Bitcoin (BTC) capped out around $46,000 on April 4 before freefalling to $38,000, causing much frustration among crypto traders who’ve been accustomed towards the market’s unreal returns previously 2 yrs following the March 2020 crash.

Feb and March demonstrated indications of recovery, especially following the steep declines in December and The month of january. But, now you ask ,, why has got the bullish momentum all of a sudden arrived at a halt?

Ongoing S&P 500 correlation

The correlation between crypto and equities, particularly Bitcoin and also the S&P 500, is constantly on the exist and it is likely to last until mid-May when Jerome Powell and also the U . s . States Fed announce a probable .5% rate hike to combat inflation.

However, this doesn’t always imply that Bitcoin will exhibit further declines. Suppose cryptocurrencies still mimic equity cost movement and never the other way round. For the reason that situation, many speculate that even though the S&P 500 continues to be shedding recently, rate hike fears may likely happen to be baked in in front of the Fed’s scheduled meeting.

Bitcoin whales purge, Tether whales surge

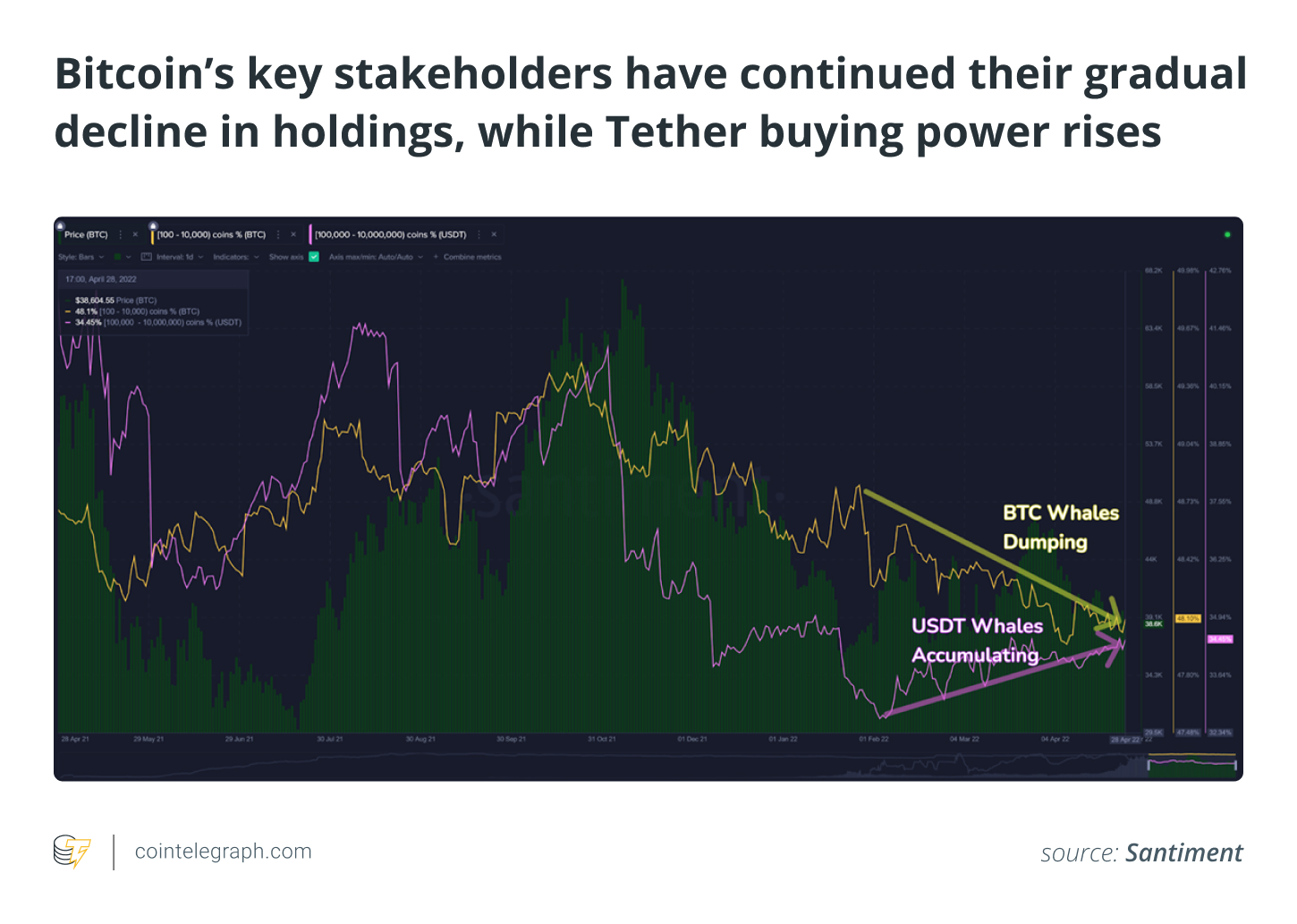

There’s two go-to whale tiers crypto data platform Santiment consistently examines to evaluate full-market future cost movement: Supply held by addresses with 100 to 10,000 BTC and offer held by addresses with 100,000 to 10,000,000 Tether (USDT).

In the last two several weeks, BTC whales out of this key group have dropped .6% of the holdings. Meanwhile, the important thing USDT group has really added 1.8% from the top stablecoin’s supply.

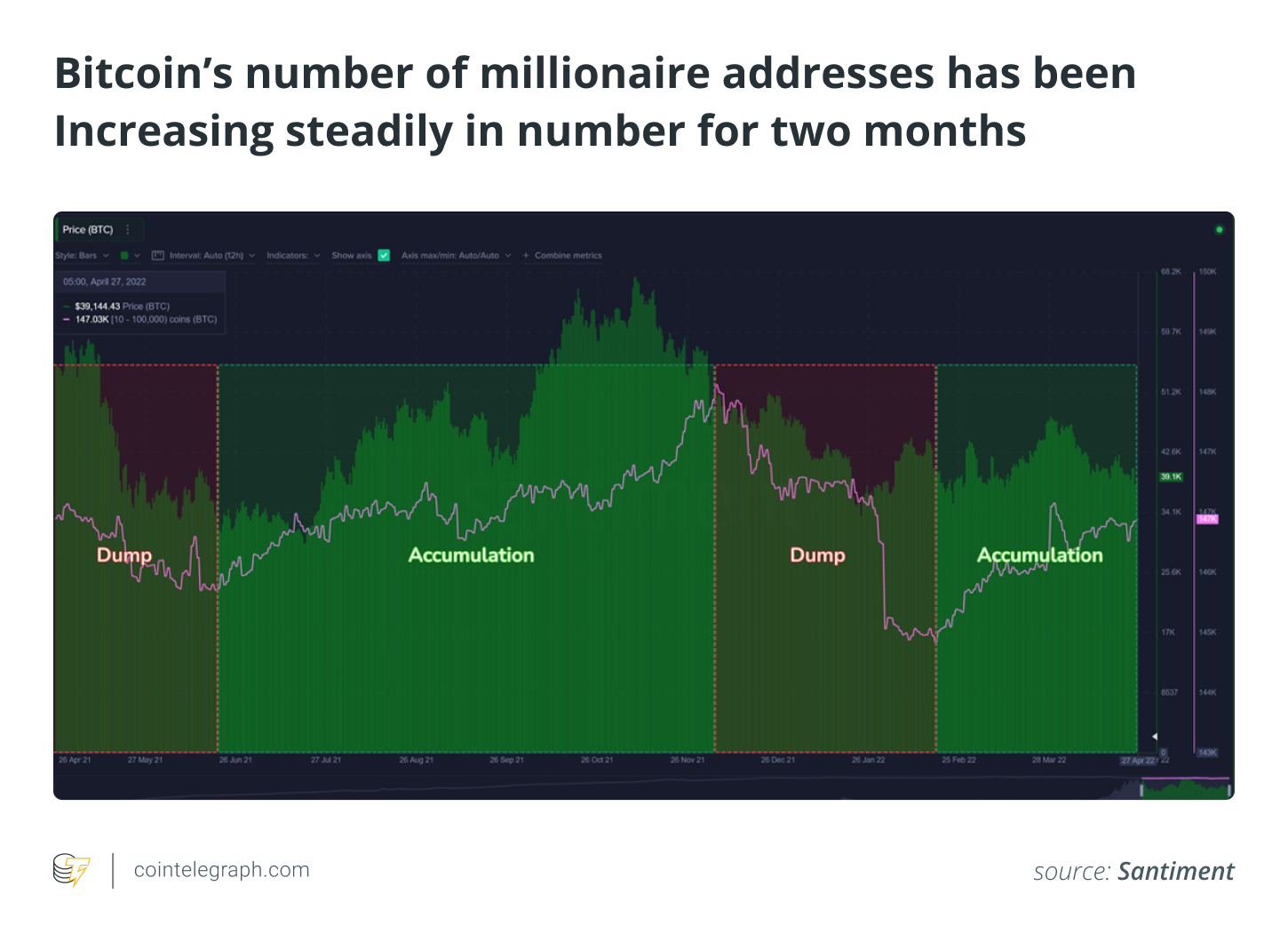

Although large whale addresses have dumped their BTC supply, evidence implies that prices generally rise when more addresses exist that hold 10 to 100,000 BTC. Addresses holding roughly $3.8 million as a whole happen to be produced or came back towards the BTC network because the Russian-Ukrainian war started at the end of Feb.

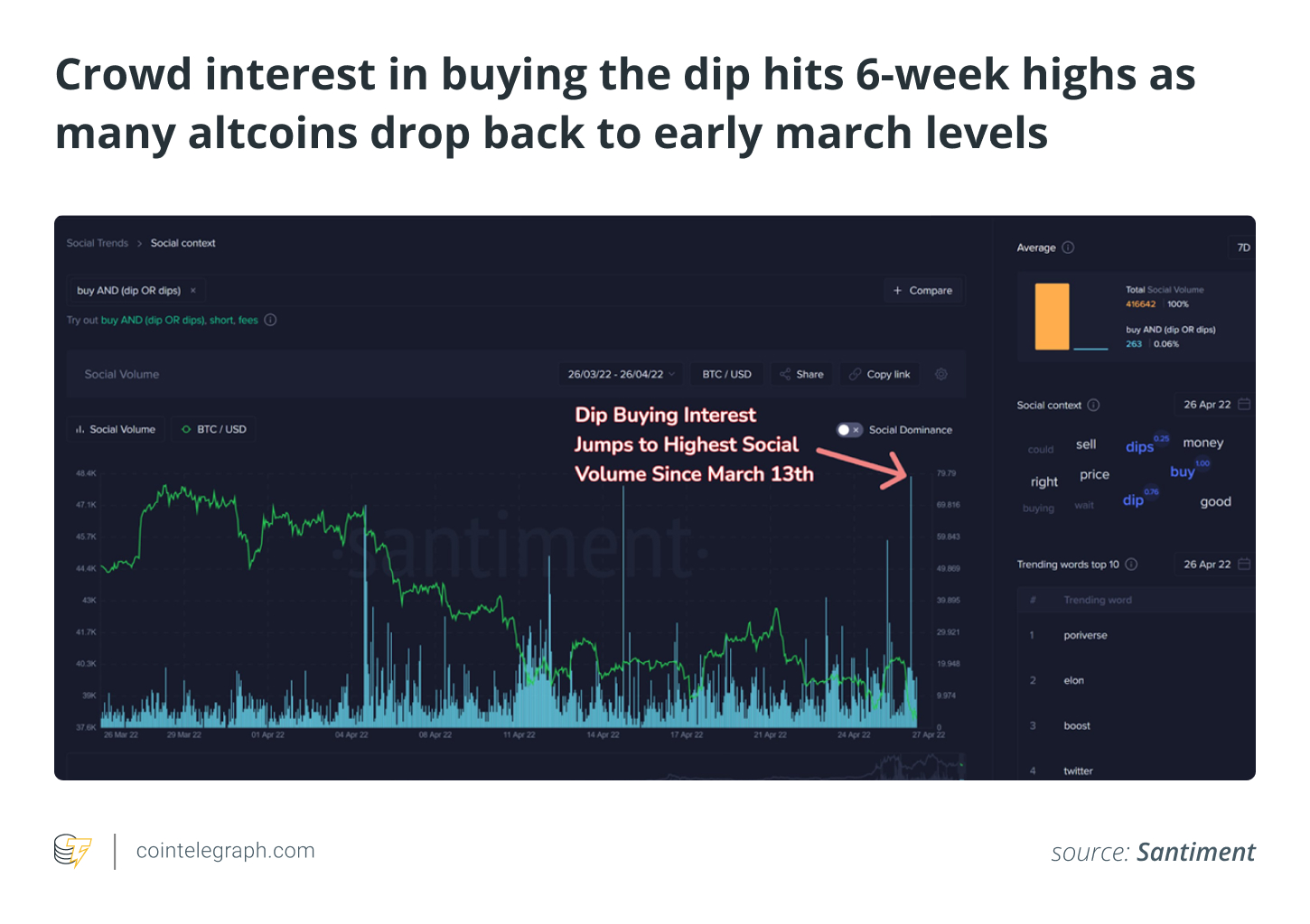

Traders fooled on dip buy chance

Santiment finds a dependable trend from the mainstream crowd being incorrect most time once they have confidence in a cost event happening too uniformly. Despite the “buy the dip” narrative entirely tilt, the chart below implies that prices didn’t bounce as traders wished. Ironically, it’s frequently once the crowd abandons any inclination to place the underside that prices do start to recover.

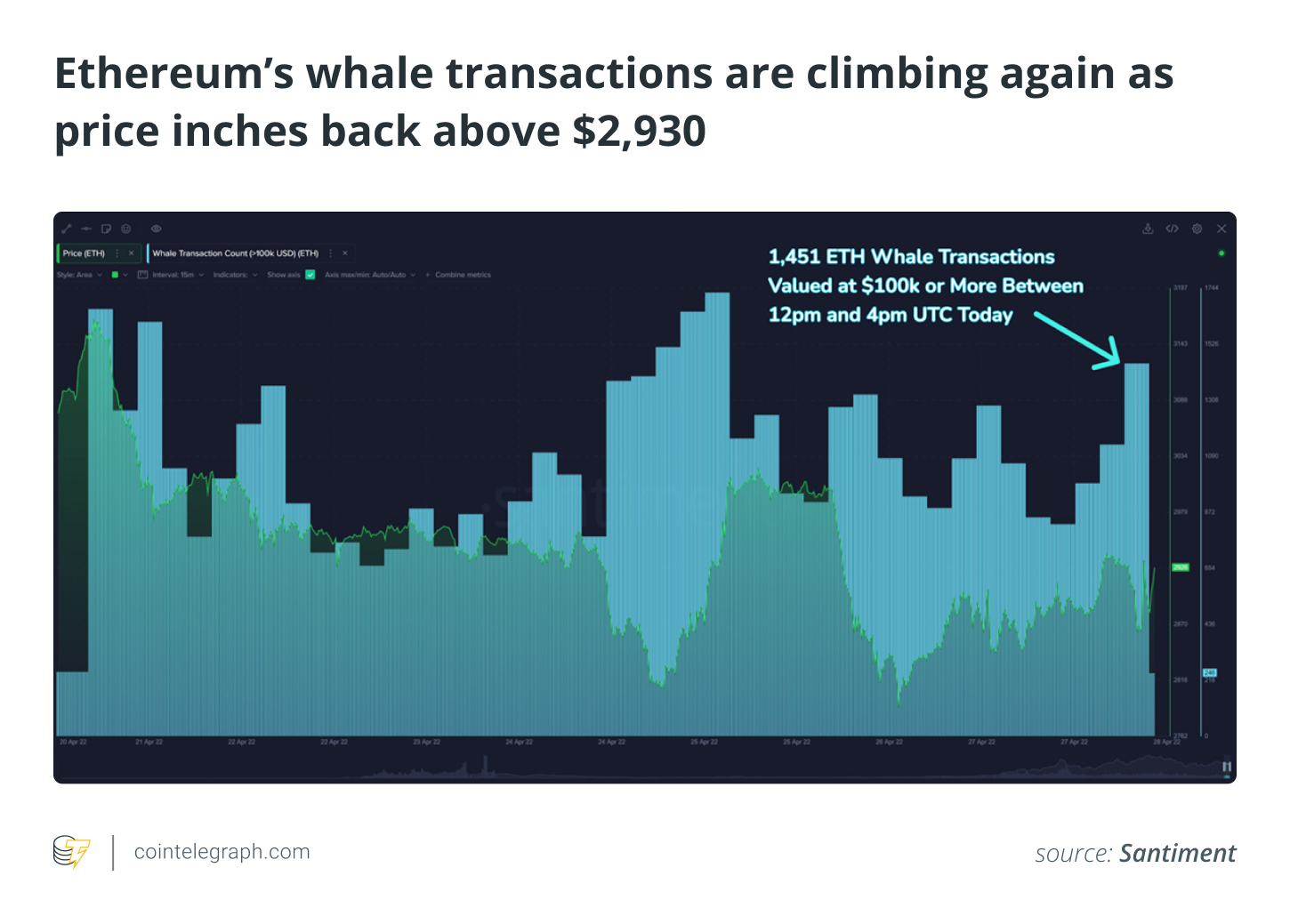

Ether whales starting to show interest

Santiment’s Ether (ETH) whale transaction count metric signifies that levels had started to rise towards the same rate well over 1,400 each day which was seen a week ago once the dip was rapidly scooped up. High-value transactions well over $100,000 may likely indicate topping key stakeholders are starting to flow their coins at bullish levels.

Traders are short heading into May

Exchange funding minute rates are another cost direction indicator. When you will find excessive longs (bets in support of prices rising) like that which was seen soon after the November all-time high, prices have a tendency to correct. However, the alternative trend seems to become happening at this time.

Significant short funding minute rates are apparent across multiple exchanges, indicating FUD all around the crypto markets is obvious. Generally, when BTC and altcoins are shorted together for this degree, there’s a particularly greater probability of prices rising to pressure liquidations against individuals betting against crypto prices rising.

You should search for capitulation signs being an indicator that the cost bottom may finally maintain. Presently, there isn’t any overwhelming proof of trader fear, but negative funding rates along with a couple of other signals are extremely helpful signs.

For an extent, a simple event just like a Given rate hike may muddle data for a while longer. But, signs a minimum of seem to be pointing toward probably the most bullish divergences not seen since last month.

Cointelegraph’s Market Insights E-newsletter shares our understanding around the fundamentals that slowly move the digital asset market. This analysis was made by leading analytics provider Santiment, an industry intelligence platform that gives on-chain, social networking and development info on 2,000+ cryptocurrencies.

Santiment develops countless tools, strategies and indicators to assist users better understand cryptocurrency market behavior and identify data-driven investment possibilities.