In the latest blog publish, Ethereum (ETH) co-founder Vitalik Buterin discussed “what within the Ethereum application ecosystem excites” him, including features associated with money, identity, stablecoins, decentralization – and voting.

He began by stating there are very couple of ideas today which are completely untouched, that has brought to a general change in perspective for him: “my excitement about Ethereum has become no more located in the possibility of undiscovered unknowns, but instead inside a couple of specific groups of applications which are showing themselves already, and therefore are only getting more powerful.”

1. Money

In poorer countries

“Cryptocurrency frequently stages in like a lifeline” in countries where links to global economic climates are restricted and extreme inflation is a continuing, stated Buterin.

Following Ethereum’s Merge, transactions around the blockchain are incorporated “considerably more rapidly”, and also the chain is much more stable. This will make accepting transactions after less confirmations safer.

In addition, Buterin once more expressed his excitement about scaling technology for example positive and ZK rollups. Furthermore, social recovery and multisig wallets have become better, he stated.

“These trends will require many years to engage in because the technology develops, but progress has already been being made, stated Buterin.”

Simultaneously, the FTX collapse advised everybody that “the most reliable-seeming centralized services might not be reliable in the end.”

In wealthy countries

The greater extreme use cases concerning surviving high inflation and fundamental financial activities don’t apply in wealthier countries – but crypto here has significant value nevertheless. For just one, it’s “much more convenient than traditional banking,” stated Buterin.

There’s even the perception of crypto as private profit age transition to some ‘cashless society’ – the transition that is being employed by governments to improve financial surveillance.

“Cryptocurrency may be the only factor presently being developed that may realistically combine the advantages of digitalization with cash-like respect for private privacy, he stated.”

Stablecoins

Stablecoins were developed because of the volatility of cryptoassets, among additional factors, and therefore are well-liked by the greater practical crypto users. However, Buterin argues that,

“There’s a real possibility that isn’t congenial to cypherpunk values today: the stablecoins which are most effective today would be the centralized ones, mostly USDC, USDT, and BUSD.”

Per Buterin, the stablecoin design space is split up into three groups:

- centralized stablecoins (such as the ones pointed out above),

- DAO-governed real-world-asset backed stablecoins (for example MarkerDAO‘s DAI),

- and governance-minimized crypto-backed stablecoins (RAI, LUSD).

Decentralized autonomous organization (DAO)-governed real-world assets (RWA)-backed stablecoins, “whether they can be produced to be effective, might be a happy medium,” contended Buterin. They’d combine enough sturdiness, censorship resistance, scale, and economic functionality to meet the requirements of a lot of real-world crypto users.

That stated, which makes it work will need real-world legal try to develop robust issuers, in addition to resilience-oriented DAO governance engineering.

2. Decentralized finance (DeFi)

DeFi began “honorable but limited,” with time that it “switched into a bit of an overcapitalized monster that trusted unsustainable types of yield farming,” stated the Ethereum co-founder. Now, however, it’s began “setting lower” right into a stable medium, having a concentrate on improving security as well as on a couple of applications which are particularly valuable.

Even though decentralized stablecoins “are, and most likely forever is going to be,” the most crucial DeFi product, Buterin noted a couple of others:

- conjecture markets: these will not make “extreme multibillion-dollar splashes,” but continuously grow continuously, increasingly helpful with time

- other synthetic assets: the stablecoins formula could be replicated with other real-world assets, including major stock indices and property

- layers for efficiently buying and selling between other assets: should there be assets on-chain that individuals desire to use, you will see value inside a layer that allows users to trade together.

3. The identity ecosystem

Whenever we discuss “identity”, this might include numerous things, for example names, fundamental authentication, attestations, and evidence of personhood.

An effort to produce a centralized platform to attain all “these tasks on your own” won’t work, contended Buterin, adding:

“Also likely works is definitely an organic approach, with lots of projects focusing on specific tasks which are individually valuable, and adding increasingly more interoperability with time.”

“And this is just what has happened,” stated Buterin, supplying types of Ethereum Name Service (ENS), Register With Ethereum (SIWE), evidence of humanity (PoH), evidence of attendance protocols (POAPs), and soulbound tokens (SBTs).

All these applications are helpful individually. But are they all truly effective is when well they compose with one another, he authored.

That stated, there are several issues ahead. Scaling is a, which may be solved “with rollups and possibly validiums,” authored Buterin. However the greatest future challenge with this ecosystem is privacy – it should be “labored on intentionally for every application.”

4. DAOs

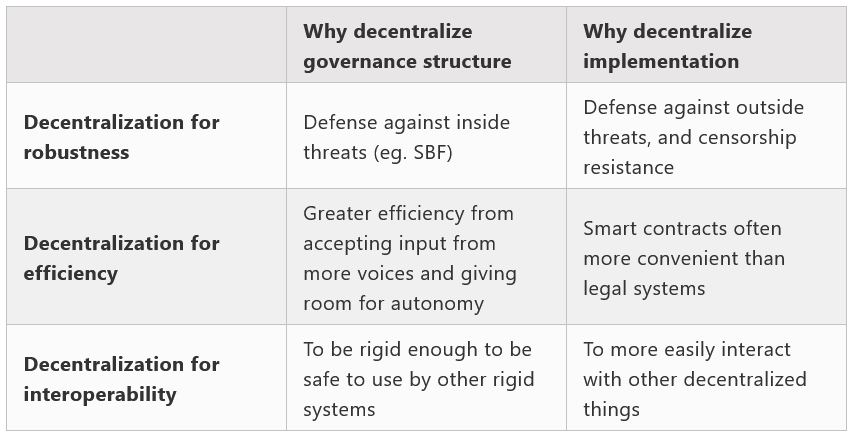

Buterin noted a distinction with regards to the term “decentralized”, that they stated may also be used to consult:

- a governance structure is decentralized if it is decisions rely on decisions obtained from a sizable number of participants,

- an implementation of the governance structure is decentralized if it’s built on the decentralized structure just like a blockchain and isn’t determined by any single nation-condition legislation.

One method to consider the excellence is the fact that a decentralized governance structure protects against attackers inside, along with a decentralized implementation protects against attackers around the outdoors, he added.

Buterin offered three “theories of decentralization”.

Decentralization for sturdiness

If Maker is taken for example, when there weren’t any safeguards with regards to the governance at the disposal of MKR holders, theoretically someone could buy half the MKR, utilize it to control the cost oracles, and steal a sizable area of the collateral, stated Buterin.

To possess a decentralized stablecoin work lengthy-term, there should be innovation in decentralized governance without these types of flaws, he opined, adding that possible directions include:

- a type of non-financialized governance, or perhaps a bicameral hybrid where decisions have to be passed not merely by token holders but additionally by a few other type of user

- intentional friction, to ensure that some types of decisions are only able to work following a lengthy-enough delay that will allow users to find out if something goes wrong and escape the machine.

Decentralization for efficiency

A decentralized governance structure is efficacious since it can incorporate opinions from diverse voices at different scales, stated Buterin, along with a decentralized implementation is efficacious because it may be more effective minimizing cost than traditional legal-system-based approaches.

“This means another type of decentralization,” he stated. While governance decentralized for sturdiness emphasizes getting a lot of decision-makers to make sure alignment having a pre-set goal, intentionally making pivoting difficult, governance decentralized for efficiency keeps the opportunity to act fast and pivot if needed, “but attempts to move decisions from the the top to the steer clear of the organization being a sclerotic paperwork.”

Decentralization for interoperability

Buterin figured that it’s both simpler and safer for “on-chain items to communicate with other on-chain things,” than getting them communicate with off-chain systems that will need a bridge layer – that could be attacked.

5. Hybrid applications

This is actually the final point discussed by Buterin, who opined that lots of applications aren’t positioned on-chain, however they still make the most of blockchains along with other systems to enhance their trust models.

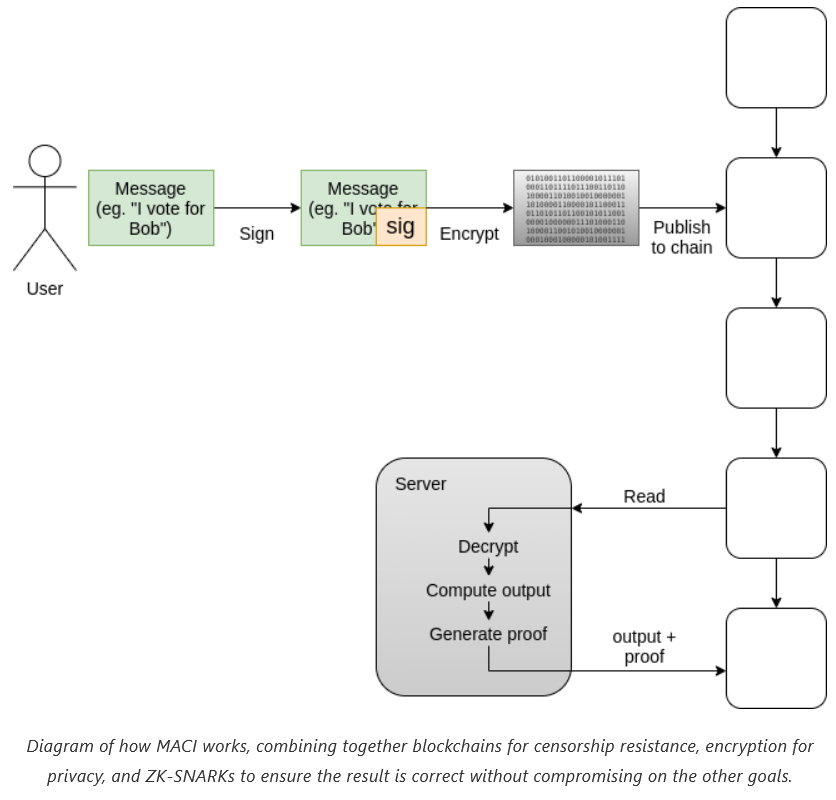

Being an “excellent example” he gave voting, which inevitably necessitates the greatest assurances of censorship resistance, auditability, and privacy. Systems like MACI, stated he, effectively combine blockchains, ZK-SNARKs, along with a limited centralized layer for scalability and coercion resistance.

While it will require a lengthy here we are at countries and voters to obtain confident with the safety assurances of electronic voting, be it using blockchain or otherwise, “technology like this is often valuable soon in 2 other areas,” stated Buterin. They are:

- growing the reassurance of voting processes that already happen digitally today (eg. social networking votes, polls, petitions)

- creating new types of voting that permit citizens or people of groups to provide rapid feedback, and including high assurance into individuals from the beginning.

Beyond voting, “there’s a whole field of potential “auditable centralized services” that may be well-offered by some type of hybrid off-chain validium architecture,” Buterin contended, for example:

- evidence of solvency for exchanges

- government registries

- corporate accounting

- games

- logistics applications

- tracking access authorization.

Though most of the pointed out applications are now being built these days, many also see only limited usage because of the limitations of the present technology: blockchains aren’t scalable, transactions accustomed to have a lengthy time for you to get incorporated around the chain reliably, wallet users need to choose from low convenience and occasional security, in addition to “the threat of privacy issues.”

That stated, “all of these are problems that may be solved, and there’s a powerful drive to resolve them,” while it’s highly relevant to be intentional concerning the application ecosystem itself, Buterin concluded.

____

Find out more:

– Ethereum Co-Founder Makes Big Changes to Roadmap – Here’s What you ought to Know

– Vitalik Buterin States His Influence Over Ethereum Decreases as Network Gets near the Merge

– Ethereum’s Vitalik Buterin Includes a Layer 3 Vision to Release Full Power Crypto

– Ethereum Founder Vitalik Buterin Worried About Elon Musk’s Twitter Plan