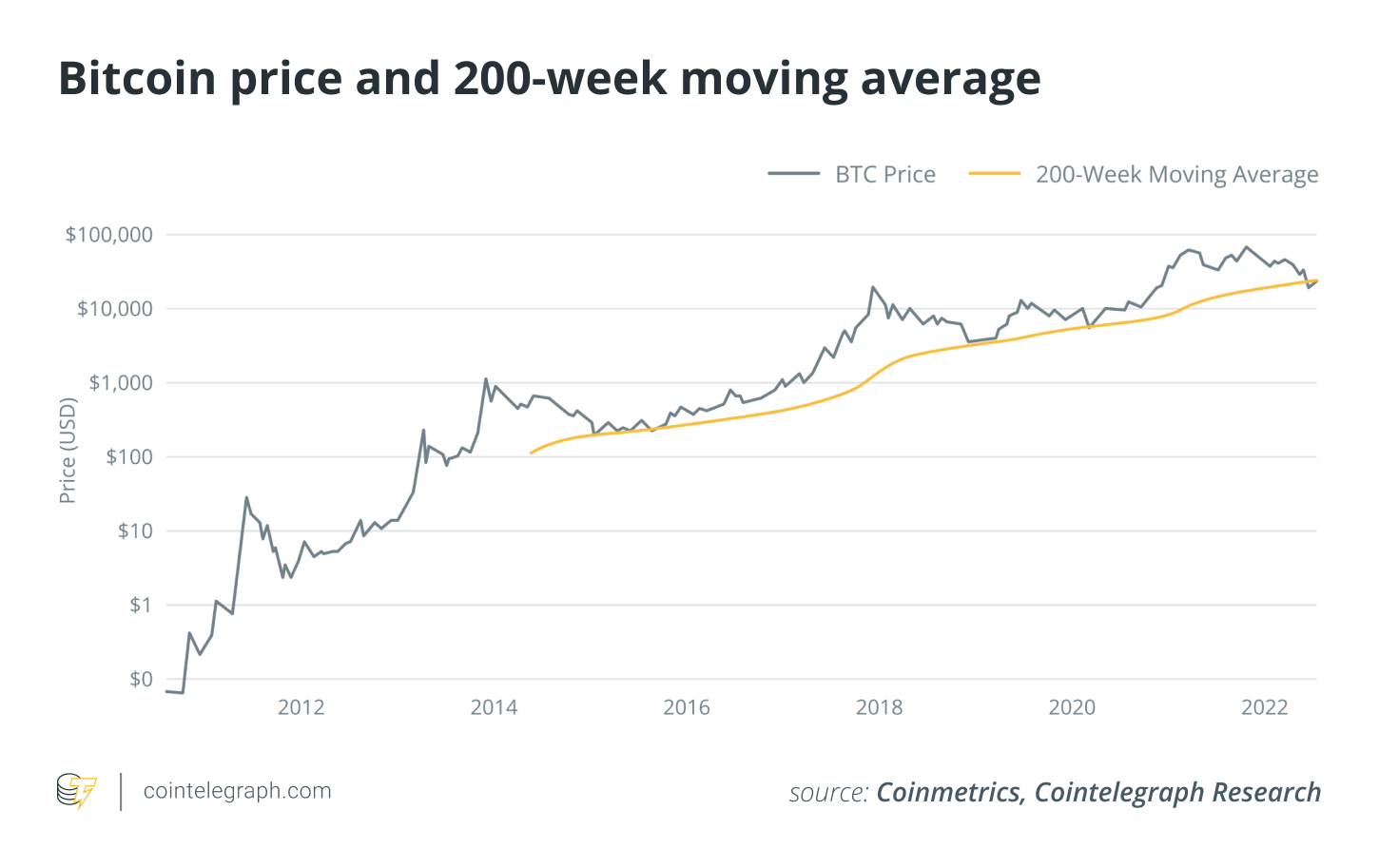

Bitcoin and Ether show indications of strength

Bitcoin closed This summer up 16.6% since the beginning of the month, an increase not seen since October 2021. BTC is constantly on the range with an amount of resistance around $24,000 however, the repeated approach and rejection will probably break sooner or later if factors change, for example positive economic growth reports in the U . s . States and elsewhere. Simultaneously, Ethereum saw an exciting-time a lot of unique active wallet addresses, 48% greater than previous records. Both indicators are bullish for that blockchain space.

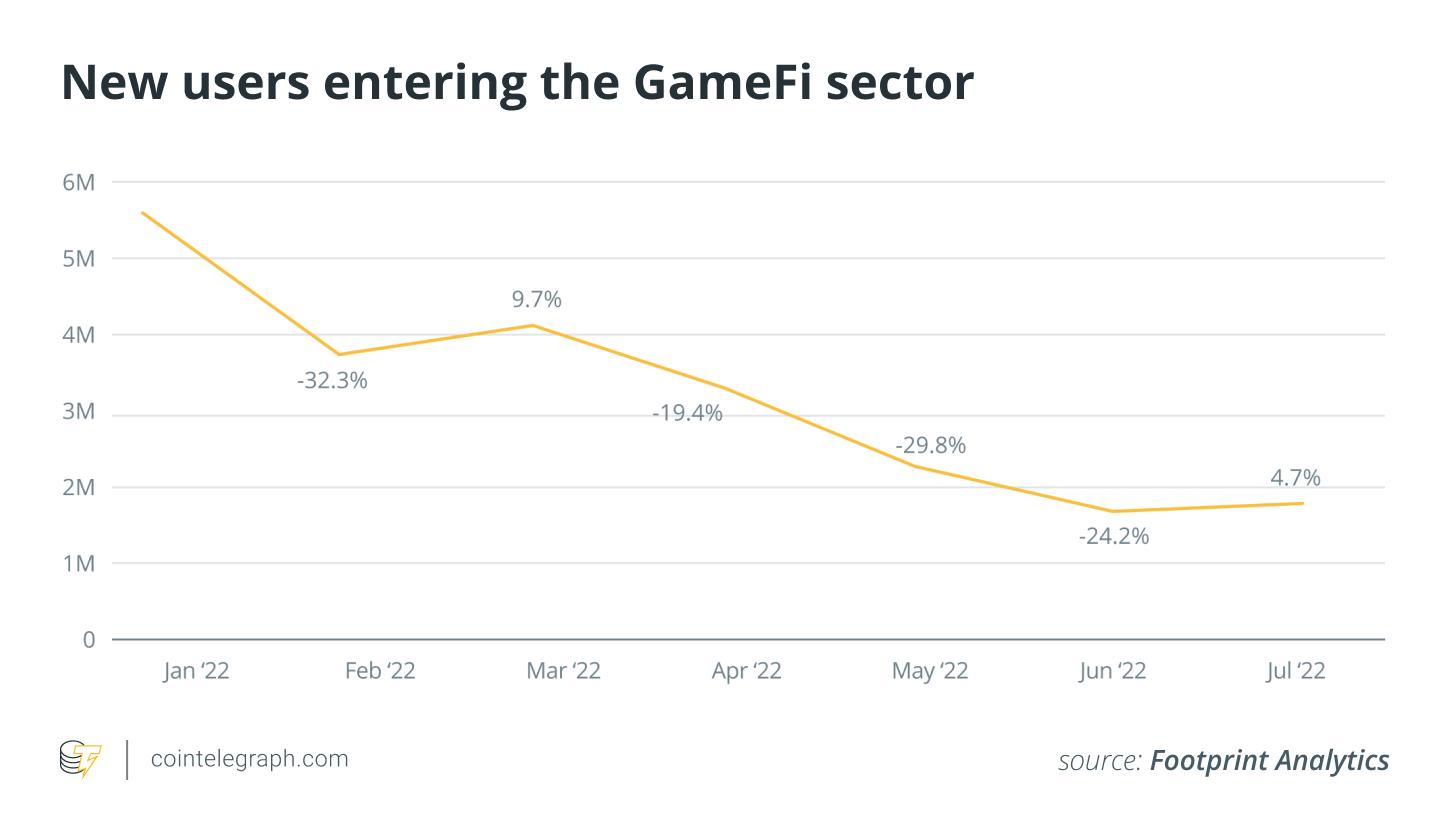

GameFi shows indications of existence

The GameFi sector continues to be on the decline because the large market crash within the first 1 / 2 of 2022. However, This summer saw a 4.7% begin new users across all GameFi when compared with June. Some highlights out of this sector range from the purchase of digital property and also the purchase of the Genesis Land plot, which selected 550 Wrapped Ether (wETH). Nonfungible tokens (NFTs) which were area of the GameFi sector composed greater than 36% from the $976 million of total NFTs value offered in This summer. This can help to color the image of activity and strength coming back with a segments from the market.

Investment capital investment decline

The investment capital investment totals happen to be on the decline within the last couple of several weeks however, This summer saw capital inflows lower 43% from June, close to $1.9 billion. This means that so what can be regarded as a bearish sentiment initially glance may warrant a pulled-back wider view.

This is because they are amounts of capital purchase of the blockchain industry that haven’t been seen since the beginning of the 2021 bull run. This is prone to subside moving with the other half of 2022 and into 2023, because the crypto contagion of failing blockchain companies appears to possess fully performed out.

The Cointelegraph Research team

Cointelegraph’s Research department comprises the best talents within the blockchain industry. Getting together academic rigor and filtered through practical, hard-won experience, they around the team are dedicated to getting probably the most accurate, insightful content in the marketplace.

Demelza Hays, Ph.D., may be the director of research at Cointelegraph. Hays has compiled a group of subject material experts from over the fields of finance, financial aspects and technology to create towards the market the premier source for industry reports and insightful analysis. They utilizes APIs from a number of sources to be able to provide accurate, helpful information and analysis.

With decades of combined experience of traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to place its combined talents to proper use using the Investor Insights Report.

Disclaimer: The opinions expressed within the article are suitable for general informational purposes only and aren’t meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.