The cryptocurrency marketplace is incredibly volatile, which may be both negative and positive for investors and traders. Volatility creates possibilities to make profits, but it may also result in losses. Passive earnings strategies, however, might be handy in offsetting these losses.

Passive earnings strategies offer investors and traders possibilities to generate income, even during challenging market conditions for example bear markets. For individuals purchasing Ether (ETH), or any crypto generally, earning passive crypto earnings provides a method to cover market crashes and downturns.

Hodling was once the main method to earn interest on one’s crypto assets. But, using the rise of decentralized finance (DeFi) protocols, nowadays there are many different ways to earn interest on Ether and DeFi protocols. This information is helpful information on how to earn money with Ethereum for novices and individuals already acquainted with the area.

What’s Ethereum and just how do you use it?

Ethereum is really a decentralized blockchain network that runs smart contracts. They are applications running just as programmed without any chance of fraud or third-party interference. Ethereum’s native token, Ether, enables users to handle several functions around the network for example making transactions, staking, buying and selling, storing nonfungible tokens (NFTs), doing offers and much more.

Ethereum can also be accustomed to build decentralized applications (DApps), that are open-source software running around the blockchain. DApps could be built on Ethereum’s network by anybody using the skills and expertise to do this, which makes it probably the most popular platforms for developers.

Ethereum once used a proof-of-work (Bang) consensus formula, which rewards miners for validating blocks of transactions. However, Ethereum formally now use a proof-of-stake (PoS) consensus formula on September 15, 2022, at 1:42:42 am EST.

The historic transition belongs to what Ethereum co-creator Vitalik Buterin, dubbed The Merge, noted as part one of numerous within the network’s multi-year scaling roadmap. The proceed to PoS is made to make Ethereum more scalable and-efficient through the elimination of the requirement for miners using high levels of electricity to secure the network.

Steps to make passive crypto earnings with Ethereum?

Here are the popular methods to make passive earnings with Ethereum:

Staking

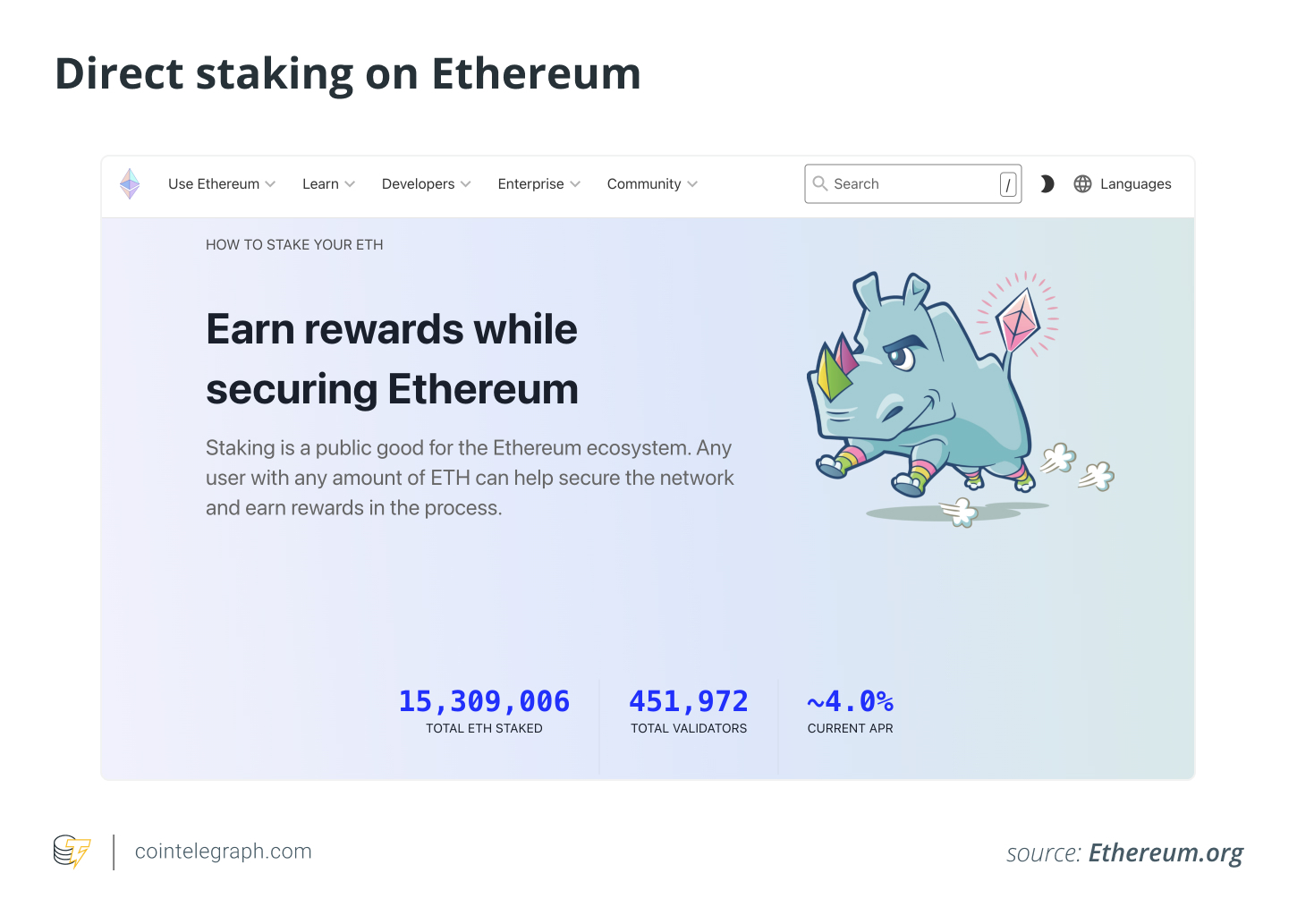

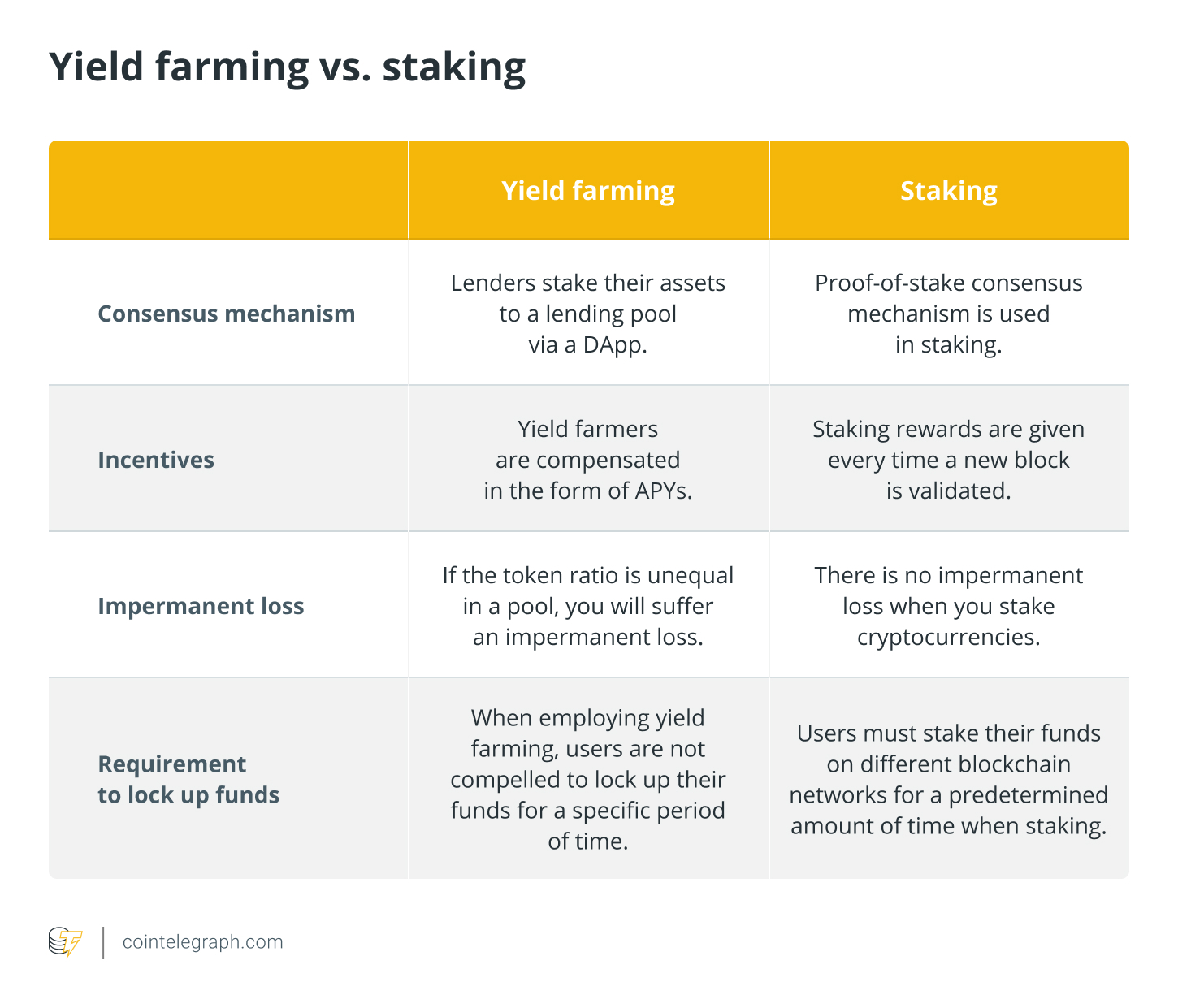

Staking is the procedure of locking one’s funds on the PoS blockchain (for example Ethereum) to assist validate transactions and produce rewards. When users stake their ETH, they’re basically putting their skin hanging around and assisting to secure the network. To acquire their efforts, stakers earn rewards by means of ETH or any other tokens.

Ethereum staking is a well-liked method to earn passive earnings from cryptocurrency, although it may be too costly for amateur investors. The brand new PoS form of Ethereum requires a minimum of 32 ETH — roughly over $50,000 — to operate a complete validator node and take part in staking.

Aside from direct staking, it’s possible to also employ providers like StakeWise and Lido. They are DApps that offer Ethereum staking services without getting to operate a complete node, allowing network participants to stake with minimal amounts. These types of services usually impose a fee on rewards upward of 10%, that might reduce one’s profits, but a minimum of they won’t have to invest 32 ETH upfront.

Hodl

Hodl, an offshoot of “hold,” also “hold on for dear existence,” is really a crypto slang expression used to explain the action of possessing cryptocurrency for lengthy-term investment purposes. When Ethereum investors hodl their Ether, they’re basically betting that it is cost will increase later on and they’re in a position to market it for any profit. It’s among the simplest and many popular methods to earn passive earnings from cryptocurrency. And, although this strategy doesn’t offer any immediate or guaranteed returns, it may be lucrative over time when the cost of Ether truly does increase. Considering that, Ethereum has witnessed a significant quantity of growth since its beginning and it is presently probably the most valuable cryptocurrencies on the planet, so there’s a strong possibility that its cost continuously rise later on.

However, it’s vital that you bear in mind that cryptocurrency costs are highly volatile and may fluctuate quickly. Which means that there’s always the opportunity of loss when hodling crypto, so investors must only place in just as much money as they’re comfortable losing.

Automated buying and selling

One other way for users to create passive earnings through their Ethereum investment is to apply a bot for automated Ether buying and selling. Automated buying and selling bots are software packages which use pre-programmed algorithms to purchase and sell cryptocurrency on exchanges 24/7.

These bots could be established to place trades instantly under certain market conditions, for example cost changes or volume. Coinrule and Bitsgap are simply a few examples of automated buying and selling software that permit users to setup buying and selling rules, either by utilizing premade templates or customizing them according to risk preference.

If effective, automated buying and selling can offer a steady flow of profits, even though it does include some risks. Bots aren’t perfect and may sometimes get some things wrong, for example selling too soon or buying far too late.

Furthermore, the cryptocurrency marketplace is highly volatile and may experience sudden changes that the bot might be unable to anticipate. As a result, investors have to monitor their automated buying and selling activity carefully to prevent any major losses.

Lending

Lending is yet another popular method for investors to create passive earnings using their ETH investment. Typically, investors earn profits by lending crypto to borrowers having a high-rate of interest. You can do this through either centralized or decentralized lending platforms.

On centralized platforms, users typically don’t need to bother about intricacies for example security, data storage, bandwidth usage or authentication. The woking platform manages all technical details and offers the opportunity of investors to optimize their assets’ yield.

Centralized platforms will often have greater rates of interest than decentralized lending platforms. One drawback, however, is the fact that centralized platforms tend to be more prone to hacks and knowledge breaches.

However, decentralized lending platforms allow users to savor a greater degree of security, transparency and customizability, allowing experienced investors to tweak settings to maximise their profits. However these platforms are frequently more complicated to make use of and wish a greater degree of technical expertise. Rates of interest also are usually lower on decentralized platforms.

Liquidity mining

Liquidity mining or yield farming can also be an alternative choice to generate passive earnings from Ethereum. Here, users lend their Ether or any other assets to liquidity pools on decentralized exchanges like Yearn.finance, SushiSwap and Uniswap to earn rewards.

Many yield farming platforms include the opportunity to exchange an expression for an additional inside a liquidity pool. Traders pay a charge once they trade cryptocurrency, which fee will be divided one of the maqui berry farmers who’ve led to the liquidity of this pool. How big the reward depends upon what amount of the total pool’s liquidity is supplied through the player.

Yield farming could be a terrific way to generate passive earnings, but you should remember that it’s a relatively recent practice and it is, therefore, susceptible to change. Furthermore, it’s really a dangerous investment, because the cost from the underlying assets can fluctuate quickly, resulting in losses.