Ethereum’s native token Ether (ETH) has declined by greater than 35% against Bitcoin (BTC) since December 2021 having a possibility to decline further within the coming several weeks.

ETH/BTC dynamics

The ETH/BTC pair’s bullish trends typically suggest an growing risk appetite among crypto traders, where forthcoming nexus s focused on Ether’s future valuations versus keeping their capital lengthy-term in BTC.

On the other hand, a bearish ETH/BTC cycle is usually supported with a plunge in altcoins and Ethereum’s loss of share of the market. Consequently, traders seek safety in BTC, showcasing their risk-off sentiment inside the crypto industry.

Ethereum TVL wipe-out

Curiosity about the Ethereum blockchain soared throughout the pandemic as developers began embracing it to produce a wave of so-known as decentralized finance projects, including peer-to-peer exchange and lending platforms.

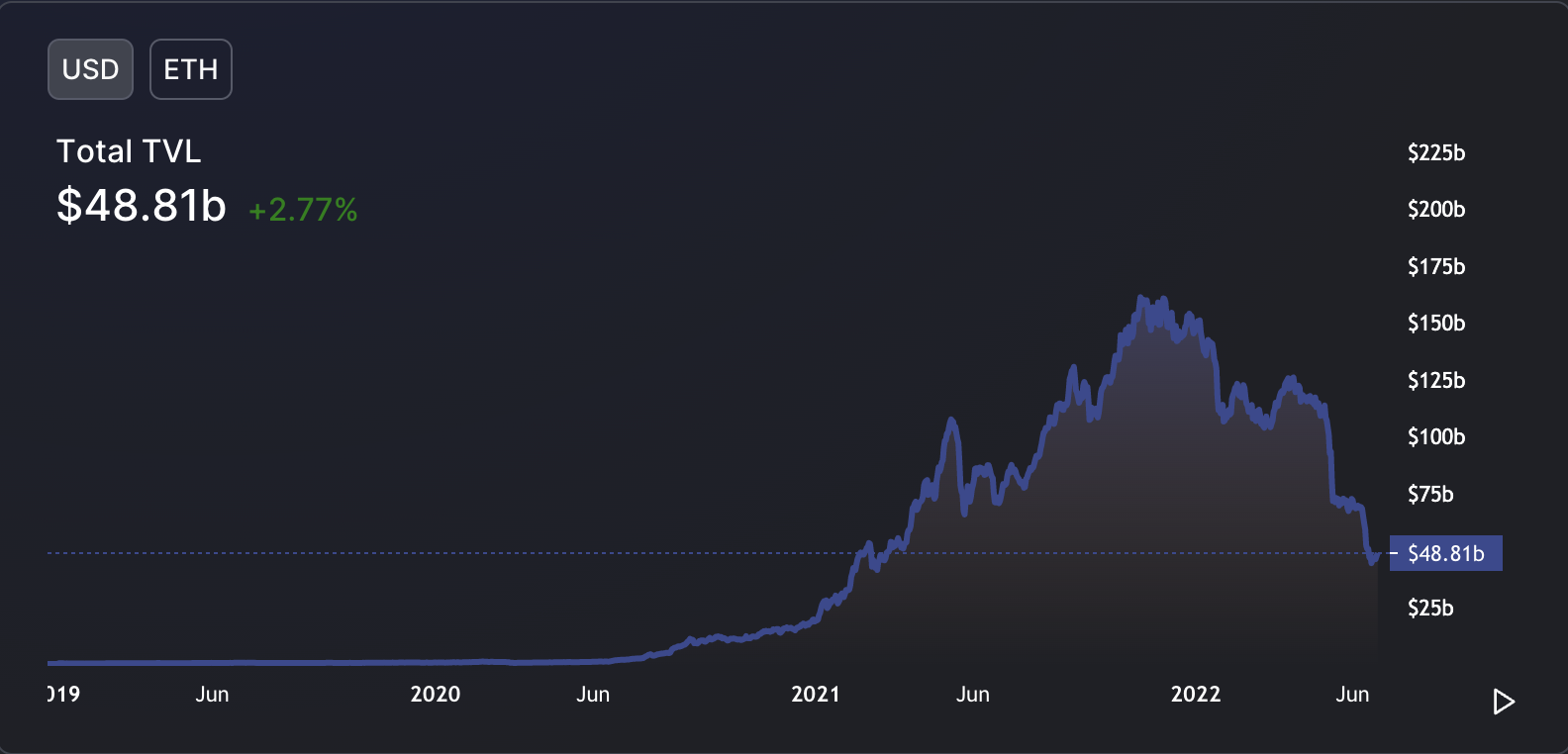

That led to a boom within the total value locked (TVL) within the Ethereum blockchain ecosystem, rising from $465 million in March 2020 up to $159 billion in November 2021, up greater than 34,000%, based on data from DeFi Llama.

Interestingly, ETH/BTC surged 345% to .08, a 2021 peak, within the same period, given a rise in interest in transactions around the Ethereum blockchain. However, the happy couple has since dropped over 35% and it was buying and selling for .057 BTC on June 26.

ETH/BTC’s drop coincides having a massive plunge in Ethereum TVL, from $159 billion in November 2021 to $48.81 billion in June 2022, brought with a contagion fears within the DeFi industry.

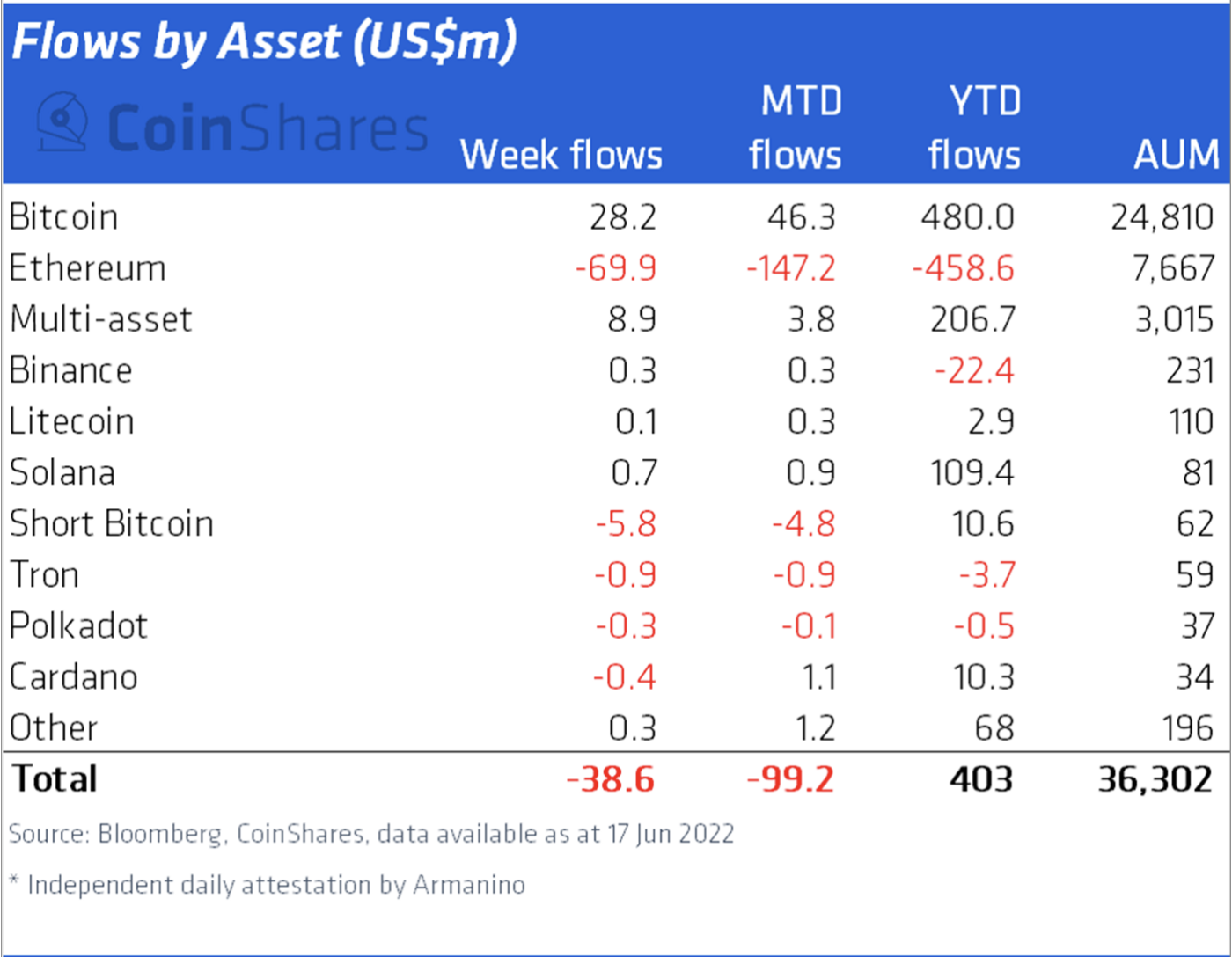

Also, institutions have withdrawn $458 million this season from Ethereum-based investment funds by Next Month, suggesting that curiosity about Ethereum’s DeFi boom continues to be waning.

Bitcoin battling but more powerful than Ether

Bitcoin has faced smaller sized downsides when compared with Ether within the ongoing bear market.

BTC’s cost has dropped nearly 70% close to $21,500 since November 2021, versus Ether’s 75% stop by exactly the same period.

Also, unlike Ethereum, Bitcoin-focused investment funds have experienced inflows of $480 million year-to-date, showing that BTC’s drop has been doing little to curb its demand among institutional investors.

ETH/BTC downside targets

Capital flows, along with an growing distrust within the DeFi sector, can keep benefiting Bitcoin over Ethereum in 2022, leading to more downside for ETH/BTC.

Related: Swan Bitcoin Chief executive officer against crypto lenders: Users are way under-paid for the danger

Theoretically speaking, the happy couple continues to be holding over a support confluence based on an increasing trendline, a Fibonacci retracement level at .048 BTC, and it is 200-week exponential moving average (200-week EMA nowhere wave within the chart below) near .049 BTC.

Inside a rebound, ETH/BTC could test the .5 Fib line next near .062. On the other hand, a decisive break underneath the support confluence can often mean a decline toward the .786 Fib line at .027 in 2022, lower greater than 50% from today’s cost.

The ETH/BTC breakdown might coincide by having an extended ETH/USD market decline, mainly because of the Federal Reserve’s quantitative tightenig which has lately pressured crypto prices lower from the U.S. dollar.

$ETH historic Bear Markets correction depth:

• -72%

• -94%

• -82% (and counting)

On #ETH Market Cycles here:https://t.co/5hIo7SC1n6#Crypto #Ethereum pic.twitter.com/7Ol0q3xM9G

— Rekt Capital (@rektcapital) June 25, 2022

On the other hand, less strong economic data could prompt the Given to awesome lower on its tightening spree. This might limit Ether and yet another crypto assets’ downside bias within the dollar market, per Informa Global Markets.

The firm noted:

“Macroeconomic conditions have to improve and also the Fed’s aggressive method of financial policy needs to subside before crypto markets visit a bottom.”

But given Ethereum hasn’t reclaimed its all-time high against Bitcoin since June 2017 despite a powerful adoption rate, the ETH/BTC pair could remain pressurized using the .027-target around the corner.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.