Bear markets have in the past been difficult to navigate for traders and also the conventional group of “reliable” indicators that determine good entry ways are not able to calculate how lengthy a crypto winter might last.

Bitcoin’s (BTC) recent recovery back over the psychologically important cost degree of $20,000 would be a sign to a lot of traders the bottom is at, however a much deeper dive in to the data shows that rapid-term relief rally may not be enough evidence of a macro-level trend change.

Evidence pointing to the requirement for caution was provided inside a recent report by cryptocurrency research firm Delphi Digital, which recommended that “we need to visit a bit more discomfort before we’ve conviction that the market bottom is within.”

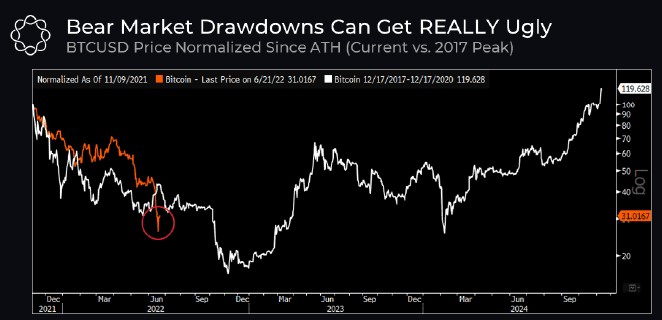

Regardless of the discomfort that was already felt since Bitcoin’s price capped in November, an evaluation between its pullback since that time and also the 2017 market top suggests the potential of further loss of rapid-term.

During previous bear markets, the cost of BTC fell by roughly 85% from the the top to the the eventual bottom. Based on Delphi Digital, if history would repeat itself in the present atmosphere it might result in “a low just above $10,000 and the other 50% drawdown for current levels.”

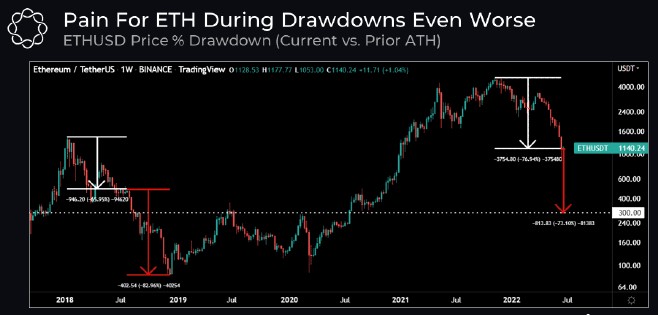

The outlook for Ether (ETH) is even direr because the previous bear market saw its cost decline by 95% from peak to trough. Should that very same scenario engage in now, the cost of Ether could drop as little as $300.

Delphi Digital stated,

“The chance of reliving an identical crash is greater than many people are most likely discounting, particularly if BTC does not hold support within the $14K–16K range.”

Oversold conditions prevail

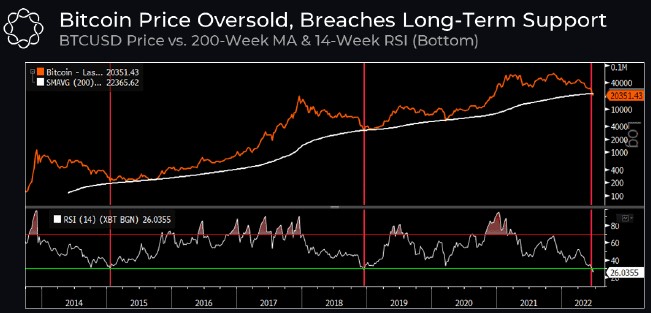

For traders searching for in which the bottom is incorporated in the market, data implies that “previous major market bottoms coincided with extreme oversold conditions.”

As proven within the weekly chart below, BTC’s 14-week RSI lately fell below 30 for that third amount of time in its history, using the two previous occurrences coming near an industry bottom.

Although some might take this like a sign that now is a great time for you to reenter the marketplace, Delphi Digital offered a thing of caution for individuals expecting a “V-shaped” recovery, noting that “In the last two instances, BTC traded inside a choppy sideways range for many several weeks before finally staging a powerful recovery.”

A look at the 200-week simple moving average (SMA) also raises question on if the historic support level holds again.

Bitcoin lately broke below its 200-week SMA the very first time since March 2020. In the past speaking, BTC cost only has traded below this level for any couple of days throughout the previous bear markets, which suggests the chance that a bottom could soon be located.

Related: Bitcoin cost dips under $21K while exchanges see record output trend

The ultimate capitualation

Exactly what the marketplace is really searching for at this time may be the final capitulation which has in the past marked the finish of the bear market and the beginning of the following cycle.

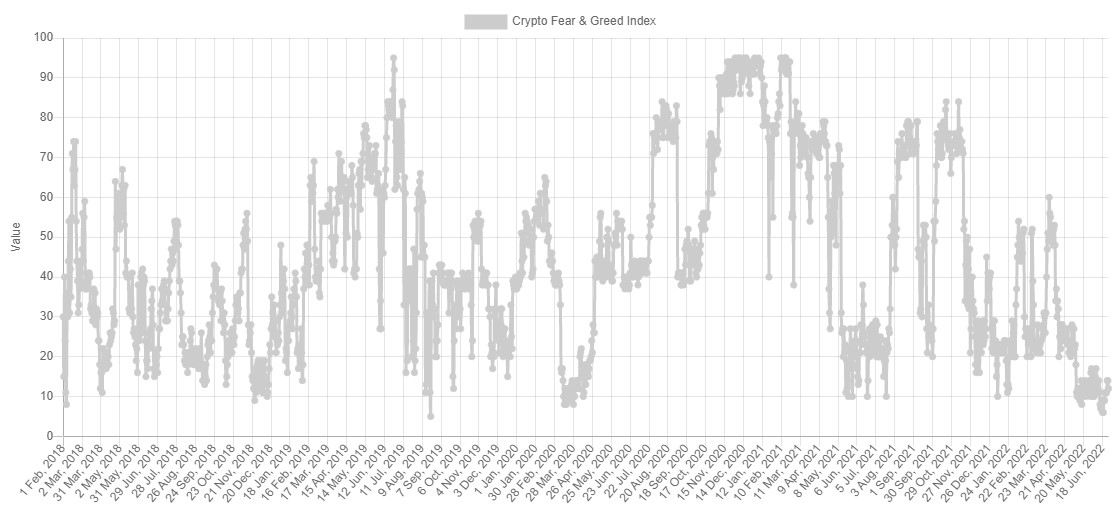

As the sentiment on the market has become at its cheapest point because the COVID-19 crash of March 2020, it hasn’t quite arrived at the depths of despair which were observed in 2018.

Based on Delphi Digital:

“We might need to see a little more discomfort before sentiment really bottoms out.”

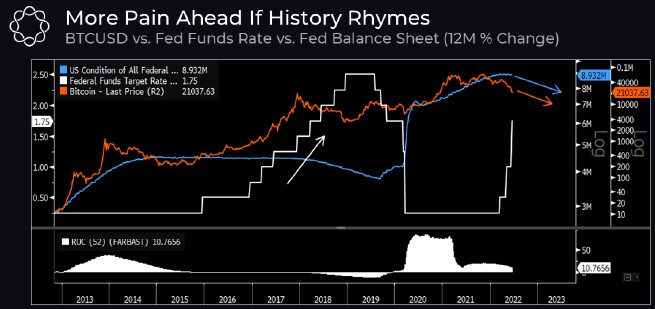

The weakness within the crypto market continues to be apparent because the finish of 2021, however the real driving pressure behind the marketplace crumbling include run-away inflation and rising rates of interest.

Rising rates of interest are usually adopted by market corrections, and since Fed promises to stay the path of hiking rates, Bitcoin along with other risk-off assets will probably correct further.

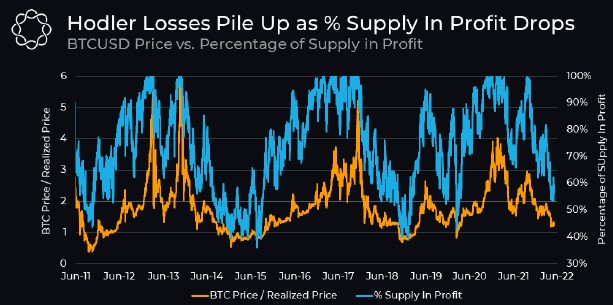

The last metric that implies that the final capitulation event must occur may be the number of BTC supply in profit, which hit a minimal of 40% during previous bear markets.

This metric is presently at 54.9%, according to data from Glassnode, which adds credence towards the perspective the market could still experience another leg lower prior to the real bottom is within.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.