The cryptocurrency industry has offered developers and investors the chance introducing new financial tools supplying plentiful choices to earn passive earnings. Simply holding crypto has offered patient investors the opportunity to make gains through the years. However, there are numerous different ways to improve crypto assets’ stacks, even just in bear markets.

Apart from staking, crypto savings accounts allow retail investors to accrue their by earning interest around the crypto assets they deposit on specific cryptocurrency platforms when they accept lend out their coins or tokens. Crypto interest accounts are particularly appealing simply because they distribute much greater returns than traditional bank savings accounts, thinking about the average rate of interest used by a crypto checking account can depend on 7.5%, from the average .06% of bank savings accounts.

Related: DeFi staking: A beginner’s help guide to proof-of-stake (PoS) coins

The main difference in rates between crypto and traditional savings accounts is sort of significant but includes greater risks connected using the service. We’ll discover here how you can access crypto savings accounts, the crypto rates of interest and deposit terms and also the risks connected using this type of financial instrument.

Exactly what is a crypto checking account?

A crypto interest account generally is a DeFi platform’s service that allows you to earn interest on digital assets you’ve deposited and decided to lend out in return for coming back. This particular service is comparable to a financial institution checking account which will lend your money with other customers or banking institutions for some some time and provides you with interest for your service.

Obviously, blockchain technology encourages users to get self-sovereign and independent from organizations. However, intermediate companies have grown to be an essential component of the profession supplying crypto savings accounts to individuals who wish to enjoy the advantages of we’ve got the technology without making an excessive amount of effort to understand complicated and troublesome processes.

Apart from convenience, these businesses may also hold a few of the risks involved and be sure depositors are compensated first if adverse occasions like insolvency occur. Some information mill supported by insurance and use well-established custodians to safeguard their clients.

So how exactly does a crypto checking account work?

When you deposit your crypto assets right into a checking account, you begin accruing interest from the first day. The majority of the popular cryptocurrencies may be used inside a crypto checking account, most abundant in selected being Bitcoin (BTC), Ether (ETH) and Litecoin (LTC), even though many favor rates of interest on stablecoins like Tether (USDT), USD Gold coin (USDC) and PAX Dollar (USDP).

By depositing your crypto assets right into a checking account, you formally grant the woking platform the authority to make use of your money for just about any purpose, from lending it to investing it or staking it in your account. Mainly, it will likely be employed for lending it to earn preferred tax treatment, most of which is going to be compensated for you as regular charges.

Crypto savings accounts offer you better rates should you accept secure your crypto for some time or hold a platform-specific token. Nexo, for example, increases rates of interest by as much as 4% for holders from the platform’s governance token.

The way to invest inside a crypto savings plan?

When you wish to purchase a crypto savings plan, the initial step would be to select the best take into account you and also get began the following:

- Select a cryptocurrency platform you trust that provides realistic rates of interest

- Transfer cryptocurrency for this selected platform

- Stick to the couple of easy steps to deposit your crypto assets right into a checking account. Usually, these steps are straightforward, and you will be led with the process through the platform

- Choose if you wish to deposit your asset for any limited period of time or pick a flexible time that will help you to withdraw your crypto anytime

- Start earning interest from the very first day.

As pointed out, there are many platforms to select from, including well-established cryptocurrency exchanges like Coinbase, using the following warning signs of rates of interest on fixed savings:

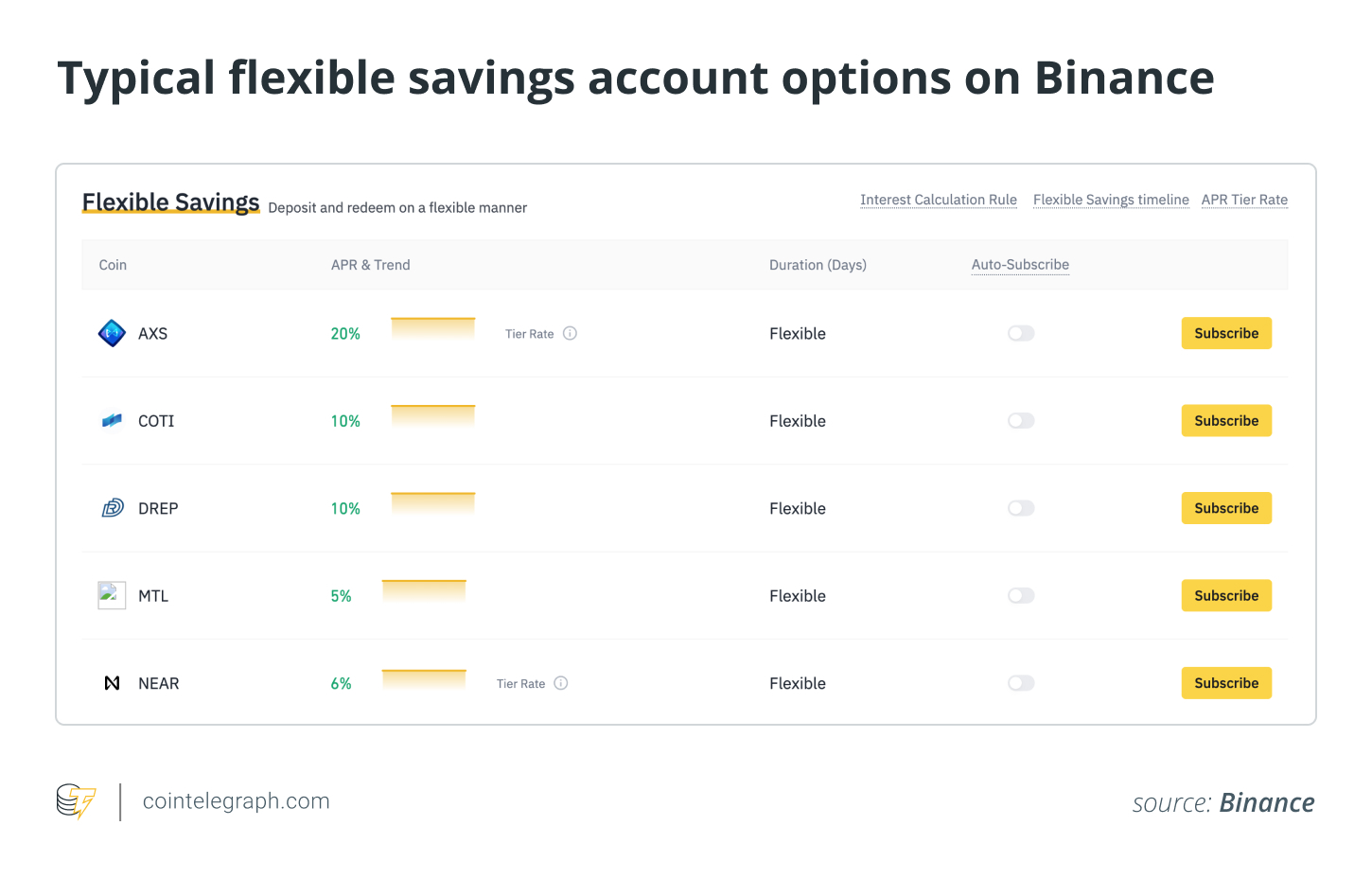

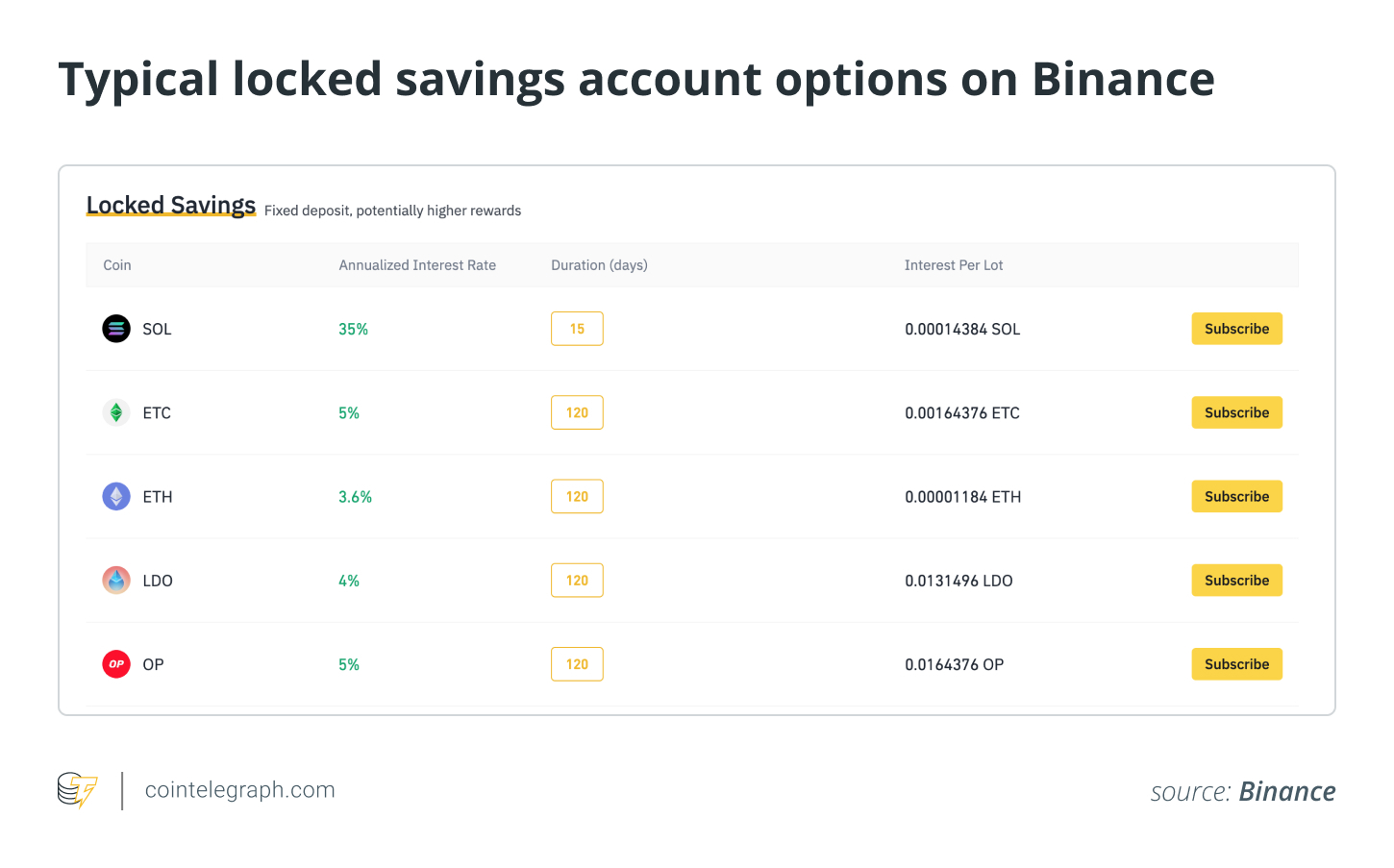

Binance may be the other global popular crypto platform that provides rates of interest on the majority of cryptocurrencies with flexible savings and locked savings options:

An growing quantity of other financial service companies and cryptocurrency platforms provide these kinds of accounts. Nexo and Crypto.com are among companies offering greater rates of interest to cryptocurrency holders who lock their assets away for days or several weeks. However, the disadvantage using this type of checking account is you can’t withdraw or sell your crypto in that period.

The amount of interest you can generate having a crypto checking account largely depends upon the woking platform and also the cryptocurrency you decide to deposit. The eye rate provided by the service may also be driven by market conditions and it is usually compensated in the cryptocurrency you’ve deposited.

While their high-rates of interest can lure you, you should think about how secure neglect the is by using them. Selecting the very best crypto interest account isn’t simply dependent on evaluating rates of interest compensated but additionally ensuring neglect the is really as safe as you possibly can.

Remember, they’re custodians of the crypto assets, and therefore by holding your funds, they even prevent you from withdrawing them or delaying the withdrawal process, which may lead to a loss of revenue for you personally if the need for the crypto asset changes meanwhile. When selecting the very best rates of interest, make certain you realize the main difference between this (APR) and also the annual percentage yield (APY) simply because they might mislead you in calculating your yearly returns.

In a nutshell, APY features a compound interest, i.e., adding interest towards the principal amount of financing or deposit (the eye on interest accrued). However, APR doesn’t include compound interest. Because of the compound interest factor, APY will give you a greater return than APR. Yet, it’s usually worth studying the savings account’s terms and conditions because certain services pays simple interest only and won’t produce compound interest with time.

Crypto saving account risks

The crypto market is mostly unregulated, therefore the investors might possibly not have any cover in situation something goes completely wrong using their assets. Within this framework, operate crypto savings accounts that don’t offer government-backed deposit insurance such as the Federal Deposit Insurance Corporation (FDIC) or even the National Lending Institution Administration (NCUA).

These savings accounts offer greater yields since they’re riskier. For instance, they might limit how rapidly you are able to withdraw your assets and, in occasions of difficulties, they may not let customers withdraw their assets whatsoever.

In return for these limitations and also the connected risk, these savings accounts tend to be more interesting to have an investor than the usual typical banking account. However, of these accounts to yield this type of high interest which might exceed 20% in some instances, you need to question the way your cash is employed without anyone’s knowledge.

Like regular banks operate within “fractional reserve” banking service, so most crypto companies. They’re lending out greater than they need to banking institutions using the difference that there’s no deposit insurance to back them, as with the situation of traditional banks.

Crypto savings accounts versus. crypto wallets

Crypto wallets simply won’t accrue your cryptocurrency holdings instead of crypto savings accounts which are created to improve the amount of coins you have with time.

This may be at the fee for key possession, though, since the private keys where you can access your coins are maintained through the crypto platform. However, most crypto wallets will make sure you retain full possession of the private keys.

Security is yet another concern that needs to be perfectly addressed. You will find security risks within the centralized platform that holds your private keys since it is potentially vulnerable to becoming insolvent, bankrupt or just being hacked, and you can lose your hard earned money.

In the same manner, you need to select a wallet carefully to prevent selecting a service with little security along with a vulnerability to hacking. Also, you have to ensure it is simple to access your wallet’s private keys should you lose your operational tool and have to reinstate your assets in another digital location.

Cryptocurrency is really a operate in progress and can likely undergo continuous changes through the years, especially when it comes to regulation, that will also affect how crypto savings accounts are managed. In June 2022, the problems of leading crypto lending platforms like Block.Fi and Celsius have elevated further concerns over the way forward for crypto savings accounts and other alike related cryptocurrency services.

Related: One step-by-step framework for evaluating crypto projects

Caution and research will always be suggested should you consider opening a crypto checking account and weigh the connected risks against the likelihood of preferred tax treatment, particularly if you risk existence savings or anything near to that.