Institutional sentiment toward Ether (ETH) seems to possess shifted into positive gear, with digital investment products offering contact with the asset getting published four consecutive days of inflows, based on CoinShares.

Before this, ETH investment products have been on the extended 11-week run of outflows that saw the entire year-to-date (YTD) outflows hit up to $458 million in mid-June.

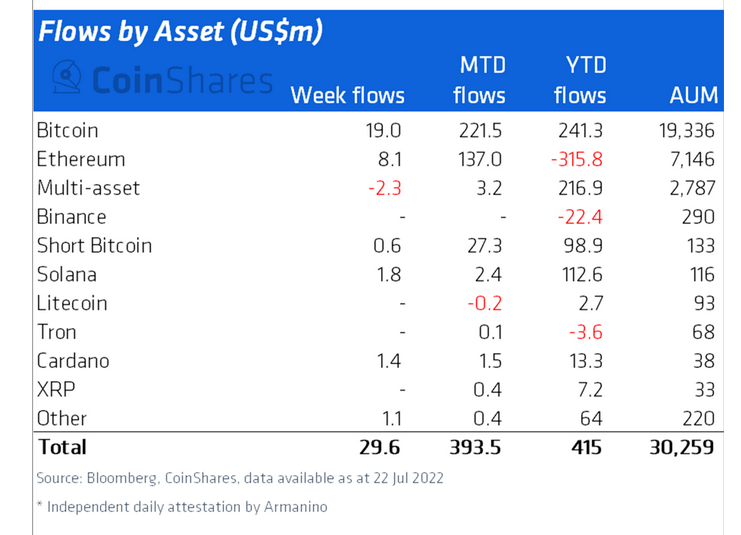

According to data in the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Ether investment products published inflows totaling $8.a million between This summer 18 and This summer 22, contributing to the prior week of considerably major inflows of $120 million.

The $120 million figure marks the greatest weekly inflows for ETH products since June 2021, with CoinShares suggesting that “investor confidence is gradually recovering” as Ethereum’s lengthy-anticipated Merge comes nearer to completion.

Because it stands, the YTD flows for ETH investment products happen to be chipped lower to $315 million price of outflows, when compared with $458 million in June.

Other assets

CoinShares data also demonstrate that investment products offering contact with Bitcoin (BTC) saw the biggest inflows a week ago at $19 million, contributing to a few days before by which BTC funds generated a substantial $206 million price of inflows.

Particularly, while institutional investors happen to be careful with ETH for many of 2022, this take on BTC has continued to be relatively positive typically — barring a couple of bumps within the road — with BTC products generating $241.3 million price of inflows YTD.

Related: The Merge is Ethereum’s opportunity to dominate Bitcoin, investigator states

Inside a report distributed to Cointelegraph, Singapore-based asset manager IDEG contended the broader crypto investor sentiment has become starting to transition from neutral to bullish, and expects Ethereum’s Merge to become a key driver from the market recovery.

“While there’s been delays and minor setbacks within the Bang to PoS migration for Ethereum, the Merge has become forecasted for Sep ‘22 – this really is giving the marketplace a obvious ‘positive upside catalyst’ to operate with,” the report reads.

The Merge is anticipated to become a bullish landmark for Ethereum because of it considerably increasing the network’s sustainability and efficiency. The main upgrade won’t reduce gas charges, however, and layer 2s are anticipated for everyone this function for that network in the future.

*Couple of quick suggests clarify:

-L2s, and not the merge, will require proper care of lowering gas prices

-Merge is really a change of consensus mechanism, no growth of network capacity

-Methods to gas charges, speed & scalability are originating from rollups and sharding https://t.co/nCH9WQ3IAY— MacKenzie Sigalos (@KenzieSigalos) This summer 25, 2022