Following a completing The Merge upgrade, Ethereum (ETH) transitioned right into a proof-of-stake (PoS) consensus mechanism, enhancing the blockchain become energy-efficient and secure. However, mining data reveals Ethereum’s heavy reliance upon Flashbots — just one server — for foundations, raising concerns more than a anchorman of failure for that ecosystem.

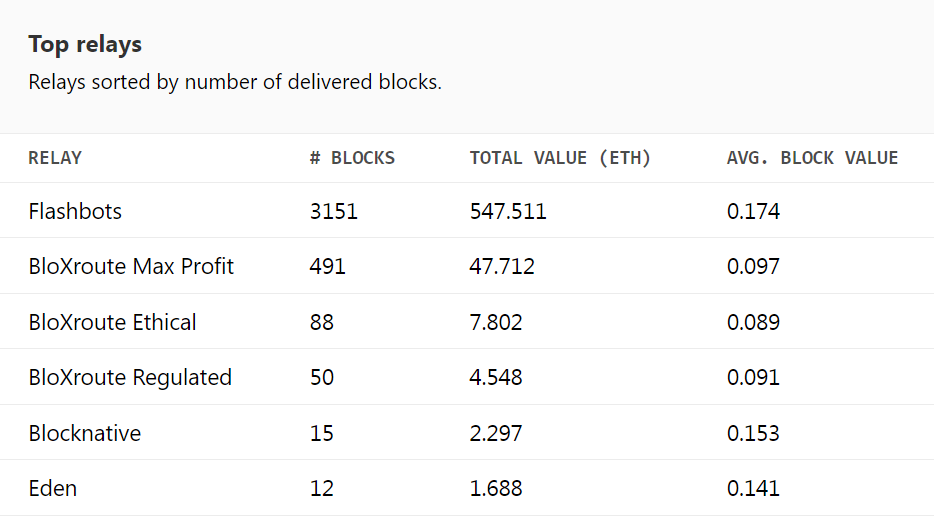

Flashbots is really a centralized entity focused on transparent and efficient Maximal Extractable Value (MEV) extraction, which functions like a relay for delivering Ethereum blocks. Data from mevboost.org show there are six active relays presently delivering a minumum of one block in Ethereum, namely Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Controlled, Blocknative and Eden.

As proven above, from the lot, 82.77% of relay blocks have been discovered to become built by Flashbots alone — adding heavily to Ethereum centralization.

An associated blog from BitMEX highlighted the requirement for an entire redevelopment of Flashbots or perhaps a similar system to mitigate unforeseen complications within an era following the Merge. However, Flashbots proponents reason that the machine is really a decentralized autonomous organization (DAO) and can eventually be decentralized itself.

Related: Ethereum Merge: Community responds to memes, GIFs and tributes

Complementing the information associated with Flashbots’ dominance, an analysis from Santiment indicated that 46.15% of Ethereum’s PoS nodes are controlled by 3 addresses.

Based on our #Ethereum Publish Merge Inflation dashboard, 46.15% from the #proofofstake nodes for storing data, processing transactions, and adding new #blockchain blocks could be related to just two addresses. This heavy dominance by these addresses is one thing to look at. pic.twitter.com/KQdFNgGloD

— Santiment (@santimentfeed) September 15, 2022

“Because the effective completing the Merge, a lot of the blocks — around 40% or even more — happen to be built by two addresses owned by Lido and Coinbase. It’s not ideal to determine greater than 40% of blocks being settled by two providers, particularly one that’s a centralized company (Coinbase),” described Ryan Rasmussen, crypto research analyst at Bitwise.